You Will Borrow and You'll Like It!

The Fed's transformation to full-blow Orwellian status continues

The rumors are now confirmed: the Fed is in the process of changing its role from “lender of last resort” to dictatorial financial overlord. If that sounds dramatic, consider that Powell & Co. plan to force banks to borrow from them - or else.

In the spirit of never letting a crisis go to waste, the Fed, the FDIC, and the Treasury are citing the collapse of several regional banks in March of last year as the impetus for transforming the discount window from an emergency measure into standard operating procedure.

What’s the discount window, you ask? It’s the primary way in which the Fed fulfills its role as the lender of last resort, giving loans to a bank when that bank can’t get a loan in the private market.

There are three types of discount window use, all of which require collateral: primary, secondary, and seasonal.

Primary is for banks in relatively good shape (aside from the fact that they’re insolvent and need a loan from the money printer). Loans can only be used for literally anything.

Secondary credit is more restricted, shorter term, available to institutions in worse shape, and can’t increase assets, meaning it has to be used for things that decrease liabilities, like paying depositors.

Seasonal is for small banks that have predictable liquidity crunches and want to rely on the Fed instead of using sound banking practices, purposely overleveraging themselves because they can charge higher loan rates to customers than they pay to the Fed.

Like most things related to the Fed, the name “discount window” makes no sense. There is no “discount” to the borrowing bank - they pay a premium instead.

Why would the Fed charge a premium, or higher interest rate, than the market rate? It’s because they don’t want you going to them first for a loan - this is supposed to be a last resort. At least, that was the idea - until now.

It’s not really a good look to be going to the discount window, at least not if you’re using it in large quantities. That signals the rest of the financial market that you’re in some kind of trouble since discount window use is publicly available information.

This makes perfect sense - you need a loan but can’t get one from the private market at anything close to the interest rates other banks are paying each other for short-term loans. There is rightly a stigma attached to a bank that’s perpetually in hoc to the lender of last resort.

Other banks and investors alike have a right to know who is taking these loans from the Fed. To hide that information would be the equivalent of countless types of fraud - like a firm hiding from investors that it has bad assets or outstanding loans that are kept off the books.

But this is essentially what the Fed wants to do: hide a valuable market signal from all participants in the financial community.

Now, you can’t do it directly because that would be too obvious. If, for example, the Fed just stopped reporting discount window use, we could just observe which businesses are getting unexplained cash infusions and know they’re still using the discount window.

So, the Fed and its cronies in government intend to muddy the waters, making everything so murky that it’ll be impossible to tell who is doing what.

If that sounds like a great backdrop from which to do illegal things and defraud investors and depositors alike, you’d be correct. Here’s the tentative plan for how the scheme will work.

The Fed, the Treasury, and the FDIC intend to force banks to use the discount window periodically, even if they can get a loan from another bank - or even if they don’t need a loan at all.

At first, this doesn’t sound like that big a deal and there’s an easy workaround: borrow the money and then immediately pay it back. It’d be like walking into a bank, withdrawing $100 from your savings account, and then, when the teller asks if you need anything else today, you make a deposit for $100.

So, get ready for pre-payment penalties and mandatory holds, along with preposterously high interest rates on reserves.

In other words, the Fed will make it so painful to repay your loan early that you essentially have no choice but to keep the money for the entire term. That makes it impossible to distinguish between banks using the discount window in times of distress vs. those compelled to do so.

Why would the Fed do this? Why don’t they want us aware of where the problems are in our financial system?

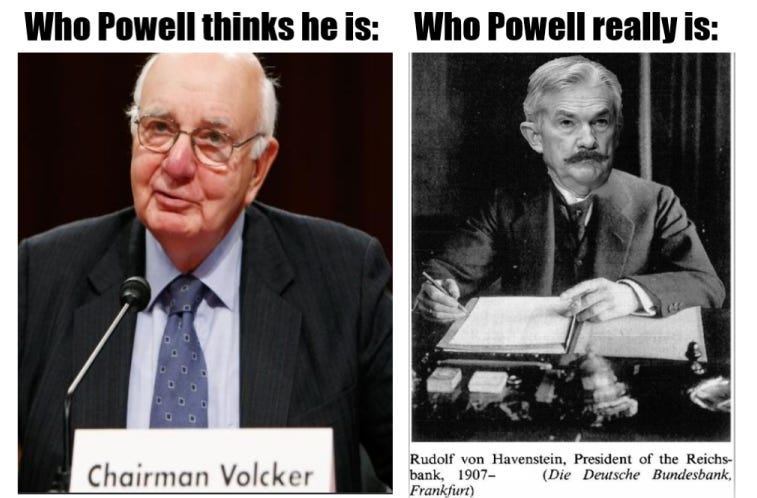

In short, because they’re everywhere. The Fed knows that they’ve created the mother of all ticking time bombs and there’s only two options: let it explode in the most violent deflationary event since the Panic of 1907 or diffuse this monstrously large bomb by throwing it in an equally large liquidity bath.

The former option is more painful initially, but healthier in the long run. Undoubtedly though, the Fed wants to do the latter because it’s what the Fed has done literally every time since 1921 when Ben Strong engineered a recession for the first time. (Unless you count Nicholas Biddle, but he contracted credit to spite Pres. Andrew Jackson, not cool off inflation. Anyway…)

One particularly insidious part of these discussions behind closed doors is that technocrats are claiming the regional bank crisis was due in part to many banks not being operationally configured to borrow from the discount window.

What a crock of $#!&.

Every depository institution is set up to borrow from the discount window by virtue of participation in the Federal Reserve System. Sure enough, discount window usage soared in March and April of last year to record highs as banks were collapsing.

Additionally, loans to the FDIC to pay depositors of failed banks also exploded. Both the discount window and the FDIC loans began their stratospheric rise a week before the Bank Term Funding Program was even created.

In that sense, the system worked as intended. The reason the BTFP bailout facility had to be opened was because the regional banks that were in trouble ran out of good assets to post as collateral at the discount window.

The BTFP (something we’ve explained in detail in an earlier newsletter) values assets at par, giving those insolvent banks an extra lifeline from the lender of last resort.

It’s not that the discount window didn’t function properly, but that banks were in such terrible shape that even the discount window couldn’t save them - the mark-to-market value of their liabilities exceeded their assets, pure and simple.

Mandating discount window use is like a permanent extension, in some sense, of the BTFP. It’s an attempt to prevent any financial institution from failing, no matter how insolvent it becomes.

Investors be damned. Depositors be damned. Truth be damned.

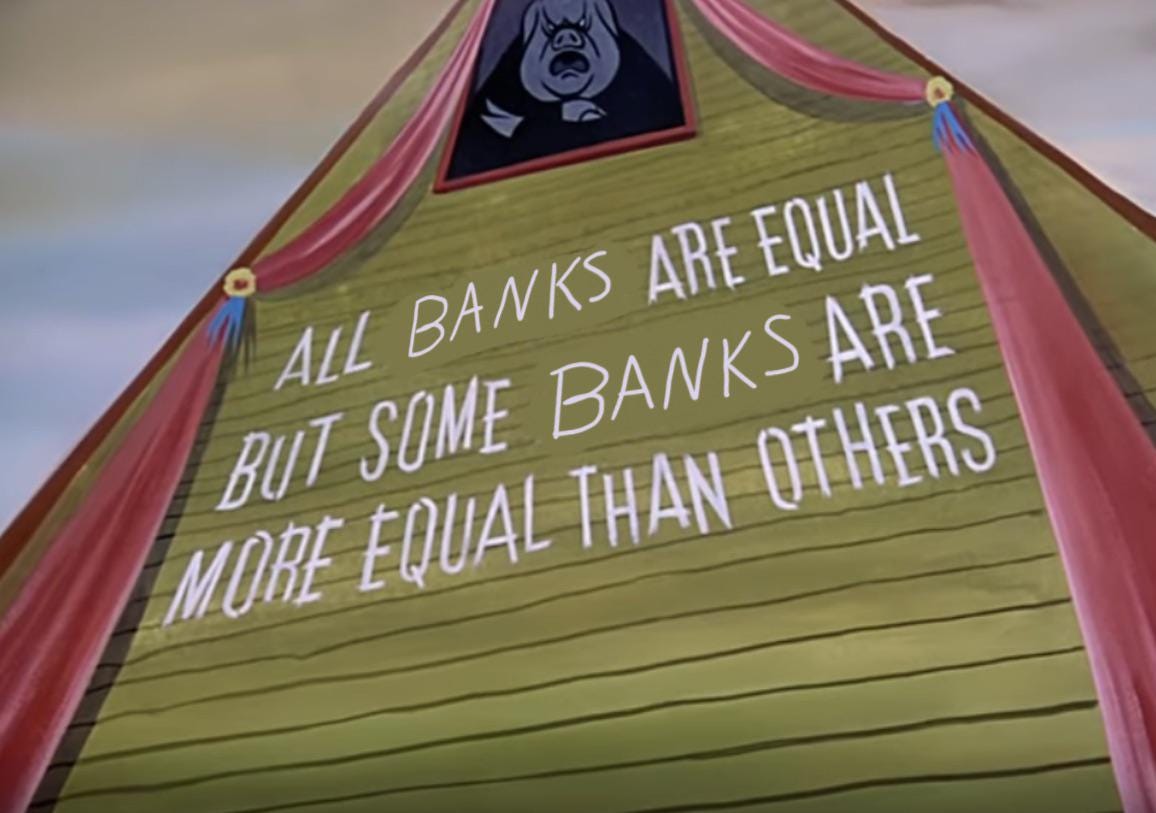

In addition to hiding all of the problems that they created, this move by the Fed also helps consolidate power, slowly eliminating banks’ abilities to borrow from each other or not borrow at all, but instead keeping their own sufficient reserves.

The banking system’s power to expand and contract credit on its own through fractional reserve banking makes the Fed’s job of manipulating markets that much harder. Consolidating all bank lending into the central bank provides much more direct control over the creating and extinguishing of money.

The Fed wants to be not just the guiding hand but the sole arbiter of the money supply. Likewise, it wants not just to be the lender of last resort, but the sole lender. The end goal here is to be judge, jury, and executioner.

You can call us alarmists if you’d like or tell us we’re paranoid. But if the last several years have taught us anything, it’s that just because you’re paranoid doesn’t mean they’re not out to get you.

So Discount Window requires Mark To Market whereas BTFP marks value at Par? If so, more F’ing inflation coming as we pick up the tab for yet another hidden bailout.

Sounds like a $CBDC for banks?