Inflation Reacceleration, Bond Deterioration

One by one, the bond vigilantes are coming out to play

Notwithstanding the occasional propitious sale of Treasuries, things have deteriorated on Yellen’s auction block.

Yields were spiking just six months ago as the Treasury was steadily running out of buyers. That’s when Powell dutifully came to Yellen’s rescue, because she’s the one who wears the pants in that relationship.

Suddenly, despite inflation being nowhere near the 2.0% target, Powell and all his evil minions at the Fed began talking about rate cuts.

Several investment houses immediately priced a quarter-point cut into the first Fed meeting of 2024. At one point, the broader market was pricing in a cut just over a quarter point.

In other words, everyone on average was sure of at least a 0.25% rate cut with a few optimistic souls buying bonds like crazy and banking on a larger 0.50% rate cut.

The predictable result was that yields fell, especially on Treasuries—exactly as Yellen had wanted. That was crucial in slowing the growth of interest on the federal debt. But it was merely a finger in the dyke.

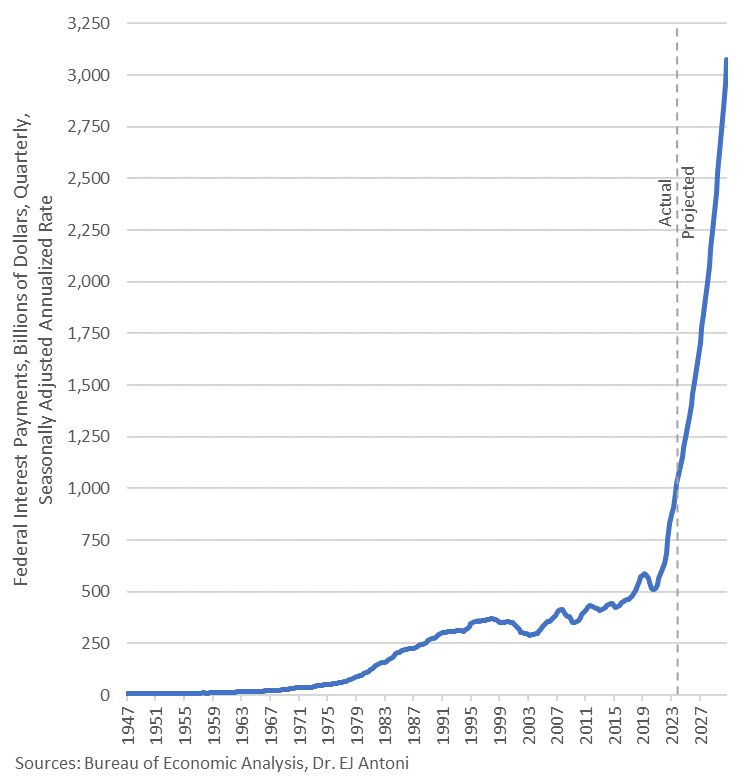

We’ve detailed before how the growing interest on the debt is a severe problem and, unfortunately, we’ve been right thus far with our growth projections.

But we certainly aren’t the only ones: in the darkened corners of the Fed and Treasury, where government bureaucrats communicate primarily using satanic runes, Powell and Yellen understand the trajectory of interest on the debt all too well.

The massive issuance (both new debt to cover the deficit and rollover of existing debt) amounts to roughly $10 trillion in 2024. And this isn’t the age of ZIRP anymore, so those trillions are being issued at 4% - 5% or more.

And that’s the recipe for disaster which the government has dutifully followed to make the current ticking time bomb.

The combination of high interest rates with high debt levels catapulted the annualized cost of servicing the debt to over $1 trillion and it’s about to hit $1.1 trillion. From there, it accelerates even faster.

In the next 12-24 months, it’ll be $1.2 - $1.6 trillion.

Before we address the wide range of those estimates on where we’re heading, we have to address where we’ve been, and what went wrong over the last six months. Half a year ago, yields were tumbling, but now we’re back to the highwater mark of 2023 and poised to go higher still.

The short answer is that Powell and Yellen sold the market a bag of hope – and they were dead wrong.

We were promised rate cuts as inflation plummeted back to the 2% target. It didn’t happen.

We were promised the ratio of interest on the debt to GDP would fall. It didn’t happen.

We were promised the deficit would be reduced. It didn’t happen.

Investors are starting to realize—slowly but surely—that the inflation problem isn’t going away because the big spenders aren’t going away. So, if 3.5% annual inflation is the new normal, it gets priced in.

And that’s what an increasingly large portion of the market is banking on. These bond vigilantes refuse to bid 3.5% on a note or a bond when they believe that’s the new permanent inflation rate going forward.

Not only would that mean giving the government an interest-free loan in real terms, but it’s worse than that because you pay federal income tax on those nominal gains, even if it’s a purely inflationary increase.

That’s why more and more people are demanding rates at or near 5% - they want to be compensated enough to surpass the inflation, the taxes due, and… the risk.

This last point is another important aspect that can’t be overlooked, and it brings us back to the range of possibilities for interest on the debt in the coming months. It’s becoming increasingly obvious that America will have to default – it’s just a question of how.

Defaulting through the front door is when you tell bond holders, “Ha, ha – just kidding. You’re not getting your money.” Basically every country in South America is a pro at this version.

Back door default is when you tell bond holders, “Here’s some freshly printed money that’s worth only a fraction of what you thought it’d be.” In other words, inflated currency with Weimar German in the early 1920s being perhaps the best example.

Imagine buying a long-term Treasury in 2020 with less than a 1.25% yield. Sadly, some of our readers may not have to imagine at all. Those unlucky folks have been completely wiped out by the 20% devaluation of the dollar that followed.

Those bonds were sold in the billions and have effectively been paid off through the hidden tax of inflation. And now, federal income tax will take even more.

As interest on the debt continues exploding, it increasingly leaves the government with only two choices: the options of default outlined above.

A higher interest rate has always been associated with default risk for any kind of security, but sovereign debt has the added complexity of inflation. Since this is an implicit default, investors will demand compensation for this risk too.

Even if all the rosy assumptions (which we debunked in an earlier post) from the bean counters in both the executive and legislative branches hold true, interest on the debt will still quickly hit $1.2 trillion per year. The best-case scenario is that it flatlines for about 2 years before climbing again.

As you start making your assumptions more realistic, however, the outlook gets grim.

The deficit grows faster, the economy grows slower, and inflation stays elevated, which also keeps upward pressure on yields. An annualized $1.4 trillion is easily attainable in 12 months.

In our worst-case scenario modeling, it hits $1.6 trillion in about a year and a half. The only thing preventing it from getting worse is that the Fed’s intervention, which we have to assume will happen, given Powell’s behavior thus far buying Treasuries.

But you know who isn’t buying Treasuries anymore?

China.

Russia.

Even our friends and allies around the world.

Russia has sold off essentially all of their US debt holding. China is now only a few years away from complete liquidation on their end too. Central banks everywhere around the world are increasingly under so much pressure to buy their own country’s debt, that they have less room on their balance sheets to buy Treasuries.

This is bad news for Yellen and her flying monkeys.

Foreigners would be dumping their Treasuries even faster were it not for the fact that many of them were purchased during the age of ZIRP and now have high unrealized losses. Their mark-to-market value has dropped pretty substantially in a world of 5% interest rates.

Still, more and more of them are realizing that it might be better to sell anyway and cut their losses. After all, inflation is wiping out the real value of the coupon payments. That’s part of the reason why people and governments around the world have been flocking to gold.

In fact, one of our team members started this year by transferring one-quarter of his portfolio into gold, and he’s currently leading the pack. But more on that in the next article…

This is all intentional. They want us to beg for a new system. The old paper money system is going out with a bang. The people will beg for a new system and they will say that digital dollars are the only way to save us. You will own nothing and be happy (or in jail).

America has Already Collapsed: People Just Haven't Figured it Out Yet

Our currency has been devalued by 98% since 1913 as admitted by the Federal Reserve.

In 1970, you could buy 250 oz of Gold for $10,000. In 2024, 250 oz cost well over $500,000.

Average wage in 1970 =$9,500. One man could afford a house, car, wife and several kids with one wage earner. Average wage in 2024 =$43,000 and it's not enough to survive in most areas.

In 1950 the average house was $6,000. In 2024, average house cost $450,000.

Car in 1970 use to cost $3,500. 2024 a car cost $47,000.

It's already over for America. It just hasn't psychologically been figured out by the masses. But they are starting to get it as the collapse gets worse and their checks more meaningless.

Substack Read:

what's the DILL?

https://blackboxpolitics.substack.com/p/america-has-already-collapsed