Janet Yellen Is Hiding the Real Deficit

How accounting gimmicks at the Treasury reduce the "official" figures

After December’s monthly statement from the Fiscal Service, many are scratching their heads, wondering why the numbers don’t add up lately. Specifically, why aren’t the deficits each month matching the increases in the debt?

Somehow, Yellen’s bean counters at the Treasury manage to consistently issue additional debt in excess of the published deficit numbers. They want us to believe a lie.

Let’s take a look at the recently released December Treasury statement from the Bureau of the Fiscal Service to figure out how this shell game works and try to find the hidden pea.

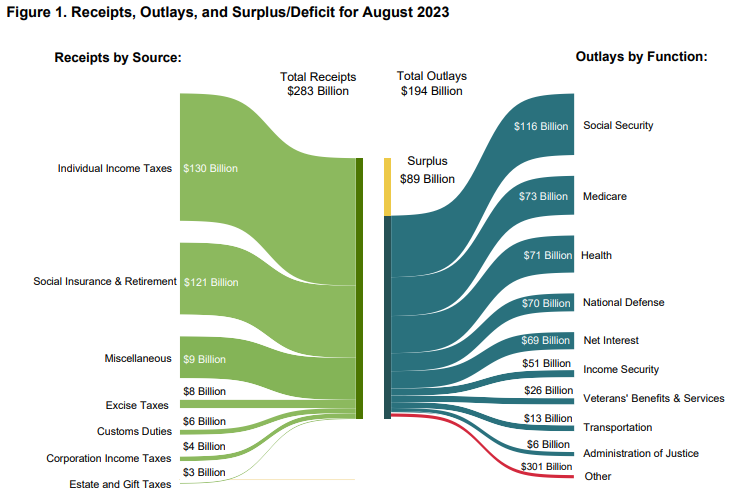

The dishonesty begins on the very first page of the report, following the table of contents and introduction page: Figure 1. Note that the deficit is $129 billion but is a teeny-tiny-itsy-bitsy bar on the chart. Meanwhile, corporate income taxes are represented as almost 4 times larger, despite being $35 billion (27%) smaller.

Likewise, social insurance and retirement receipts are represented as being more than 5 times larger than the deficit but are really only bigger by $12 billion (9%). Individual income taxes are even more of a joke: they look 12 times larger and are only $49 billion more (38%).

Only off by more than 1000% - bravo.

If you’re naive, you might believe this graphic was put together by an intern whose IQ begins with a decimal point. Forgive us for being a little more cynical and alleging that the Treasury knows full well what it’s doing here - trying to deceive the public.

Anyone who glances at that figure will instantly think the deficit is smaller than it is because that’s how graphical representations are supposed to work: size matters!

But now we draw your attention to exhibit A: total public debt outstanding, AKA the federal debt. It shows that December’s increase in the debt (same as the deficit) was actually $123 billion, with the debt rising from $33,878.679 billion to $34,001.494 billion.

That’s not far off from the Treasury’s monthly statement - it’s basically a rounding error. In fact, it indicates the monthly statement may have overestimated the deficit by $6 billion. So, what’s causing this discrepancy and what about the overestimation that we started talking about originally?

December’s difference was a case of open accounts, meaning certain things were not closed out. That’s very common for the federal government because so much of its allotted spending will span months or years.

It’s kind of like when a business has uncashed checks at the end of the month. The accounts receivable and payable need to be reconciled. But public debt outstanding is an up-to-the-day accurate count of bills, notes, and bonds issued by the Treasury.

Small discrepancies like December are normal, but now let’s go to Figure 2 and see something that isn’t normal.

According to the monthly statement, the first quarter of fiscal year 2024 (September, October, and December of 2023) saw a deficit of $510 billion. Then why the %#@& does the debt increase by $834 billion over that same time? That’s 64% more than the monthly statement!

It’s largely because of the crazy accounting rules at the Treasury which allow for an obscene level of manipulation.

For example, money spent this month doesn’t always have to be recorded this month. The same thing’s true for the receipt side of the equation. And the same bill can potentially be paid with money out of dozens of different accounts, many of which will show up at different times in these “official” figures.

Remember: these are the same folks who want to know how you got that $600 Zelle or Venmo payment. Hope you got a receipt.

But we digress. Shouldn’t these mistimed expenses just even out in the long run? Only if the accounting was honest. Which it isn’t.

The treasury is constantly robbing Peter to pay Paul in order to manipulate these numbers, making shady transfers of money that is already spoken for in the future and putting it towards some expense today.

But doesn’t that also exacerbate our nation’s unfunded liabilities crisis? Well, yeah, but that’s tomorrow’s problem.

For an example of this unseemly accounting, let’s take a stroll down memory lane to the September monthly statement, the last of Fiscal Year 2023.

Apparently, the deficit for the fiscal year was $1.7 trillion. Or was it? Returning to exhibit A, we find that the debt increased by $2.0 trillion. What the %#@& happened to the $300 billion in between? Let’s hop into our time machine once more and look at the August monthly statement. *Queue sci-fi noises*

Why is the missing $300 billion showing up as a negative on the expense side of the ledger? That’s supposed to mean we spent money but then got it back, like when you return a defective item to a store, and they refund your purchase.

As you’ve probably guessed by now, that’s not what happened, and the figure is yet another misrepresentation.

When the Supreme Court ruled that the Biden administration’s misuse of a 9/11-era law to grant blanket student loan forgiveness was blatantly unconstitutional, the Treasury bean counters started sharpening their pencils.

They estimated that over the course of a decade or so, the now-defunct student loan forgiveness would’ve cost about $300 billion. Immediately, they counted that as an expense returned to the Treasury…

…even though not a dime had even been spent.

Keep in mind, even if the Supreme Court had allowed the program to continued, it would not have cost the Treasury $300 billion in August. The Treasury had originally estimated that the debt cancelations (AKA taxpayers assume the debt) would be spread over many years.

But the Treasury decided to frontload everything into August, turning a monthly deficit into a surplus and reducing the annual deficit by $300 billion - but only on paper.

The debt still rose $2 trillion because bond holders don’t care what you call a debt; you still owe them.

But what’s crazier is that the Dept. of Ed. is still going to spend that $300 billion, just on other stuff. It was already allocated for that part of the executive branch and, sure enough, they are already fast at work wasting it.

That means this was effectively a $600 billion swing in terms of the accounting: $300 billion in future spending was not spent but counted as “savings” today, while that same $300 billion will just be spend in the future on something else.

You may be thinking that the student loan fiasco is a one-off and that this problem of undercounting the deficit isn’t anywhere near as bad as we’re making it out to be. After all, $300 billion on a $34 trillion debt is less than 1%.

You’d be wrong. That doesn’t explain the over $300-billion discrepancy in the first three months of fiscal year 2024 that we mentioned earlier.

Furthermore, in the second half of 2023, the monthly Treasury statements had a cumulative deficit of $812 billion, but the debt rose $1.7 trillion - more than twice as much and about a $900-billion difference.

We purposely didn’t include June because that month had extra borrowing when the debt ceiling was suspended. While it would make our case look even stronger, we’re honest (unlike this Treasury Department).

Before the end of June, however, the Treasury was already back on track, having undone its “extraordinary measures” in an $868-billion borrowing spree, so that doesn’t explain the giant gap from July onward.

In brief, if you want to know the real deficit the federal government is running, you have to look at the hard data in the market for Treasury bills, notes, and bonds.

Colorful diagrams that look like they were put together by a kindergartener whose favorite flavor is the blue crayon will not help you.

It’s just another example of how you really can’t trust bureaucrats.

That’s why we’re here - to give it to you straight, every time. Having an accurate sense of the true size of the deficit is not just important from a public policy standpoint, but it affects other decisions, including how you invest.

I find it hilarious that the Treasury is playing games in order to hide the obese, triple quarter-pounder with cheese chomping elephant in the room. The debt is over $34 trillion and it's growth is accelerating rapidly. Hiding $300 billion with gimmicks is doing what? Trying to convince us that the oncoming locomotive will hit us at 95 MPH versus 100 MPH?

I politely disagree. Your solution addresses only one side of the equation, spending. Plus, many of the spending programs are actually underfunded significantly.

The other side of the equation requires an increase in corporate taxes for a long time to reduce the debt levels. Business has had 50 years of tax cuts and extraordinary share price increases but only support politicians so the corporate neoliberal free market, low taxes and trickle down games can continue ad infinitum.

In any event, a sovereign nation is not and cannot be run as a business enterprise. The accounting machinations forced on the treasury are the direct result of the last sentence of the prior paragraph.

Even so, the accounting does need to be cleaned up and properly allocated and accrued where it should be.

By the way, corporations play the same sorts of accounting games game at the end of every quarter and in their annual statements. Absent detailed cash flow analysis it’s actually very difficult to understand where they stand.