Welcome to the New Normal

Why 3%+ inflation is here to stay

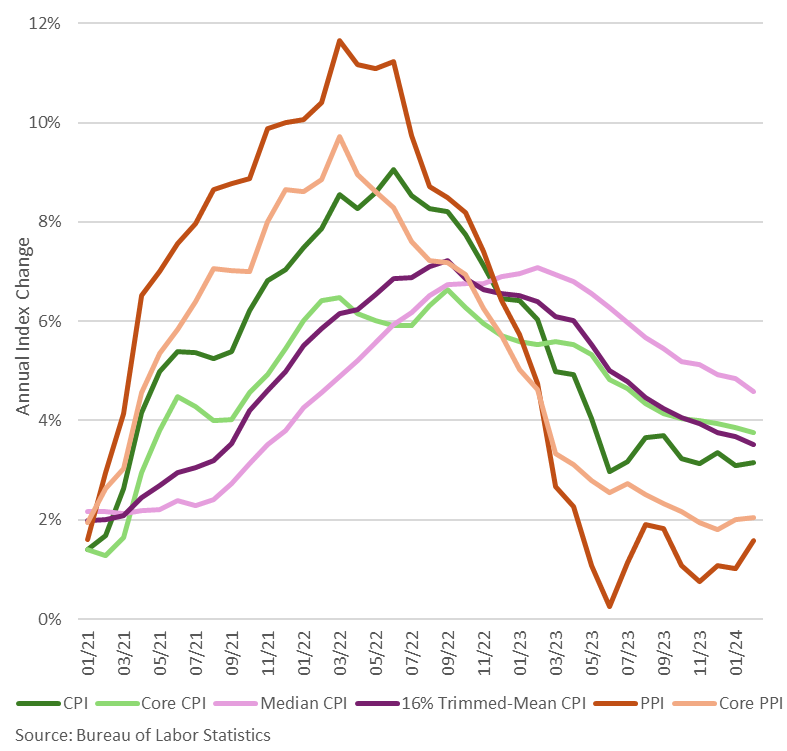

When January’s inflation numbers came in hot for both consumers and businesses, many pundits chalked it up to "seasonally adjustments” and other one-offs. We said it was structural, and February’s data show we were right.

But there’s no celebrating here and no spiking the football. This is bad news.

We can forget about price stability in America - it’s not going to happen anytime soon. Even the Fed’s 2.0% target isn’t going to happen, and here’s why.

First, there’s no empirical basis for the 2% inflation target. It was thought up in New Zealand of all places, as a rate that would be tolerable to the citizenry. Note that it was not arrived at from a discussion of optimization, but toleration.

There’s no benefit to the economy from your currency constantly losing 2% of its value over time. But there is a benefit to the politicians who are quietly confiscating the value of your income and savings via the hidden tax of inflation.

Monetary scientists figured out several decades ago that 2% inflation was high enough to keep their political masters happy but low enough so as not to arouse anger from the people.

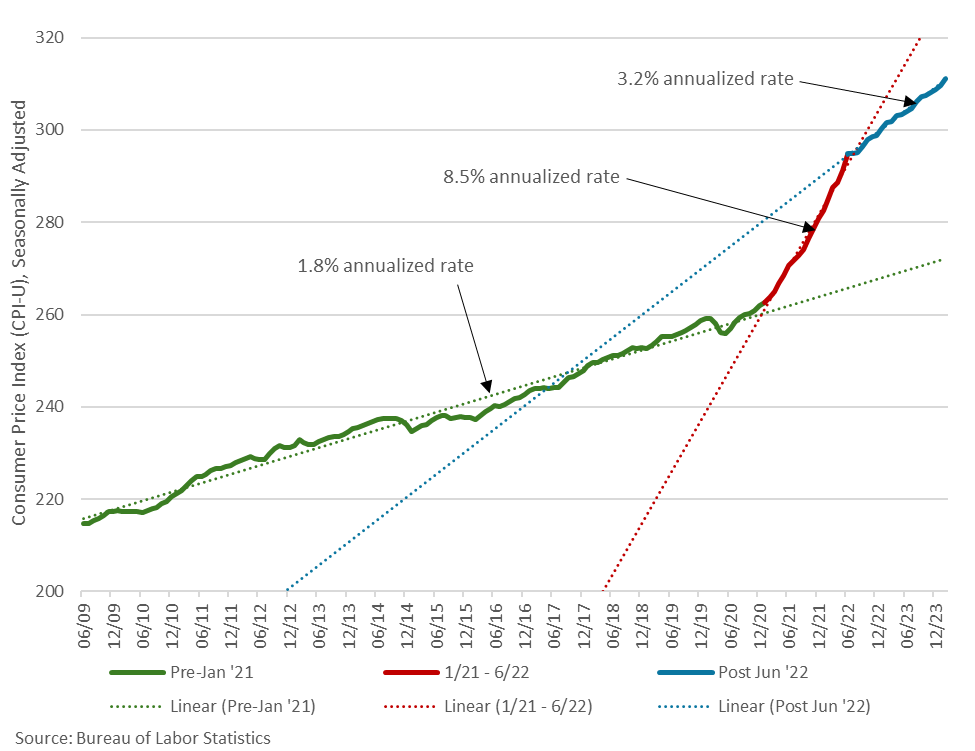

Since the last big inflationary wave of the late 1970s and early 1980s, the masses became desensitized to this slow currency devaluation. It took the price spikes of the last three years to wake people from their slumber, but that also reset people’s baseline of expectations.

In other words, people became mad about inflation again, which was good. But they also allowed the Overton window to move in the wrong direction, which was bad.

As inflation has fallen to the 3% to 4% range, some people seem content that prices aren’t rising 9% every year. “Things are bad, sure—but they’ve gotten better,” is the thinking.

The inflation shock that began in mid-2021 has warped the nation’s perception of what’s tolerable, and the monetary scientists and politicians alike know it.

With that in mind, those who keep saying “we’re still not at the inflation target” are technically right but practically wrong because the target isn’t 2% anymore.

It’s 3%+ and the data show it.

After inflation peaked in June 2022, our benevolent rulers at the Fed and Treasury kept telling us that inflation was coming down and trending toward 2%. The first part was true, which help to disguise that the second part was a lie.

Inflation has trended very steadily to 3.2% since that time. (It’s no coincidence that this was also February’s annual inflation rate.) In fact, the trend has been more consistent than it was in the economic expansion before Covid, which lasted from mid-2009 to the beginning of 2020.

The Fed has used every tool at its disposal to heavy-handily ensure that prices keep rising a little over 3% annually.

So, why are they doing this? Because they need to finance the Treasury’s spending spree. Yellen & Co. are borrowing at a $3-trillion annualized rate, exploding the debt. Faster inflation is reducing the real value of what the government owes, which is the only thing supporting such fast rates of debt accumulation.

As long as they keep up these spending levels, they need the inflation to stick around in order to pay for it all. With the clown show that is today’s Congress, we don’t have much hope that they’ll slam the brakes on the spending anytime soon.

This doesn’t mean that all prices are going to rise in unison at a steady 3.2% rate - many things take time to catch up and then do so in big ways.

We’re seeing that broadly in the insurance market right now. Actuarial tables that were built on 2019 prices have resulted in claims that far exceed premiums. Consequently, insurers have turned to the reinsurance market to make up the difference.

As reinsurers adjusted to the new reality, they seriously upped their premiums charged to insurers in order to recoup their losses, return to profitability, and rebuild cash reserves to cover the next wave of bailouts for insurance companies.

That means insurers now need to charge higher premiums to customers in order to cover higher priced claims and higher payments to reinsurers. The result is spiking insurance costs across the board, everything from cars to homes.

In many markets, consumers’ premiums have jumped 40% in just the past year. As businesses also pay higher and higher premiums, they raise their own prices to cover these costs, meaning price increases slowly spread to the rest of the economy.

Likewise, workers’ reservation wage rises, which is a fancy economist way of saying people increasingly demand higher pay to cover the increased cost of living from these higher insurance premiums.

Prices don’t all adjust at once, and these shocks predictably get the blame for inflation from the very people who caused the problem—like Powell saying insurance is the “hidden” cause of inflation. But make no mistake, things like the “wage-price spiral” are symptoms and not the disease.

If this sounds like a very bearish outlook, it is, but only on the general economy. Things can (and usually do) appreciate in price during sustained inflationary periods. Remember that most items (investments included) are priced in nominal, and not real terms.

Evaluating asset performance on inflation-adjusted returns is what matters in “the new normal” of 3% inflation.

2% inflation target came from the same thought process as 6 foot social distance.

"Yellen & Co" is an interesting name for "Congress" or for "Entitlement programs".

Social Security, Medicare, Medicaid and interest expense are the four categories where spending is surging.

Discretionary spending and military spending are not elevated relative to GDP.

When debt to GDP is this high and big portion of the population is retiring, negative real rates of return are the only way to minimize the damage from massive deficits.