The Real Data is in the Revisions, Not the Headlines

When it comes to economic data, Biden is either the luckiest president in American history or he deserves his recent Trump-bestowed moniker of “Crooked Joe.” An increasingly unlikely pattern of downwardly revised data makes things look good at first, but then we find out later that they aren’t good at all. But at that point, the media moved on. The GDP comprehensive update is the latest example.

To be clear, comprehensive updates to the national accounts that make up data releases, including GDP, are part of normal operating procedures. But again, it’s beyond odd (nearing statistical impossibility) how often things are revised down under Biden. The big GDP update includes not just a new base year (goodbye 2012 dollars, hello 2017 dollars) but also methodological improvements and better data.

In other words, the new numbers are more accurate. And, of course, they’re worse.

The first big takeaway is that the economy was actually growing faster than originally estimated when Trump left office: 4.2 percent vs. 3.9 percent. Under Biden, the revisions tend to go the other way, with 4 quarters revised down, just 2 quarters up, 4 quarters unchanged, while the recession (yes, it was a recession) in 2022 was worse than previously estimated.

And it’s not a matter of rearranging deck chairs on the titanic where the upward and downward revisions cancel out. The Bureau of Economic Analysis simply snapped its fingers and over $100 billion (half a percent) disappeared from the Biden economy. Imagine if economists were expecting a 0.5 percent increase in GDP and the quarterly report showed a goose egg – markets would sell off like crazy.

But not everything got revised down – the bad news got revised up: inflation. It turns out prices have risen even faster than BEA previously estimated. For Biden’s tenure, we now have 7 quarters revised up, 2 down, and 1 was unchanged. The common man could’ve told you this was the case, however, so maybe the countless government statisticians aren’t necessary to tell us inflation is horrific.

(click here to follow FXHedge on X (formerly Twitter)

This not only brings the BEA data more inline with a plethora of private survey data, and even some Bureau of Labor Statistics (BLS) data, but it also changes several previous inflation reports from beats to misses. In other words, when the Street thought inflation came in lower than expected, it was actually coming in higher.

And those inflation adjustments help explain what has really been going on with consumer spending. The real (inflation adjusted) personal consumption expenditures figures weren’t matching up well with reports like retail sales or data from the regional federal reserve banks. Once again, the BEA just snaps its fingers, and the problem disappears.

In 5 of the last 6 quarters, real consumer spending—the lifeblood of this economy—was revised lower, with only a small increase at the end of 2022 ruining the streak. The first three months of last year even saw real consumer spending shrink. Maybe there was something to calling it a recession after all, especially when consumer spending doesn’t even decline in some downturns.

Just how bad are the consumer spending numbers of late? Growth here has become so anemic that government spending has grown faster for each of the last four quarters than consumer spending.

The disparity in growth rates between the private and government sectors has become so large that the growth in government spending even contributed more to the headline GDP number than consumer spending in two of the last three quarters. That’s a shocking statistic when you consider that consumer spending is a multiple of government spending. Very large percent increases in government spending are necessary to surpass the dollar growth in personal consumption.

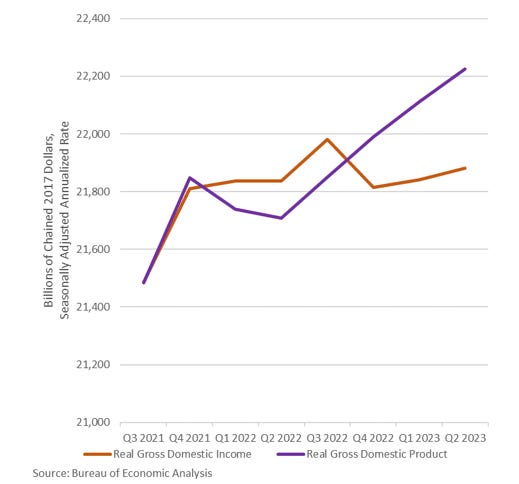

While most of the GDP comprehensive update left the reader scratching his head, there were a few parts that answered more questions than they asked. For instance, the bizarre divergence between GDP and GDI was partially resolved but remains unusually large. Consider that in the third quarter of 2021 GDP and GPI were identical – off by less than 0.02 percent, or about $3 billion in 2017 dollars. Shortly thereafter, things get weird.

From the fourth quarter of 2021 till today, real GDI is almost flat, rising just 0.3 percent. But real GDP is up 1.7 percent over that same time. Given the current environment of rising interest rates, cash-strapped consumers with no savings left, lower real earnings, and a Treasury Department draining the loanable funds market—just to name a few economic headwinds—I’d say GDP is going to catch down before GDI catches up.

All of this speaks to the fact that no individual datum point can ever be viewed in a vacuum. Data scientists have a duty to take a holistic approach and consider all available information, not cherry pick what their political benefactors want to hear.

The consequences of playing games here are difficult to overstate. Imagine if the Fed engages in an aggressive interest rate hike campaign, only to find out two years later that the data were faulty. Oops – looks like we destroyed the economy for nothing. Conversely, if the initial data is “massaged” to show no or little inflation, the Fed will be behind the curve.

For example, the Fed closely watches the monthly employment situation from BLS, which we usually call the jobs report. Every single month so far this year has been revised downward. Never before in BLS’ record keeping have more than seven consecutive months in a calendar year been revised down. Add onto that the large downward benchmark revision and it turns out about one-third of all the jobs initially believed to have been added this year didn’t actually exist.

As fears grow about “official” government data becoming increasingly politicized, private, or semi-private, data might be the go-to choice for those serious about knowing what is going on in the economy. The Federal Reserve Bank of Philadelphia, for example, publishes an alternative measure of the economy called “GDPplus.” It shows an anemic economy even worse than the downwardly revised GDP data.

Not only are there arguments for GDPplus being a better economic gauge than GPD, GDI, or the average of these two (gross domestic output), but it also is a reasonably good predictor of recessions. Given the negative GDPplus reading at the end of 2022, there’s a decent chance that a recession will be retroactively dated to begin in late 2022 and continue passed where we are today.

Sadly, even the timing of recessions has been politicized, although that’s been the case for a while now. People forget that the National Bureau of Economic Research waited more than 20 months after the 1990-1991 recession was over before declaring the recession had ended. That gave the Democrats the ability to campaign in 1992 on their opponents presiding over a recession that had lasted for more than two years.

In reality, the recession was only 8 months long, not even a whole year—not even three full quarters. Maybe the special interests have been helping to “cook the books” longer than we think.

Nothing the leftists do makes sense, if you assume they have good intentions.