Taper Tantrum, Inflation Anthem

The Fed shows its hand and comes clean on bailing out the Treasury

Powell has officially bent the knee to his political masters and will fire up the money printer in short order. That means more inflation. Lots more.

In the Federal Open Market Committee meeting this past week, Powell & Co. decided to leave interest rates unchanged but to cut back on securities sales. This is the taper to QT as many have called it.

To understand what this means and how it will affect investors and average folks alike, let’s just take a quick second to get our terms down so we’re all on the same page.

First: QT or quantitative tightening. This is basically just the sale of debt instruments on the Fed’s balance sheet. It typically refers to Treasury bills, notes, and bonds, along with mortgage-backed securities.

Oh, and one other thing—most of QT is not actually selling these assets. Rather, the majority of what the Fed does is “roll off” debt instruments. When a security matures, the Fed chooses not to replace it.

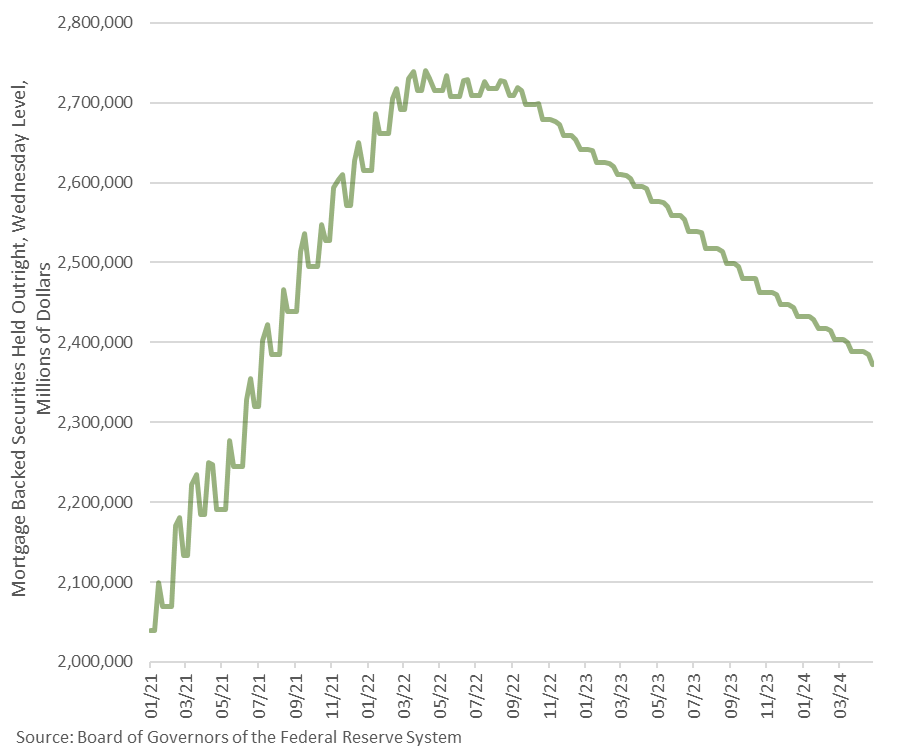

Either way, the Fed has been conducting QT in the form of reducing its holdings of Treasuries by $60 billion per month and reducing MBS by $35 billion per month.

The reason it doesn’t matter if the Fed sells a security or allows it to mature is that the effect on the quantity of money is identical—the dollars are vaporized.

In either of the two cases, someone pays the Fed, either to buy the rights to a debt (selling) or to pay off the principal (rolling off). Whenever anyone pays the Fed, however, the money vanishes into a magical account with a perpetual zero balance. We’ve explained this mechanism before in another post, so we won’t repeat the whole explanation here, but this is the cliff notes version.

So, that means QT has been fighting inflation because it’s been reducing the amount of dollars in existence. Since its peak in 2022, the Fed’s balance sheet has come down 17.9% and securities held outright are down 19.0%.

“But then why, FX Hedge,” we hear our loyal subscribers ask, “has inflation been running rampant this whole time if the Fed was supposedly tightening?”

The main reason is that the Fed’s balance sheet is just the tip of the upside-down pyramid that is the money supply. The Fed purposedly allowed bank reserves to grow throughout 2023 and into this year, as money flees reverse repurchase agreements on its way to be spent by the Treasury.

(RRPs are another topic we’ve covered in detail, so feel free to check out those posts as well if you’d like a refresher.)

In short, Powell has been fiddling with multiple levers of power to merely give the appearance of fighting inflation while he has actually been facilitating it. After all, it’s helping pay off the real value of the massive $34.6 trillion federal debt.

The decision for the taper, which will reduce Treasury run off to a mere $25 billion per month, was to alleviate pressure on Treasury yields, although Powell would never say that out loud.

As Yellen continues financing massive deficits, she’s running out of borrowers. The Fed is a net seller with QT going on. Foreigner investors are net sellers. Major governments who are beginning to reject the reserve currency status of the dollar are also net sellers.

The only way to attract sufficient buyers for this many trillions of dollars in Treasury issuance has been to offer higher yields. But those high yields are going to cripple government finances because massive debt and high interest rates are a deadly combination.

That’s why the annualized cost of servicing the debt is already over $1 trillion and projected to continue exploding higher.

Those projections rely in part on interest rates, which Powell intends to bend downward.

“But FX Hedge,” we hear you say, “I thought Powell left rates unchanged and merely reduced the pace of the balance sheet runoff?”

Insightful question, astute reader! That brings us to the effects of tapering the runoff of Treasuries.

The Fed was set to return its balance sheet, at least its securities held outright, to pre-pandemic levels by the start of 2028.

But now, the monthly reduction has been cut by more than half, dropping from $60 billion to just $25 billion. That’s less than the $35 billion monthly reduction in MBS which remained unchanged (more on that in a bit).

At this new pace, it’ll take almost a decade to get back to pre-pandemic levels, which means it’ll never happen.

Some new crisis is bound to happen between now and then – a recession, a war, a series of bank failures, a blow up in the Treasury market, you name it. There’s absolutely zero chance the Fed sticks to this new plan for the long haul.

Nevertheless, the short-term effect is that Yellen doesn’t have to auction as many Treasuries in the open market. Previously, she had to borrow to cover the monthly deficit, plus the $60 billion the Fed was rolling off. Going forward, Powell just bought her $35 billion of breathing room per month.

By reducing the supply of Treasuries on the market, that puts downward pressure on the interest rates attached to those Treasuries.

It’s just another example of Powell and Yellen desperately trying to reduce the rates on Treasuries, particularly long-term ones like bonds and, to a lesser extent, notes. Yellen is conducting the Treasury equivalents of the Fed’s previous Operation Twist and QE.

To reduce bond yields, Yellen has shifted debt issuance to a heavy reliance on T-bills, which is one reason why their yields have exploded higher. But because financial markets tend to treat these very short-term debt instruments like liquid cash, more of them can be absorbed by the market than bonds.

Issuing another $1 trillion in bills causes a smaller spike in yields than the equivalent issuance of bonds. That’s why Yellen is now also buying back longer-term debt and reissuing it as shorter-term debt.

The manipulations never end because if everyone knew the truth, there’d be panic and chaos in the Treasury markets. Instead, Yellen and Powell are conspiring to artificially keep down rates on Treasuries and create money where they think no one is looking.

“But FX Hedge,” we hear our brilliantly inquisitive readers ask, “why doesn’t Powell also reduce the runoff in MBS?”

Because Powell doesn’t answer to the National Association of Homebuilders – he answers to Yellen.

The Fed isn’t concerned with giving the housing market breathing room or making homes more affordable. The American Dream be damned. Powell wants financial markets to lend to Yellen, not mortgage originators.

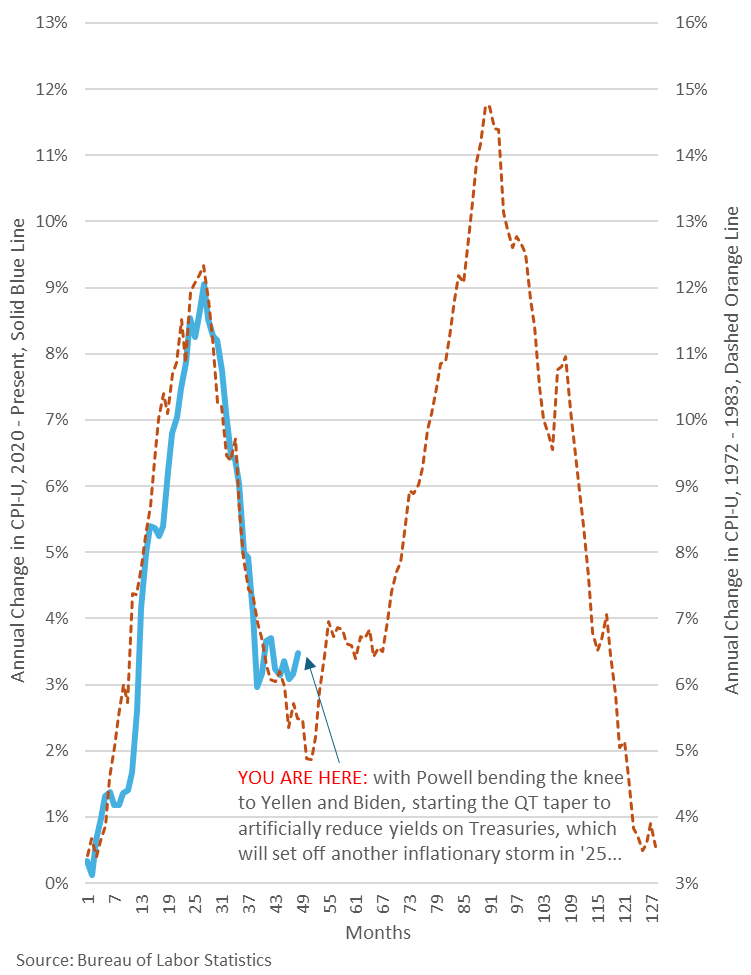

All this combines to tell us that inflation is here to stay. The rest of 2024 will probably be erratic in terms of price changes, but that’s largely due to geopolitics and highly volatile energy markets. The broader upward trend in prices will nevertheless continue at rates of 3.0% and up.

Where things get crazy, however, is 2025, for three reasons.

First, the constant siphoning of capital away from the productive private sector and to the vampiric public sector will hamstring economic growth. That means the money supply will be growing even faster relative to the economy.

Second, the money creation that happens today usually takes six months before it first starts showing up as inflation. That process typically continues for 16 months or so before the full impact is felt.

Third, as the debt problem gets worse, the Fed and Treasury will likely manipulate markets even harder to try and square the circle of reducing the cost of a growing federal debt without causing inflation.

We’re likely in for a repeat of the late 70s and early 80s—another topic we’ve discussed previously, and about which we’ve been correct thus far. Powell seems hellbent on becoming Arthur Burns 2.0 and creating an inflationary storm in 2025.

Buckle up…

Will Central Bank Digital Currency provide a “relief” to the money supply or an aggravation? If the crypto is “tethered “ to the dollar, can bank deposits of crypto be FDIC insured? Sounds like an extra complexity to me.

Just in time for the 2025 inauguration. If Trump or RFK Jr win (which looks probable), the shitshow will belong to them. If I was more conspiratorial, I'd say all this was planned......but that can't be. :-)