Repocalypse Now

The repurchase agreement markets are sounding the alarm...

Almost a year ago, last December, we gave a thorough explainer on repurchase agreements, reverse repurchase agreements, and some of the plumbing in the financial system—you can read it here if you’d like a refresher. But it’s time to revisit the topic because things just started deteriorating quickly and we’re barreling towards the next crisis.

Let’s start with the Fed’s recent “emergency-sized” rate cut of 50bps. There was no macroeconomic justification for it, even from the standpoint of the flawed Keynesians models that the clowns at the Fed love to use.

Inflation remains above the 2.0% target and the monthly increases in core price indexes indicate we’re not trending to an annual rate of 2.0% yet. Likewise, the official labor market data don’t show a need to bring down rates either, according to the Keynesian thinking.

That just leaves two options, which are not mutually exclusive—note that both of the following can be true. Powell & Co. are playing politics and conducting election interference, and/or the financial system is being held together with bubble gum and bailing wire.

And note that option one is not unique to today; the Fed has a long history of being political because its masters are politicians—people in Congress and the President. If the Fed steps too far out of line, the politicians will clean house at the central bank.

On the second point, there are clean signs of distress in the financial system. Now, you won’t see any when looking at financial stress or the financial conditions index (both of which show levels today that are below historic norms), but the signs are there, nonetheless.

Exhibit A: secured overnight financing. After the Fed did their jumbo rate cut, the secured overnight financing rate ended up spiking, erasing nearly one-half of the cut in just two days’ time. Was this a spike in demand or a drop in supply? The huge surge in volume to over $2.5 trillion for the first time ever indicates it’s the former. The upward trend here matches the increased borrowing needs of an ever-hungrier Treasury.

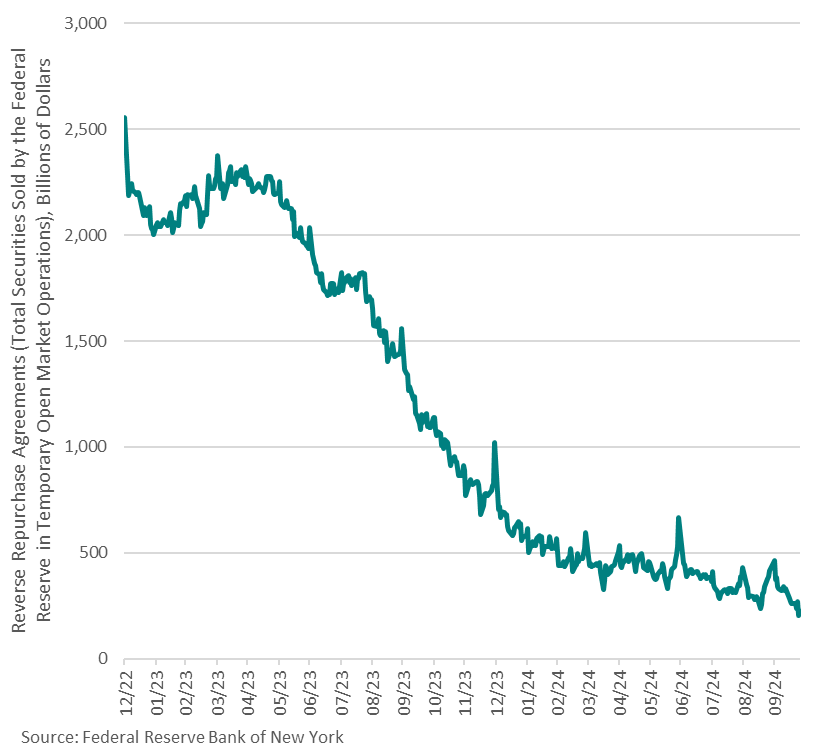

Simultaneously, the continued decline in RRPs (again, refresher available here) indicates that the Fed is allowing money to return to circulation and, more importantly, to return to the loanable funds market.

This is countering the Fed’s balance sheet reduction, which has slowed significantly since the Summer when they reduced the rate of Treasuries run off, even while keeping the MBS run off the same. (To Hell with mortgage rates, just keep the yields on Treasuries low!)

So, we’re really not looking at a supply crunch here. Supply has actually been increasing later—just check out M2. Conversely, demand is surging.

And there’s simply not enough loanable funds to meet that demand. We are in a shockingly similar position to where we were almost exactly five years ago, when the Fed’s overzealous tightening spawned a repo crisis and the central bank—which ostensibly sets interest rates—temporarily lost control of interest rates.

Fast forward to today, and the standing repo facility has been tapped in an attempt to keep interest rates within the Fed’s target range without a line forming at the discount window.

It’s now clear that bank reserves are in a downward trend and have been for some time. These trends have been difficult to establish in a post-pandemic world because of the repeatedly large swings induced by the Fed’s almost weekly manipulations, but now there’s no doubt we’ve been on the way down since about mid-March.

No coincidence, that’s also when banks could no longer borrow from the BTFP. What we’re observing right now is essentially the financial plumbing running dry. The Fed is barely holding everything together, with no cooperation from the Treasury. Liquidity is being sucked from reserves to buy Treasuries as money market mutual funds explode higher from this transfer.

And while $1.5 trillion served as a relatively stable level for reserves as 2020 dawned, it’s no longer anywhere near sufficient today. The lowest comfortable level of reserves (LCLOR) is now higher—much higher.

Circling back to the demand-supply imbalance, the Fed is trying to decrease supply to strangle inflation, but the Treasury is jacking up demand. So much so that today’s interest rates make absolutely no sense, and we believe we’re heading to another repo crisis. Why? Because the demand surge is about to go into overdrive—just look at the latest quarterly refunding data from Treasury.