Rate Cuts Are Coming – And So Is the Money Printer

Slashing rates means QE and even more inflation 🔥🔥🔥

With the squashing of further rate hikes and now talk of three rate cuts during 2024, Powell’s turning to the Dark Side is all but complete. Stocks, Bitcoin, bonds, oil, and of course gold, all rallied. But few people are pricing in how the Fed will be forced into QE (Money Printer go Brrr), either through balance sheet growth or “stealth mode.”

There will be consequences.

First and foremost, the interest rate is a price – the price of loanable funds. Right now, the Treasury is borrowing so much money that it’s been putting upward pressure on interest rates. To a certain extent, that’s been a welcome change from the Fed’s standpoint.

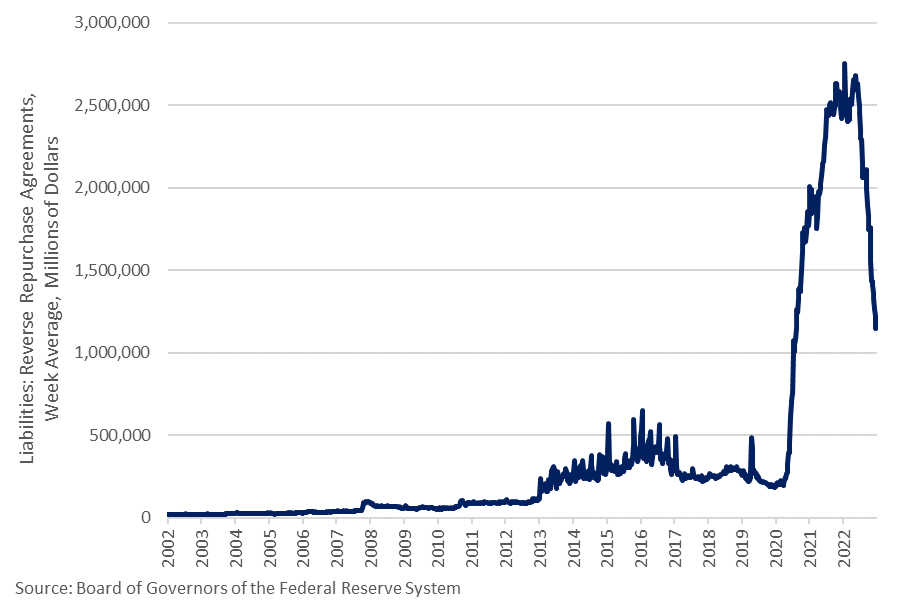

That’s because the Fed created so much cash from the spring of 2020 through the spring of 2022 that it struggled to maintain an interest rate floor, especially when Powell belatedly raised rates off zero.

The Fed used the reverse repo market to soak up nearly $3 trillion in liquidity and make loanable funds scarcer. Wringing out that excess supply provided the floor on interest rates necessary to keep them within the Fed’s target range.

But the repo market was never designed to be a long-term fix. For that, the Fed would need to either shrink supply through securities’ sales or demand would need to rise. The Treasury has accomplished the latter.

Reverse repos have come down from their high-water mark of $2.8 trillion to about $1.2 trillion, the effect of $1.2 trillion in securities’ sales by the Fed and nonstop auctions at the Treasury measured in the billions of dollars.

But even Yellen’s multi-trillion-dollar borrowing spree and Powell’s trickle of securities’ sales have not completely closed the gap, and total reverse repos remain over $1 trillion. If the Fed cuts rates, the situation gets worse.

At first glance, the opposite appears to be true. Reverse repos are screaming from the rooftops that there is an imbalance between the artificially imposed, arbitrary interest rate set at the Fed and the equilibrium price determined by supply and demand.

In this case, reverse repos are basically telling us that rates still want to go lower, and the Fed is still propping them up. Wouldn’t lower rates be more in line with actual market conditions?

Only if we’re talking about the artificial conditions that the Fed has temporarily imposed on the market.

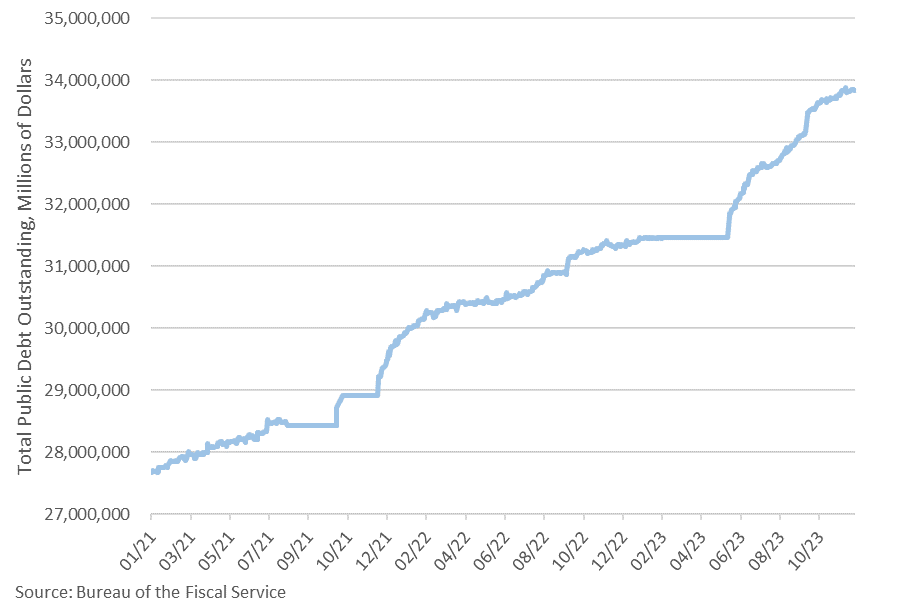

In reality, the Treasury is on track to borrow about $3 trillion this fiscal year. Some people are asserting it’ll be much higher (we recently saw a $6 trillion estimate), based on what was borrowed in October and November—the first two months of the fiscal year—but that ignores an important factor.

Almost $700 billion of the annual deficit is front loaded into the first six months because the Treasury is rebuilding its General Account at the NY Fed, which ran dry during the shutdown earlier this year. That borrowing won’t be repeated. Even still, $3 trillion is eyewatering and consequential.

It means the combination of Treasury auctions increasing demand coupled with securities’ sales at the Fed reducing supply are going to keep pushing the market interest rate higher and probably eat through the rest of the reverse repos in a matter of months.

At that point, the Fed will have to violently throw the levers of power from one direction to the other, switching from fighting to maintain an interest rate floor into maintaining an interest rate ceiling.

That’s when the Fed transitions from using reverse repos to repos, something we explained in detail in an earlier post. But what this also marks is a mandatory return to QE: Quantitative Easing – a fancy way to say money creation.

While the Fed could rely on repos for a time to inject liquidity, what we call stealth QE, that can’t last forever. Banks aren’t willing to play that game indefinitely.

Unlike the stealth QT of reverse repos, which allow financial institutions to get a risk-free return for doing absolutely nothing, repos have risk associated with them. They are one of the financial system’s “in case of emergency, break glass” tools.

Let’s fast-forward a few months to when reverse repos have run dry. Banks will borrow using repos to perform arbitrage on Treasuries, but only for short maturities and only for a while. Recall that the repo market is made up of short-term loans. If there’s a chance rates rise, that arbitrage stops working.

At that point, banks will be stuck with Treasuries paying a relatively low rate, say 3%, while the repo rate they pay is higher, even if only slightly higher, say 3.05%. The banks will lose money. If they borrowed to perform arbitrage on a 2-year Treasury, they’re stuck paying higher rates for that period while receiving a lower rate in return.

It’s effectively the risk of borrowing at a variable rate while loaning at a fixed one. If this sounds like the mess that encompasses the regional banks today, that’s because it’s essentially the same problem.

And the longer the charade goes on, the leerier participants in the system get. Even wide spreads between rates at the Fed and Treasury won’t be able to entice sufficient funds. At that point, the only buyer left is the Fed itself.

When the tipping point is reached, the central bank will be forced to buy securities to maintain its interest rate ceiling, just as it did in the end of 2019 when the repo market went haywire. It was the only way for an embarrassed Fed to regain control over interest rates.

But the fact that lower rates will force QE shouldn’t even be surprising – those two are supposed to go hand in glove. It’s only been since Powell & Co. decided to expand the functionality of the interest on reserve policy to reverse repos that the Great Divorce between rates and the balance sheet became truly viable.

Coming full circle for a moment, since the interest rate is the price of the loanable funds market, QT and QE should each coincide with opposite movements in the interest rate. This is as elementary as saying that a decrease or increase in the supply of smartphones will affect the price at which they sell.

Lastly, we have to address the elephant in the room (besides the elephantine size of the balance sheet), which is the Fed’s timing. Using some equations from Milton Friedman and others, we can see that the inflationary impact of money creation will really start in earnest about 13 months after initiation.

In other words, Powell & Co. are going to juice the economy in the middle of a hotly contested election and the fallout will only come in the middle of 2025, long after the ballots are cast.

From St. Jerome’s perspective, this is the right approach. Trump is leading in the polls and has already promised to replace Powell, calling him “the worst pick ever.” (If you read that in Trump’s Queens accent, bravo, so did we.)

So, St. Jerome’s chairmanship is dependent on Biden winning next year, an unlikely outcome if the economy is in a tailspin and homes remain unaffordable to all but the top 10% of income earners. Much more palpable will be freshly printed money – more hair of dog instead of the painful detox.

Don’t be surprised by the suggestion that Powell is a human being susceptible to incentives like everyone else. The Fed has shown repeatedly that they are neither politically independent nor data dependent.

While his first term as chairman was ending, the inflation alarm bells were deafeningly loud, but Powell ignored them until after he was confirmed, keeping rates below 1% as inflation ratcheted up to 40-year highs.

Less than a month into his second term, Powell cranked rates up 75 basis points, after promising a hike of that size was “off the table.” He then delivered 4 in a row. Apparently, they were off the table because they were taking center stage.

This also means that the Fed is setting itself up to repeat the catastrophic mistakes of the 1970s. When it was on the brink of success, it bowed to political pressure, fired up the printers, and the inflation race was back on.

Another round of drinks only intensified the economic alcoholism, brought even worse inflation, and necessitated Fed chair Paul Volker’s shock treatment, which made the back-to-back recessions of 1980 and 1981-82 ones for the record books.

It was as if Volker was trying to atone for his mortal sin of persuading Nixon to end the gold standard almost 8 years to the day before he took the helm at the Fed. For the 8 years thereafter, while the Stars and Stripes hung over the Eccles building, Volker might as well have flown the Jolly Roger – he took no prisoners.

That was likely why even Ronald Reagan didn’t have the stomach for anymore of Volker’s medicine and replaced him with Greenspan in 1987, a man whose easy money policies eventually created the first too-big-to-fail bailout by the Fed (Long Term Capital Management) and housing bubble with subsequent financial crisis.

What further proof do we need that the Fed is beholden to its political masters? If and when QE returns, prepare yourself accordingly.

Great article FX Hedge! I agree with pretty much everything you said. But let me add another element to why rate cuts are coming, and h/t to Luke Gromen @ FFTT for educating me on the following....

In mid-October, the MOVE index hit 140, indicating acute US Treasury market dysfunction (5th time in four years: Sep. 2019, Mar. 2020, Sep. 2022, Mar. 2023) had returned as there were several weak auctions. Fed speakers immediately started talking the USD down in the following weeks, then the QRA came out telling us Yellen is going to push the huge supply of bonds to the front end of the curve. What happened then?

November saw the most significant easing in financial conditions in any single month in the past four decades, and US bonds had their best month since May 1985. Yellen running down the TGA by $100-$150 in November certainly helped, and it was no surprise everything went up (gold, BTC, equities, & bonds) except the dollar (and oil, which is another story).

But what else happened in November? November US True Interest Expense (Social Security + Medicare + Medicaid + Interest Expense) was $345 billion vs. tax receipts of $275 billion. Fiscal Dominance has arrived (https://thexproject.substack.com/p/fiscal-dominance).

US fiscal position is forcing the Fed to stop hiking (weakening the dollar) and forcing the Fed to cut rates before inflation is back down to its targets. So I agree there are political and self-preservation angles to the Fed pivoting to cutting rates. But this is really a desperate effort the keep the financial house of cards from crashing by weakening the US dollar significantly in order to drive US asset prices and inflation significantly higher, which will allow US tax receipts and GDP growth to rise significantly, which they hope will reduce deficits and therefore US Treasury issuance.

But, all that will at some point (maybe past the election they hope) once again weigh on the US Treasury market, and then what? I fear the end-game is near as the road on which they've been kicking the can down appears to be a dead-end with a brick wall ahead and bond vigilantes from behind fast approaching.

Even with government spending at high levels GDI is in contraction and when combined with other indicators is showing that recession is near. This leads me to believe that tax revenues are set to decline and substantial borrowing will be needed to make up the difference as election year spending kicks in. I think the $6T guess should not be completely discounted. Any attempt by the Fed to soak this up could easily set up an inflationary spiral with all sorts of ugly consequences. As an aside, IMO the TGA should be counted in the money supply as the Fed is acting in the role of a commercial bank.