The jig is up, and Federal Reserve Chairman Jerome Powell has finally admitted it. What we’ve long telegraphed has arrived right on schedule and the Fed is already warming up the printers.

To understand why, we’ll do a recap of the financial plumbing in the Fed-controlled system, which you can of course read in greater detail in our earlier posts. But here’s what you need to know right now.

The Fed has painted itself into a corner because they’ve actually abandoned most of their monetary tools, at least for their traditional purposes. Under Powell, the Fed has chosen to turn the dials mostly to influence the financial plumbing, not inflation or the labor market.

In truth, those last two are secondary considerations, despite them being virtually all that Powell and his colleagues discuss—their “dual mandate.”

What Powell & Co. are really laser focused on right now is liquidity and bank reserves, the latter being the money that banks have parked at the Fed. For about a century, the only reason banks kept money parked idle in the Fed vaults was because they had to.

Not so today. The Fed abolished the reserve requirement in 2020 and started paying banks interest on reserves (for several years prior, the Fed paid interest on “excess reserves” which was anything above the reserve requirement).

Powell & Co. also expanded the reverse repurchase agreement (reverse repo) facility which essentially functioned the same way.

Reverse repos pay interest just like bank reserves, and there’s only a few basis points difference in the rates. In both cases, the Fed is keeping liquidity on the sidelines—ready for action, but out of the fray.

Repos and reverse repos were supposed to be like shock absorbers, temporary ways for the Fed to quickly inject or absorb liquidity, respectively. It’s faster than changing open market operations and it’s not permanent since these are short-term loans, not mere exchanges like the purchase or sale of securities.

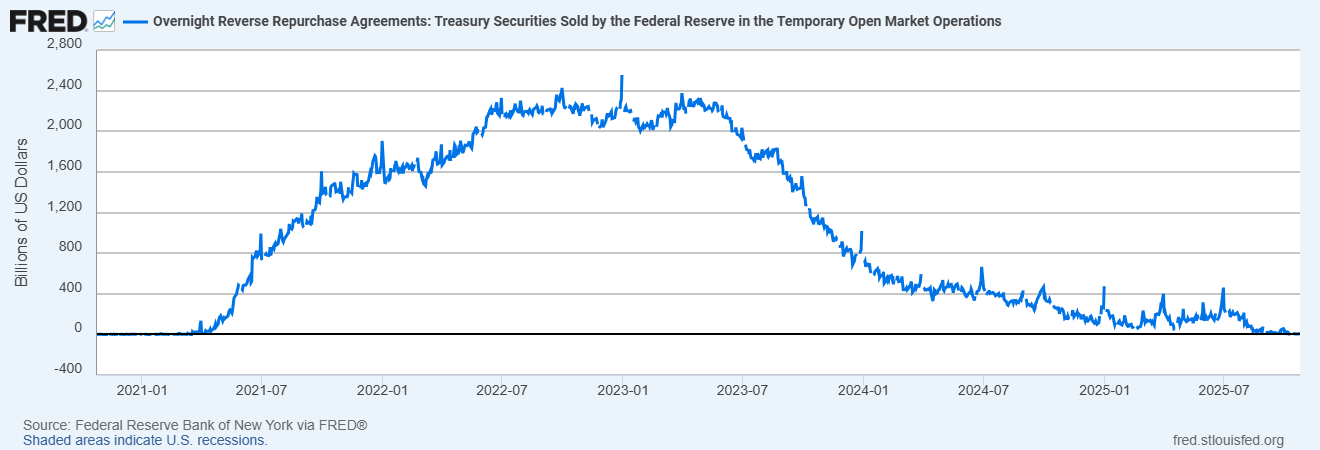

But the Fed changed the rules of the game after the unprecedented money printing that began in 2020. When reverse repos were exploding, that was the signal for the Fed to call it quits, but they didn’t.

The Fed kept printing.

Reverse repos at the New York Fed (the main trading desk, though all 12 branches have one) topped out at over $2.5 trillion, partly due to an end of year spike as liquidity looked for somewhere to go when banks were awash with cash to appease regulators.

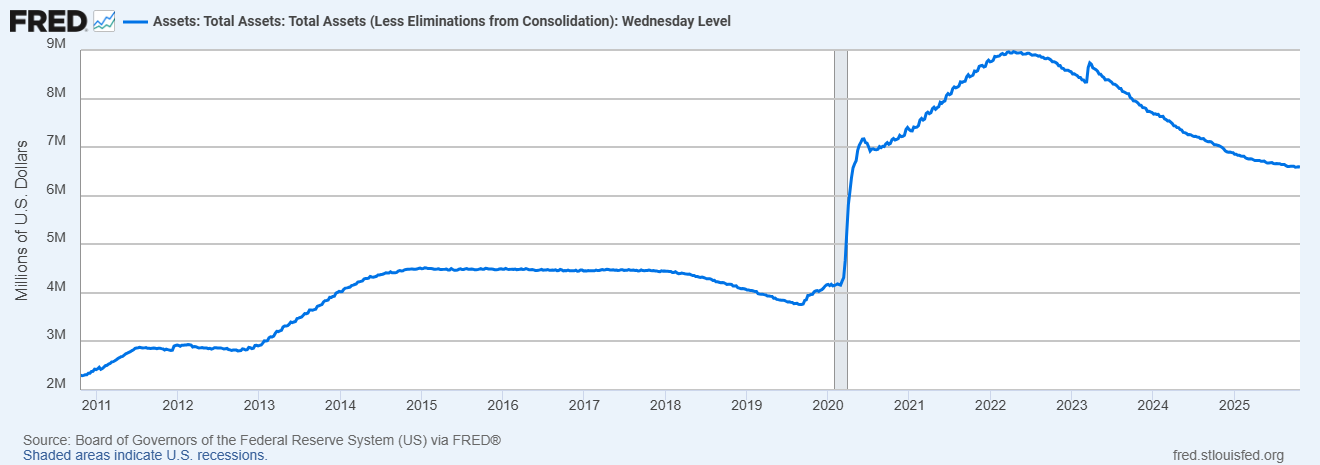

When the Fed belatedly stopped buy securities—euphemistically referred to as quantitative easing, or QE—and then started selling assets—that’s quantitative tightening, or QT—the liquidity drain was on.

The Fed had finally pulled the plug on the overflowing bathtub and the water level started falling.

But much of what happened initially was transferring spilled water back into the tub so that the level didn’t fall much. As a very loose analogy, think of the reverse repos as towels that had soaked up the overflowing water on the floor and draining the reverse repo facility was like wringing out those towels back into the tub.

Fast forward to today and the reverse repo is completely drained. For several days, we’ve seen the repo facility be tapped, meaning the Fed is injecting liquidity.

Of course, the sums here are so trivial that they’re not even rounding errors for the Fed. Two or three billion dollars a day in a repo market that’s well over $1 trillion is effectively nothing.

But that brings us to what we forecasted a while ago: the Fed has drained all the liquidity it can before things start running too dry.

Since Powell & Co. are primarily focused on the financial system’s plumbing, this will force their hand into adding liquidity.

A.K.A., printing money.

The first step in this process has already been expressly said by Powell himself during a recent public address, wherein he declared QT would end soon. Of course, that’s just step one.

Will this solve the Fed’s underlying problem? No, not at all. It merely buys time. And very little time at that.

The Fed’s pyramid scheme requires bank reserves to grow over time, essentially maintaining ratios with things like the size of the economy or the level of bank assets. The problem for Powell & Co. is that those things are growing.

That means bank reserves have to grow, or things will start to break. QT, rather problematically, has been reducing bank reserves ever since the debt ceiling was lifted earlier this year and the Treasury then had to compete with the Fed for loanable funds.

The result was banks deciding to lend to Bessent instead of Powell.

And that’s drying up bank reserves, not to a historically low level, but one that’s below the ridiculously high level of “abundant” reserves and is not just “ample” reserves—what some call the DANGER zone.

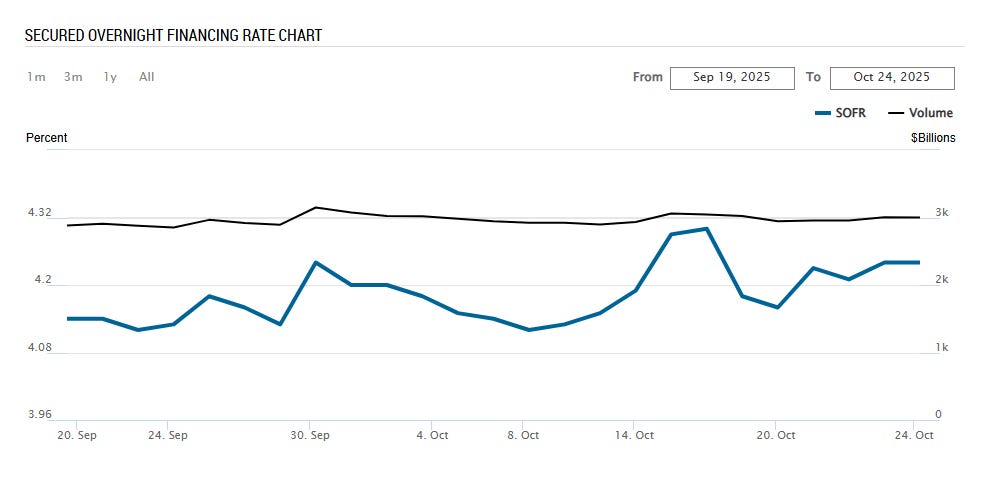

Just like the Autumn of 2019, the Fed today is starting to lose control, first of interest rates and then something much worse.

The latest secured overnight financing rate (SOFR) is at the upper bound of the Fed funds rate target range, and SOFR has recently even exceeded this upper bound a couple of times.

Similar to backwardation, we’ve seen overnight lending become more expensive on secured than unsecured loans via Fed funds—a sign something is amiss at best and terribly wrong at worst. Powell & Co. are on the verge of losing control.

But they won’t, of course. They’ll take even more control instead. And that starts with ending QT, which will happen at either this week’s meeting or the next.

There’ll be no more runoff of Treasuries and as old ones on the balance sheet mature, the Fed will simply buy new ones to replace them. However, this only stops the destruction of bank reserves—it doesn’t increase them.

And that’s where the next round of QE comes in.

It may take the Fed a few more months, but the system they’ve built requires more bank reserves over time, and just maintaining the status quo of the balance sheet’s current level will soon push the system below “ample” reserves.

That’s when we go to “scarce” reserves territory and the Board of Governors run around with their hair on fire.

What if the Fed cuts rates at the same time they stop QT? Surely even more easy monetary policy will help, right?

Unfortunately, no. Returning to an earlier point, Powell & Co. have straightjacketed many of their monetary tools into plumbing tools only, so very few dials can be turned without having adverse and counterproductive consequences.

Each time they cut rates, it reduces the incentive for banks to keep money parked at the Fed in reserves. This could very quickly exacerbate the problem as banks pull money out of Fed vaults and loan it to the Treasury or the private sector.

Ironically, Powell & Co. might need to step on the gas and brake at the same time to increase reserves at flank speed: QE (gas) to regrow the balance sheet and push liquidity into the system while hiking rates (brake) to incentivize banks keeping more of that liquidity in reserve.

That’ll cause reverse repos to zoom back up as the Fed works to maintain an interest rate floor while flooding liquidity into the banks.

Of course, this is a recipe to strangle the real economy while paying tons of interest to the bankers. Sound familiar? That’s because we’ve lived through a version of that for the last several years, with both financial firm profits and asset prices exploding higher, but the average Joe just gets inflation.

Today, it also means the Treasury has to compete vigorously for loanable funds, which is making it more expensive to finance the national debt.

Regardless, “Printer is Coming.”

This isn’t a secret and the well-informed in the financial sector know it. That’s why they began buying gold when we alerted readers to do so as well. And guess what? They’re still buying. Even at well over $4,000 an ounce.

That should tell you something.

Much of the coming QE is already priced into gold because the smart money saw the writing on the wall earlier this year when liquidity was just getting tight, even before the government could borrow because of the debt ceiling.

And as soon as that restriction was lifted, the plumbing system got much worse—exactly as expected.

So, how to look at the coming storm? In brief, it’s a buy-everything opportunity. That doesn’t mean the real value of everything is going to increase, but rather that the price of everything will.

As the dollar loses value, it’ll take more of those dollars to buy anything and everything.

Stonks go up, as it were.

But things with a monetary premium or financialized assets (like gold, silver, Bitcoin, housing, collectibles, etc.) tend to appreciate in price much more during these episodes.

The return of QE is very bullish on a whole lot of stuff, but will of course cause much more inflation, impoverishing everyone and siphoning off the real value of countless people’s savings and earnings. It is, as Lenin correct said, the best way to destroy the capitalist system.

Powell thought he could engineer the mythical “soft landing” scenario—which has never, ever been achieved by the Fed—wherein he would bring down inflation and not create a recession. Powell was wrong, and now he’s choosing “no landing,” meaning we stave off a recession in exchange for the inflation.

In that sense, we all lose—but you can mitigate the damage in your own life.

Now, if the Fed’s plan is so terrible, what’s the solution? Get back to basics.

The central bank needs to reinstitute the reserve requirement, first and foremost. Stop paying banks not to lend. Second, don’t stop but accelerate the balance sheet runoff.

Wait, won’t that lead to a catestrophic collapse in the money supply? Not at all. It will be directly countered by banks loaning money that was previously parked at the Fed.

Third, let the Fed funds rate float and just set the discount rate (price to borrow directly from the Fed) at a steep penalty to the prior day’s Fed funds rate. This same methodology can also be used on both repo desks until they eventually get shut down too.

Is that all pie in the sky, wishful thinking? Probably.

But until the Fed finally does the right thing, we’ll still be figuring out how to protect ourselves from their mistakes.

You man....... First of all, thank you dearly for these wonderful insights,

Second, YOU ARE A GENIUS BRUH......🥳😉😎😎😎😎

I always compare the Fed with the old Soviet Union's various bureaus. Just like the Fed, stacked with supposedly smart people but still totally impossible to determine money supply, interest rates, etc. for a very complex economy. Still, they pretend and everyone pretends the Emperor's clothing look just fine. Of course, Trump, being in real estate, would ignite inflation off the spreadsheet if his super-low interest rates ever happen. Central banks just cause financial bubbles in the various sectors through their mismanagement.