Past the Point of No Return?

History Says America’s financial doom loop may have already begun

The late Toby Keith sang “I love this American ride,” but that ride may be about to end abruptly. To be blunt, the signs do not look good, and we’re already past some milestones where other countries were brought to their knees.

The latest red line to be crossed is mandatory spending.

The word “mandatory” is somewhat misleading. We know, we know – you’re shocked that the government would ever use misleading language. Hang tight for a second.

Mandatory in the budget context essentially means spending that has already been promised. Conversely, discretionary spending is subject to annual appropriations.

Virtually all mandatory spending is for some form of social assistance or social insurance – welfare, broadly speaking. It’s things like Social Security, Medicare, unemployment compensation, and food stamps.

It even includes things like some agriculture programs and student loan subsidies – anything that’s already been promised and doesn’t need another Congressional approval to make a payment.

Believe it or not, defense spending is in the discretionary category despite military readiness being a necessity in today’s world, especially for America. Nevertheless, since Congress has to approve military spending each year, it’s discretionary.

All government spending can be divided along this binary of mandatory and discretionary, with the notable exception of interest on the federal debt.

Oddly, this very large category is neither fish nor fowl, with the Congressional Budget Office considering it as its own category.

This is possibly a callback to the days when interest on the debt was so small that it didn’t really matter where in the ledger the bean counters put it – the bottom line didn’t change noticeably.

Not so, today. Gross interest on the debt is fast on its way to becoming the biggest line item in the budget – it’s already number three, having passed the total spending on all military programs many months ago.

Even the made-up category of “net interest” which makes interest on the debt look smaller than it really is has eclipsed defense spending.

But interest is an unusual category, and we have to admit that it doesn’t quite fit in either mandatory or discretionary. It technically isn’t mandatory because most of it actually hasn’t been promised. Most of the interest paid each year is entirely uncertain because of debt rollover.

Treasury bills have a maximum duration of 52 weeks, and most are much shorter than that. By definition, all T-bills rollover at least once in a given calendar year, with some rolling over several times.

What is the amount that has been promised on that debt? It’s uncertain. No one knows for sure what those T-bills will go for at auction - today’s yields are blowing away previous Congressional Budget Office forecasts, for example. And T-bills might effectively get rolled over into a different debt instrument, like notes or bonds.

Notes and bonds are also maturing every year, and those are likewise rolled over too. The interest rate may go up, it may go down, it might stay unchanged. In a word: uncertain.

Then there’s also more specialized Treasury issuance, like I-bonds, which do not have a fixed interest rate or fixed coupon payments but can vary based on factors like inflation.

Debt instruments like that can change how much the Treasury has to pay without the debt instrument even maturing.

So, while existing fixed-interest-rate debt that will last through the year without maturing (some fraction of notes and bonds outstanding) has a “promised” or mandatory expense attached to it, the rest doesn’t fit this strict definition.

And yet, discretionary doesn’t fit either. There’s no Congressional appropriations bill that authorizes Treasury auctions. This money, even if it’s not a fixed amount, is going out the door whether Congress acts or not.

Nevertheless, if terms of the financial health of a nation, we’re going to treat interest as mandatory spending because if you shut off the spigot tomorrow and renege on those payments, the entire global financial system would decent into chaos – and that’s not an exaggeration.

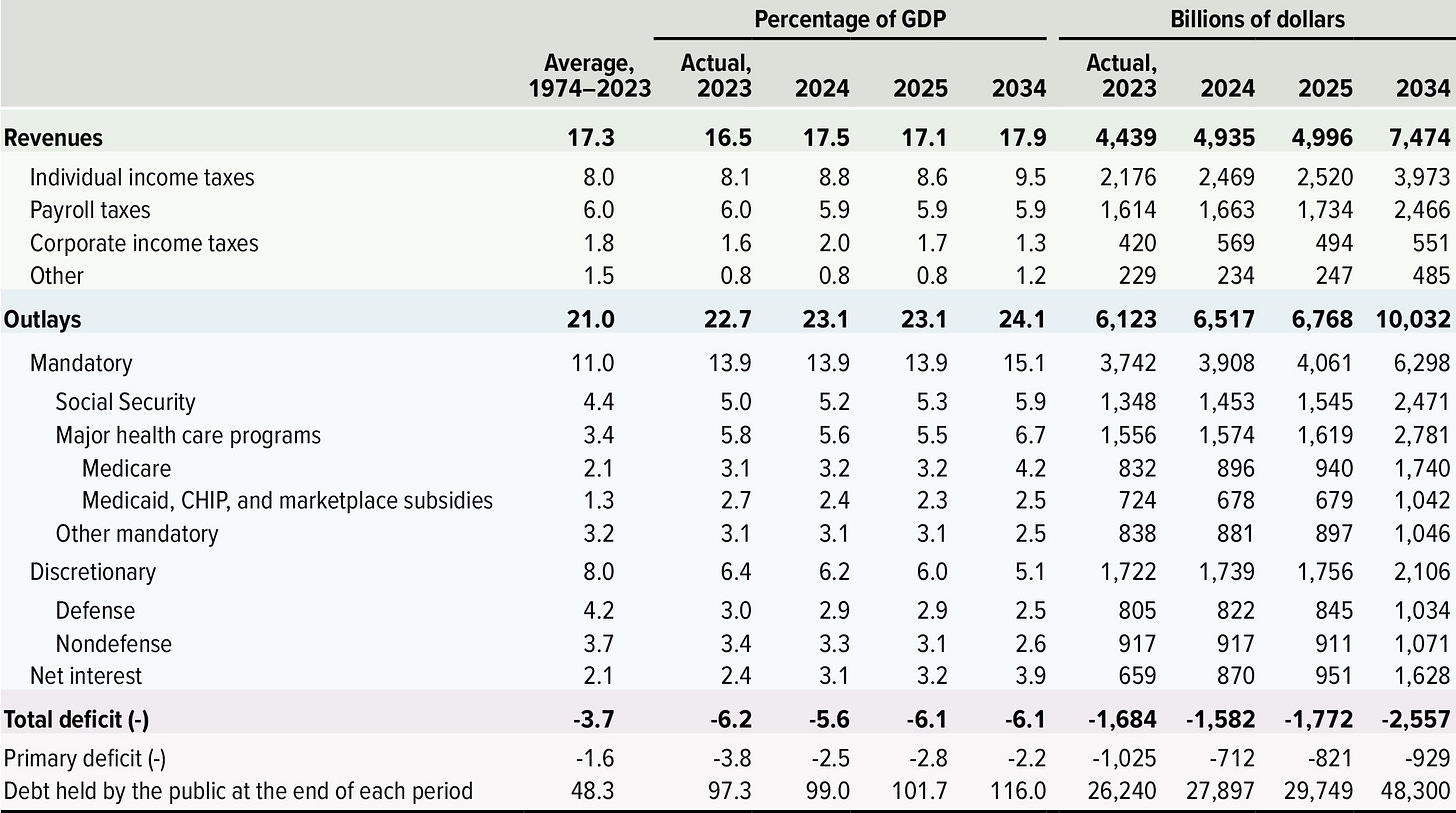

Combining mandatory and gross interest spending yielded $4.7 trillion in 2023. Even if you use the CBO’s fake category of net interest, mandatory and interest spending were $4.4 trillion, or 99% of GDP.

And things are getting worse. By 2034, CBO projects mandatory and interest spending will be $7.9 trillion, or 106% of all tax revenue.

Before we spend a single dime on discretionary spending, we’re already taking on debt. One hundred percent of the military budget is financed entirely by borrowed money.

It’s likely not possible to pull out of this doom loop without massive currency devaluation, if history is any guide. When most nations in the past reached this point, it was an existential dead end heralding eventual regime change via revolution – often violent.

There are exceptions however, like Greece.

By 2008, it was clear to even the bureaucrats in Brussels that Greek debt was a time bomb about to explode. Debt was over 100% of GDP with deficits 15% of GDP (even though statutory deficit limit was 3%).

Greece’s massive government bills were driven mostly by previous promises: mandatory spending and interest on the burgeoning debt.

Greece was spiraling out of control, going further into debt to German bankers with each passing day and having no realistic hope of being able to make good on those debts.

But when it joined the European Union, Greece gave up its sovereignty, and was no longer master of its own destiny. That was doubly true during the European debt crisis since Germany was the EU’s largest economy with German bankers holding disproportionate political sway in Brussels.

That meant Greece didn’t control its own central bank to simply monetize its debts and print its way out of trouble with hyperinflation. The European Central Bank would have no such thing because, again, Germany.

Likewise, Greece couldn’t simply stiff the other EU member states and default. In the end, the Greek people got austerity, the bond holders got screwed, and the bankers… got paid.

The EU gave Greece a massive cash infusion just so it could pay interest. In other words, they loaned Greece money so that Greece could repay money. Yep – totally checks out.

In exchange for this bail out, the Greek government instituted harsh austerity measures which decimated the Greek economy. Unemployment hit 28%, exceeded 20% until 2018, and has never fallen below double digits for a single month since their debt crisis began.

Pensions and the Greek versions of Social Security and Medicare were cut to the bone.

Even still, there was uncertainty if Greece could pay their bills. Before the dust settled, interest on Greek 10-year debt exceeded 30% as the EU unlawfully forced bond holders to accept massive losses in a “restructuring” – which used to be called default or just theft.

The Herculean effort never really solved the problem as much as it kicked the can down the road.

Greek debt to GDP eventually hit 207% in 2020 before massive currency devaluations worldwide brought that down to 160% of GDP – another hosing of creditors.

So much for making progress.

Nevertheless, Greece is still around, anemic as it may be. But that’s not a datum point in America’s favor because the same EU dynamic doesn’t apply to Uncle Sam – at least not 100%.

There’s no American Union to force austerity measures on the US government, which also has its own central bank. We can inflate at will, which we have done, are doing, and will continue doing.

Furthermore, the US government has shown a willingness to abuse the reserve currency status until death.

Without a serious de-escalation in the growth of mandatory and interest spending, the US is just not going to make it. On top of axing nearly all discretionary spending, including defense, Congress needs to sunset major entitlements.

These things were set up as Ponzi schemes, reliant on exponential population growth. When birth rates began collapsing, immigration put off the day of reckoning, but didn’t change the calculus.

We need serious spending reform – but who’s going to force such austerity? Prepare accordingly.

Yep, the good old US of A is flat broke. You would have to pay someone to take it off your hands.

https://truthaddict.substack.com/p/the-usa-is-now-officially-worthless

https://truthaddict.substack.com/p/the-great-reset-is-the-great-taking

The problem is government and it's unsatisfied need to control everything. That adds up to big costs. It doesn't matter even if the tax receipts suddenly doubled. Spending would double also. Money of any kind has no real value other than what humanity places upon it. Take your dollars, gold, bitcoin and diamonds to another planet and see how much it buys.

150 years ago, there were much fewer outlets for consumer consumption. Fast forward to the 2020's and there is an endless force of marketing idiots begging for everyone to spend themselves to death. It's the same with the government...there is a bottomless pit at the end of all that spending that will never get filled. There is always another hand needing a handout and another place to spend a dollar. It's why government always fails.