Out of the Frying Pan, Into the Fire

Treasury just had its worst August ever and things are getting worse

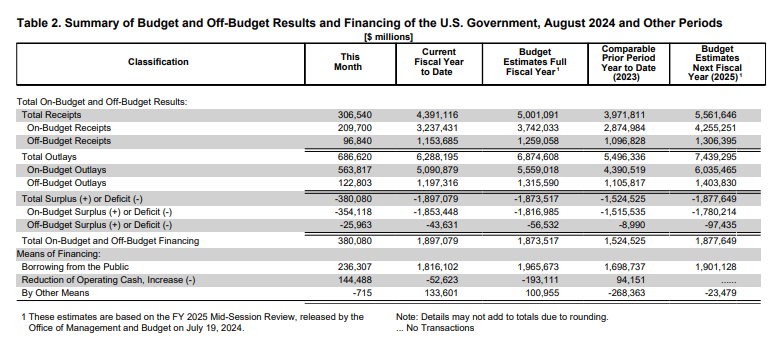

Janet Inflation-Is-Transitory Yellen once again has egg on her face. After laughably low deficit projections for the current fiscal year, Treasury has now blown past those forecasts, and we still have a month to go before the end of the current fiscal year. Worse yet, the latest monthly Treasury statement set several record “firsts” — none of which were good.

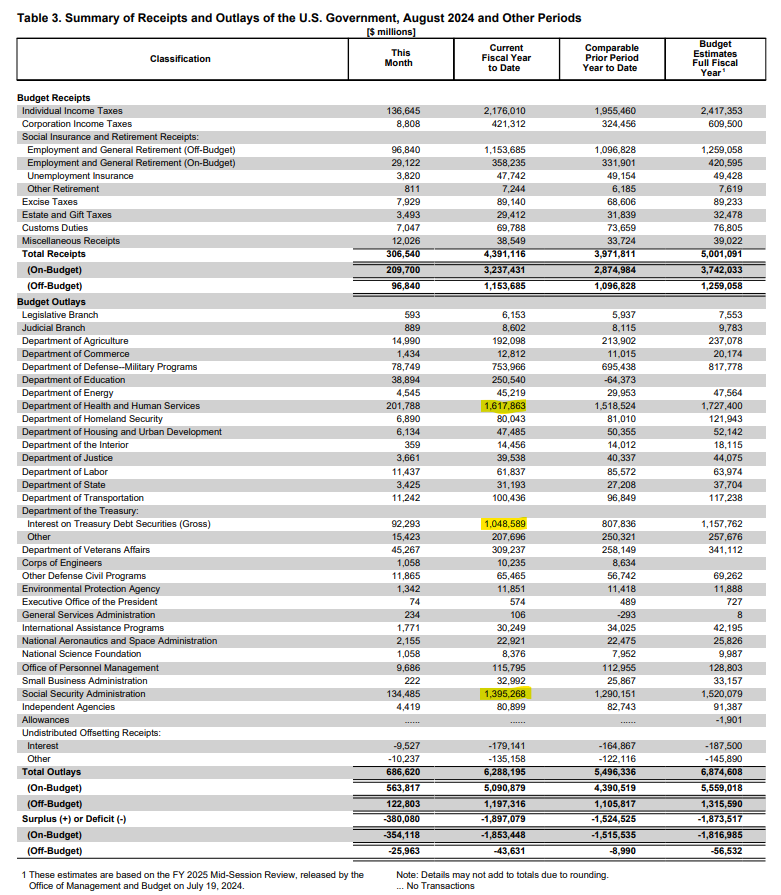

While our readers already knew that annual interest on the debt was heading to $1 trillion, this was the first time it had ever been recorded. As of August, the 11th month of the fiscal year, the government has spent over $1.049 trillion just to service the $35.3 trillion debt. What makes it scarier is that we still have another month to go in the current fiscal year.

It didn’t even take all 12 months to prove wrong those folks saying interest on the debt wouldn’t break the $1-trillion threshold.

Even with interest rate cuts, there’s no significant evidence that the problem is slowing down. That’s because interest on the debt is a function of BOTH the average interest rate on securities AND the total debt outstanding. Well, the latter is exploding.

We’ll add about another $1 trillion to the federal debt before the end of the calendar year, and then likely continue adding about $1 trillion every 100 days or so form there on out.

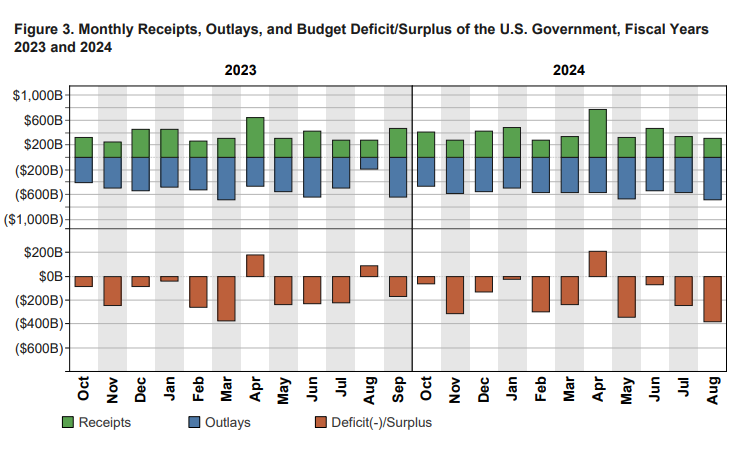

This was also the worst deficit for the month of August ever—including the blowout spending years of 2020 and 2021 when Congress pushed through all kinds of bloated pork. In fact, at $380 billion, it’s larger than any other monthly deficit of fiscal years 2024 or 2023.

And this isn’t a revenue problem—it’s a spending problem. Despite concerns of a recession, tax revenue has actually held up, so the burgeoning deficit is clearly coming from the other side of the ledger.

In the first 11 months of the current fiscal year, the federal government took in almost as much revenue as in the entire prior fiscal year. If we look at the comparable period (first 11 months of both FY’s) then we see revenues have increased from $4.0 trillion to $4.4 trillion. Spending, however, has increased even faster.

This past August, federal outlays were $687 billion, compared to $194 billion in August 2023 — more than tripling in just one year. Outlays in the comparable period between both years have gone from $5.5 trillion (2023) to $6.3 trillion (2024).

Clearly, the ballooning deficit is a spending problem. And what a problem it is.

We were very critical of Treasury’s overly optimistic projections on the current fiscal year’s deficit and, sure enough, we were right. The deficit has already blown past the projection for the fiscal year and—as we’ve already said—there’s still another month to go.

The $1.9-trillion deficit will break the $2-trillion threshold with ease once September is in the books.

And there’s no reason to believe multi-trillion-dollar deficits are going away anytime soon because the runaway spending continues. In fact, mandatory spending and interest on the debt together will exceed government revenue for the foreseeable future. So, literally all discretionary spending will be deficit spending.

The monthly Treasury statement for August bears witness to this sad situation: 55 cents of every dollar the federal government spent last month was borrowed. Spending was more than twice all government receipts.

While the profligate spending out of Washington, DC has certainly exploded over the last four years, the interest on the debt is now also a major contributor to the deficit. The increase in the trend of discretionary spending is now less than the increase in the trend of interest on the debt.

In other words, depending on how you want to measure it, interest on the debt is now the largest contributor to the deficit.

For the fiscal year to date, interest on the debt is the third largest line item in the Treasury’s August statement, behind only the Social Security Administration and the Department of Health and Human Services, both of which have increased relative to their pre-2020 projections, but by much less than interest on the debt.

Federal finance is clearly in shambles, but where do we go from here? Are we actually already in the fiscal doom loop? Well, yes and no—it’s complicated.