MMT: Mostly Manipulated Terminology

Why this economic craziness is wrong and why the “experts” can’t explain it

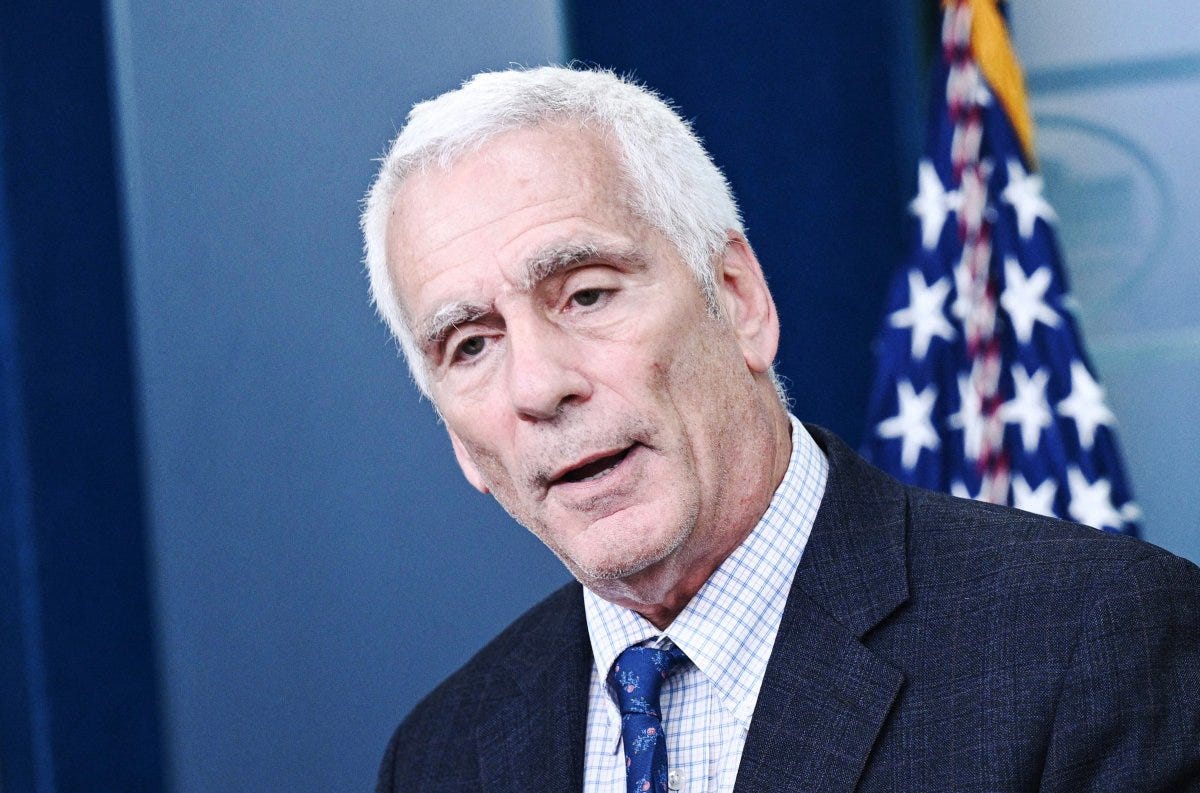

Long time readers of this newsletter are aware that we’re no fans of Jared Berstein, one of the White House’s chief economic advisors. To be fair, we’re equal opportunity haters and call out spin doctors on both sides of the aisle.

But Berstein found himself in hot water again recently, not for lying in an attempt to defend his boss, but for exposing his complete lack of understanding regarding anything even remotely related to economics.

As a refresher for those who assume government employees are chosen for their knowledge and skill, Berstein is not an economist. He’s a musician turned social worker.

No, we’re not being sarcastic – that’s literally true.

He holds no economic degrees, nor does he have any training in the field. Hence, his abysmal job performance. And bad advice on policy. And bombing of interviews.

But the interview that went viral recently was specifically related to monetary policy. Now, in fairness to Berstein, this is arguably the most difficult branch of economics to understand so we should cut him some slack.

But, as Dirty Harry famously said, “A man’s got to know his limitations.” Ignoring that warning, Bernstein’s pride went before his humiliating fall.

An advocate for Modern Monetary Theory asked him why the US government borrows money if it can just print the money, and Bernstein’s incoherent, rambling response was exactly as follows—verbatim:

“The U.S. government can't go bankrupt, because we can print our own money. Well, um, the uh, so the, I mean, again, some of this stuff gets, some of the language that the, some of the language and concepts are just confusing.

“I mean, the government definitely prints money, and it definitely lends that money. Which is why, uh, um, the government definitely prints money and then it lends that money by, uh, by selling bonds. Is that what they do?

“They, they, uh, they, yeah, they, they, um, they, they sell bonds. Yeah, they sell bonds. Right? They sell bonds and people buy the bonds and lend them the money. Yeah. So, a lot of times, a lot of times, at least to my ear, with MMT, the language and the concepts can be unnecessarily confusing.

“But there is no question that the government prints money and then it uses that money to, um, uh, uh, so, um, yeah. I, I guess I’m just, I don’t, I can’t really, I don’t get it.

“I don’t know what they’re talking about, like, cause it’s like, the government clearly prints money. It does it all the time and it clearly borrows, otherwise we wouldn’t be having this debt and deficit conversation. So, I don’t think there’s anything confusing there.”

Berstein is the Michael Scott of economics.

This helps explain why America is in such a fiscal mess. One of the nation’s chief economic advisors doesn’t understand how money works, how the bond markets work, how federal finance works, etc.

But Bernstein’s confusion stems just as much from his own lack of economic understanding as it does from MMT’s abuse of economic terms.

What MMT advocates do is muddy the waters so thoroughly that nothing is clear, and then follow up with a seemingly simply question that has become ineludibly unanswerable.

That brings us to the crescendo of every MMT argument, which is to simply assume the opposite of what can’t be explained.

Let’s apply this process to the situation with Bernstein to see it working in action.

The MMT crowd start with a couple of truths and then manipulate the terminology from there. They state that the US borrows money. Obviously true.

And that the US creates its own currency. Obviously true.

But then they assume that creating money is an economic neutral, meaning it has no second order effects. The government can print cash with literally no negative consequences.

Anyone whose IQ begins with a digit and not a decimal point knows that’s not true. This is highly inflation, as the last three years will attest.

If you ask the MMT crowd, however, inflation is caused by the citizenry spending too much money. If prices are rising, we need to tax away people’s earnings so that they have less money to spend, and that downward demand shock will reduce prices.

Of course, this is also where MMT devolves into class warfare, telling the plebes that all their problems stem from an elite wealthy class having too much money, which the government just needs to tax away, so that utopia may finally arrive.

But if people overspending causes inflation, why does government overspending cause inflation? Especially when it’s the government creating the money for itself to spend in the first place?

Such questions expose MMT for the fraud it is, and so are ignored.

Since government spending is simply assumed to never ever cause any inflation at all, why wouldn’t we just print to our hearts’ content? Why borrow a dime?

At this point, the MMT crowd has undermined the foundation of the answer to the question. As soon as you take for granted the ludicrous starting point of this ideology masquerading as theory, you’re forced to come to their conclusions.

With no negative consequences, of course the government should just print money and not worry about borrowing.

Prices, including the price for money which we call the interest rate, are relics of a forgotten time. Modern man, through his genius, has overcome such archaic ideas. MMT says we can square the circle of getting something for nothing, and government is the vessel by which to do it.

Not only is MMT a deceptive shell game by wordsmiths and sophists, but it’s also misnamed.

First, it’s not modern. FDR’s Treasury Secretary, Morgenthau, was a proponent of it. Note that Morgenthau himself didn’t even come up with the ideas, which predated him, but he simply defended them, almost 100 years ago.

Second, it’s not monetary. It’s really a fiscal scheme that reduces monetary policy to simply an extension of fiscal policy – a way to finance government deficits.

Lastly, it’s not a theory. It has been tried in different countries, on different continents, at different times. Each time it failed. Disastrously. The last three years were just the latest example.

The end result of MMT is you having a pile of worthless cash, which the government gave you in exchange for the proceeds of your labors.

But the government is not to blame! Nay! It is your fellow man who, in his spendthrift nature, has driven prices beyond your reach. It is a fiscal war of each against all, and no one wins but those at the levers of power.

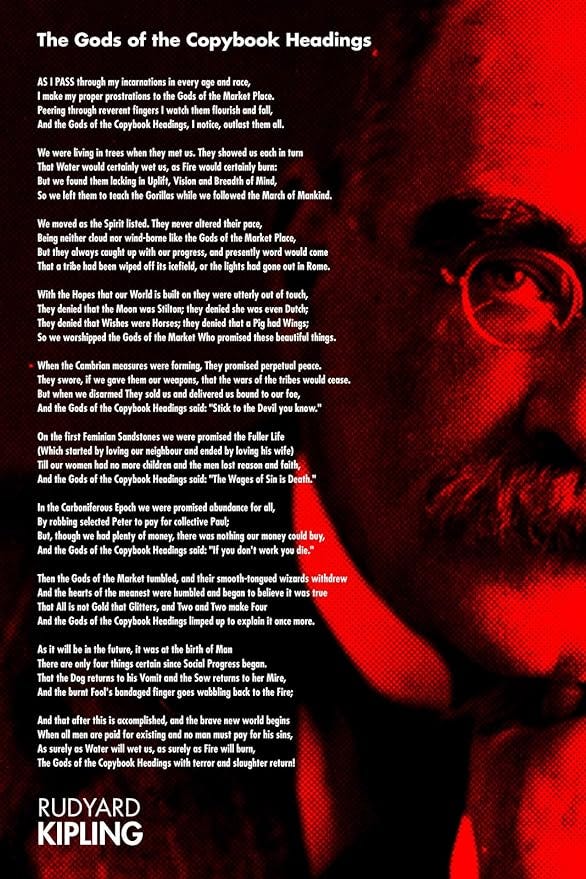

Perhaps Rudyard Kipling put it best:

“In the Carboniferous Epoch,

We were promised abundance for all,

By robbing selected Peter,

To pay for collective Paul,

But though we had plenty of money,

There was nothing our money could buy,

And the Gods of the Copybook Headings,

Said, ‘If you don’t work, you die.’”

MMT is the process by which government prints money, buys all the stuff, and when there’s no stuff left to buy takes away everyone else’s money to avoid any consequences ….. to the government.

I finally understand MMT - thanks.

"But if people overspending causes inflation, why does government overspending cause inflation?"

Makes better sense to me this way:

But if people overspending causes inflation, why does government overspending NOT cause inflation?