Jerome: Judge, Jury, & Executioner of Small Banks

Powell just signed the death warrants of more banks, and he plans to execute them himself

A month ago, we did an exposé on how Powell & Co. had transformed the Bank Term Funding Program from a supposed lifeline for regional banks into a money printer for big banks. They just reversed course and doomed many small banks in the process.

Perhaps because of the alarm bells we and others raised, the Fed decided to end the ridiculous arbitrage they created (you can read our detailed explanation here) before more people figured out what they were doing.

Whatever the motivation though, the way they eliminated the arbitrage not only shut off the spigot of free money to big banks, but also lit a fire that may burn down what’s left of the regional banks.

The arsonists in firemen’s clothing have returned.

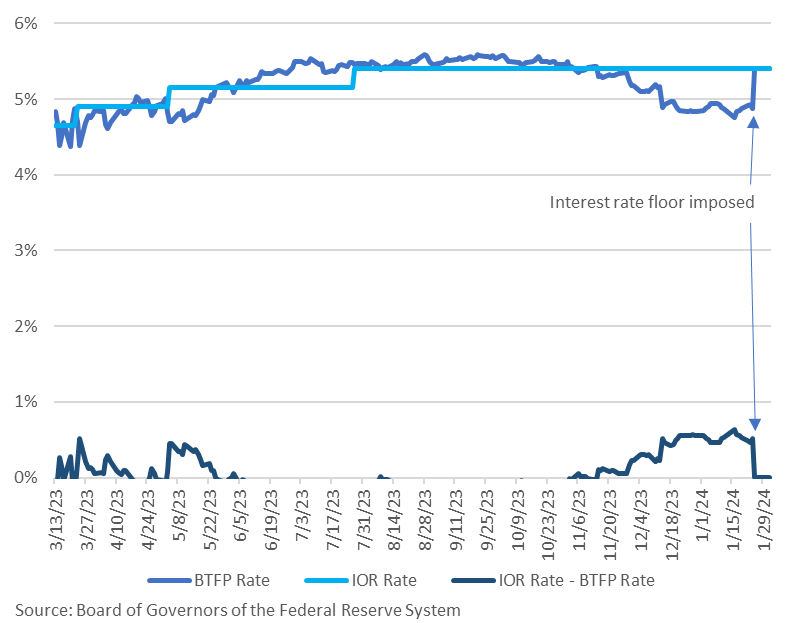

The seemingly innocuous fix imposed by Powell & Co. was to impose an interest rate floor on the BTFP loans equal to the interest rate on reserves. Easy peasy lemon squeezy.

Now, banks can no longer borrow money from the Fed and immediately lend it back at a higher interest rate. Sure enough, the week after implementing this change, loans from the BTFP went down, not up:

For the week, banks were repaying more of these loans than taking out new ones. Theoretically, that’s how the system should be working as we get further removed from the SVB crisis in March 2023 with regional banks repaying their loans.

But that’s not what’s happening.

On a small scale, things are progressing as advertised: as low-interest rate assets reach maturity, a small number of banks are repaying their loans to the Fed and using the newly freed up cash to make new loans at market rates.

No harm, no foul.

But last week’s decline was also driven by the giant sucking sound coming from Yellen’s Treasury department, which just borrowed $190 billion in January and is hungry for more.

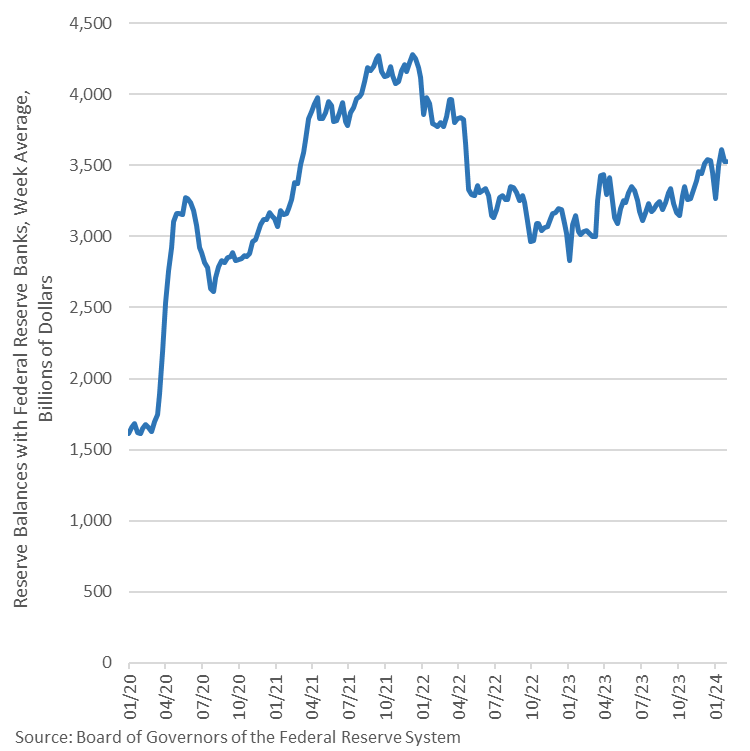

In brief, big banks are increasingly choosing to lend to the Treasury instead of the Fed. That’s bringing money out of sterilization, causing it to multiply. This is a key reason why bank reserves have changed course and trended up for a whole year as reverse repurchase agreements have gone down.

Through fractional reserve banking, the loaves and fishes are multiplying, freeing up even more cash for big banks who in turn are paying off any loans they have, including from the BTFP. (We suspect BoA is a big culprit here based on anecdotal evidence.)

Having a lot of cash on hand is a great place to be in if you suspect a credit event is coming and you want to keep your powder dry. Sure enough, cash at big banks has been skyrocketing as small banks hemorrhage.

But why is this all such a killer for the already-troubled regional banks?

Many small banks were genuinely reliant on the BTFP as their only source of credit. With so many devalued assets on their books, they effectively became insolvent. Selling those devalued assets elsewhere would decrease their available assets by more than the cash they could raise - a veritable death spiral.

The BTFP wasn’t free money - it was always a loan with an interest rate. A bank, therefore, needed to use the proceeds from the loan to earn interest in excess of what it was paying the Fed and whatever rate differential existed on its assets and liabilities beforehand. Margins were thin to say the least.

For example, let’s say a bank had an asset like a mortgage with a 4% interest rate but was paying 5% interest on its deposits, effectively losing 1% on its balance sheet.

It went to the Fed and used that mortgage as collateral for a loan at 4.5% and used the proceeds to finance another mortgage at 6%. At first, it looks like the bank is making 1.5%, but after deducting the 1% it’s losing from the original mortgage and depositors, the bank is only clearing 0.5% - not exactly raking it in.

On top of that, many regional banks had to use some of their BTPF proceeds to pay depositors who were withdrawing money - that earned zero interest for the banks, eating further into their total margins.

This is one reason why the BTFP never really solved the banking crisis, just papered over it.

With that in mind, we come to the conclusion that imposing an interest rate floor on the BTFP equal to the interest rate on reserves has jacked up the cost of borrowing for the banks who are truly in trouble and were using the facility as intended: emergency lending.

Now, the margins aren’t even zero for many regional banks - they’re negative.

And that brings us to the final reason why the BTFP went down last week - no regional banks can afford to use it anymore, so no new loans are being taken out from the facility.

It’s not that the regional banks aren’t in distress - it’s that the program is no longer helpful. What was a life raft has turned into a lead weight that will sink the banks even faster if they touch it under these new terms.

So much for easy peasy lemon squeezy - this is stressed depressed lemon zest.

Thus, with one simple change, Powell has doomed countless regional banks, pulling the rug out from under them by effectively shutting down the one source he gave them for cheap credit.

St. Jerome giveth, St. Jerome taketh away. Blessed be St. Jerome.

Powell & Co. have judged the regional banks and found them wanting. They are hereby sentenced to death. Without interest rate cuts, securities purchases at the Fed (quantitative easing or QE), and further bailouts, more small banks are toast.

In part, it’s their own fault for acting so stupidly and for believing the talking points from Powell & Co. But it’s also the Fed’s fault for creating systemic interest rate risk in the first place, promising banks rates wouldn’t rise, and then reneging.

The Fed is not a referee who enforces the rules, but one who constantly changes the rules to get the outcome desired by the elites.

Now, with balance sheets that still haven’t been cleaned up, a commercial real estate time bomb ticking down to zero, and the BTFP effectively already closed before its March 2024 deadline, regionals have nowhere left to turn.

Well, almost nowhere.

Powell & Co. are effectively driving them into the waiting arms of big banks who are flush with cash. The giant pools of liquidity will allow the big banks to take on low-interest rate assets and ride them out until maturity.

Remember, the problem with the bulk of the assets at regional banks isn’t default risk; they’re relatively sound loans that are being paid back on time. The problem is the low interest rates on those loans and their mark-to-market losses.

So, when the next bank collapses, Powell will drag the carcass onto the auction room floor and start the bidding at cents on the dollar to account for those mark-to-market losses, plus the realized losses from the commercial real estate side of the ledger.

That’s when the JP Morgan’s and Wells Fargo’s of the banking world will decide who wants what and divvy up the carcass.

The shareholders at the failed bank? Wiped out.

Taxpayers? They’re stuck financing the deal and paying for the FDIC coverage of depositors, along with the mountain of losses in the commercial real estate division.

The big banks? It’s a red-letter day.

Just goes to show you who’s really running this show.

If you have any further doubts that Powell has just sentenced more banks to their death, consider that the Fed removed the following line from the latest Open Market Committee statement:

“The U.S. banking system is sound and resilient.”

They’re trying to memory hole what they’ve been telling us for 10 months because they know what’s coming - after all, they engineered it.