Investing Like It's 1979

For better or worse, we're poised to repeat some tough times

The New Year is right around the corner, which means brand new opportunities to turn those paper hands into diamond hands. We’ve had tons of questions about portfolio allocation, so this seems like the perfect opportunity to answer those inquiries.

Obviously, we can’t give blanket advice when personal finances are, by nature, an individualized discipline. That being said, here’s what we’re doing when it comes to investing: letting history be our guide.

There are striking parallels between the late 70s and today, a fact which might help inform your investment decisions. The leading indicators tell us that we’re firmly in a holding pattern that’ll waffle between inflation and recession for some time.

In the 70s and early 80s, there were sectors that outperformed during the inflationary spells, others than outperformed during the recessions, and some even beat the market throughout the entire dismal period.

Depending on where you and your financial advisor believe we are in that cycle, you can allocate your portfolio accordingly.

Here are some noteworthy categories that outperformed the market at various points of the trading chaos in the 70s and into the early 80s:

Gold and silver

Commodities broadly, along with raw materials

Utilities

Counter-cyclicals

Selective REITs

And energy

The advantages of these investments translate fairly well to the anticipated conditions of 2024, with the occasion caveat or twist but nothing too crazy or earth shattering. Let’s take energy first.

Oil consumption accounts for much less of America’s GDP today than in the 70s and we pump a greater share of our own oil. That provides slightly better insulation from foreign-induced supply shocks, like the Arab oil embargo.

But we’ve also thrown the albatross of “green” energy around the neck of the economy and greatly increased costs while decreasingly reliability. That positions traditional energy sources in a position to hold hostages.

Imagine (this will take no imagination for those of you who have lived through it already) that the sun isn’t shining, and the wind isn’t blowing enough to meet your community’s power needs. You’re told not to charge your electric vehicles, to adjust your home’s thermostat, and don’t use any major appliances.

Those dirty dishes and piles of laundry will just have to wait because states like California and Texas had the brilliant idea to rely on things like wind power. And who comes to the rescue in these instances of spiking demand and dropping supply?

Dispatchable power, which is primarily natural gas, but includes coal too.

While these reliable energy sources have been beaten down by additional taxes and regulation in the deceptively named “Inflation Reduction Act,” they can still do very well in the unstable environment created by overreliance on unproven technologies.

That’s a nice segue to utilities. Because they have monopoly status granted to them and provide necessities, they’re one of the best classes of businesses at passing costs on to customers – there’s price inelasticity, as it’s called.

It doesn’t matter if there’s slow or rampant inflation – just pass those costs on to ratepayers.

It doesn’t matter if prices are spiking because the “green” energy sources conked out during peak demand (*cough* winter storms in Texas) – just pass those costs on to ratepayers.

Same thing in recession – people will get behind on their bills but tend to prioritize food, rent, and utilities, so steady revenues are more likely to continue.

And that’s why counter cyclicals can help you ride out the storm too: they outperform when the consumer is cutting back on things like discretionary spending. People may not be eating out or watching streaming services as much, but they’re still paying for toothpaste, deodorant, and trash collection.

On the commodities front, these seriously level up from inflation, but take a hit during recessions as demand plummets. But if you believe that the coming downturn will be accompanied by more inflation, as happened in the 70s, then commodities will hold up even if demand collapses.

The ultimate choice here is, of course, gold because of its monetary history - and silver is a close second. Things like platinum and palladium have industrial use, but lack this monetary luster.

What about real estate? Stay away from the commercial side (more on that later) but we believe there are quality REITs (Real Estate Investment Trusts) that are poised to go much higher in the coming years – perhaps as soon as next year.

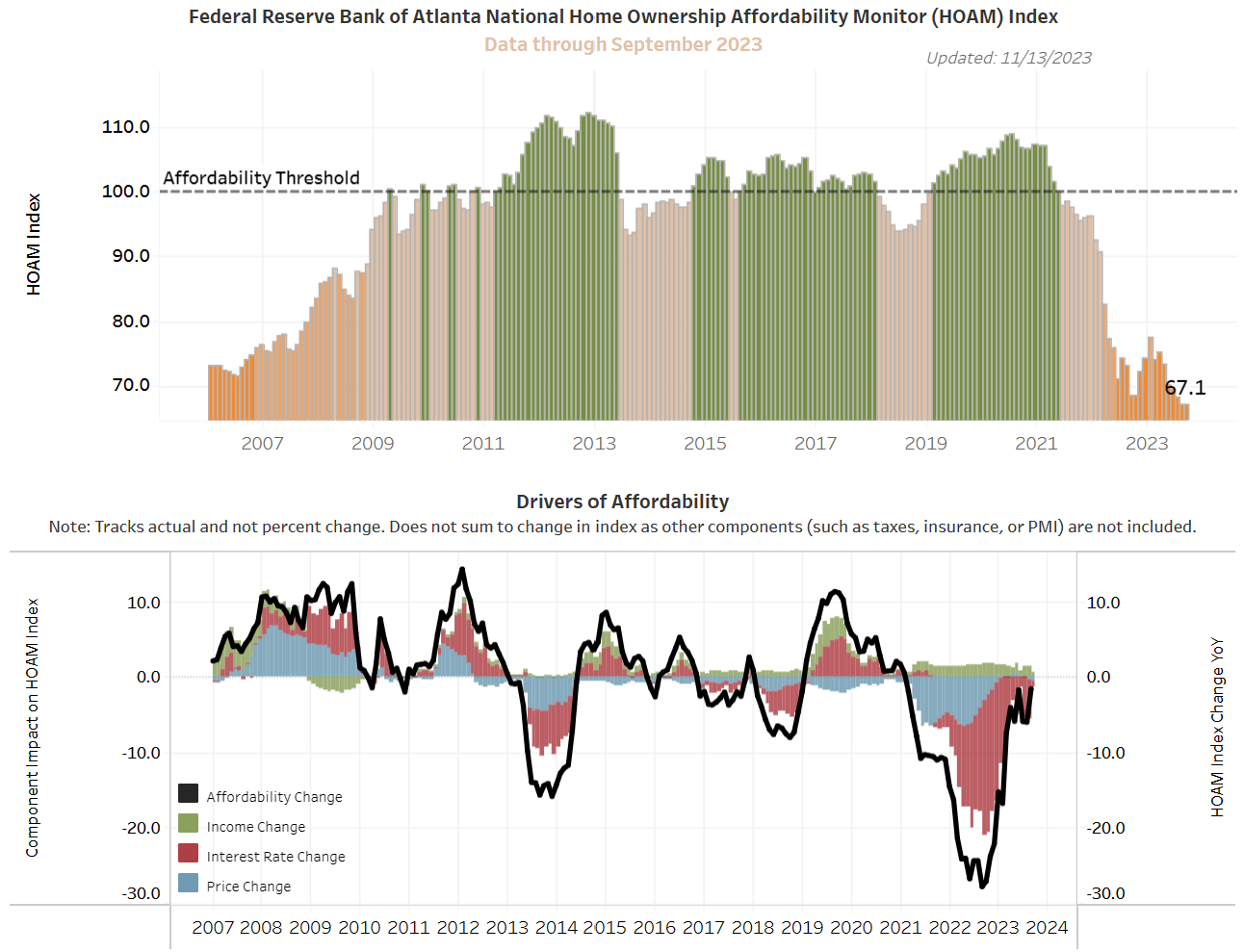

We explained in a previous post that interest rates and home prices have begun recoupling. That is restoring the inverse relationship between home prices and interest rates.

If and when rates are cut next year, prices will rise enough to keep monthly payments relatively steady over time. People will just be paying less in interest each month but more in principle.

That’s bad news for homeownership affordability because it means monthly payments are stuck at stratospheric levels. But it’s a boon to investors if those lower rates significantly push up prices.

There are also plenty of shorting opportunities, TIPS and I bonds, along with more exotic financial derivatives that allow you to bet against a myriad of bad assets that were kept on life support by low interest rates and are taking their last gasps now that the court jester pulled the plug.

It’ll be a good idea to keep a close watch on things like I-bonds because, as disinflation continues, they will lose value and become a buying opportunity before the next round of government spending and asset purchases by the Fed.

The time to buy these things is not when inflation runs up to 9 percent or when the higher coupons kick in. Rather, you buy when inflation is low, and Powell & Co. are telling you it won’t come back.

On a more macro level, don’t make the mistake many others have in underestimating the impact of the normalization of the reverse repo market – another topic that we’ve covered in detail during previous posts.

As financial institutions increasingly replace lending to the Fed with lending to the Treasury, over $1 trillion has already move out of sterilization and into circulation.

That’s why so much of the reverse repo drain has moved into bank reserves and the interest expense at the Fed has stayed around $700 million per day. The Fed has not tightened nearly as much as it appears if you only look at their securities held outright and ignore bank reserves.

The addition of so much liquidity is juicing the economy. Recall from a previous newsletter that money coming out of reverse repos adds much more than what the reverse repo market loses.

That’s because the money changes from being “sterilized” to multiplying in the banking system. As long as that continues, equities likely have room to run.

So, what are we avoiding at the moment?

We’re mindful that the classic mix of broad stock indexes and government bonds were deadly to investors back in the 70s and early 80s. There are multiple indicators that say we’re now in a “lost decade” or “structural bear market” for both stocks and bonds.

While the average investor had nominal gains from traditional investment strategies in the 70s, he had significant inflation-adjusted losses.

That doesn’t mean every stock and every bond will have a dismal record for the next ten years, but rather that the markets on average likely will do so. Broad indexes, like the S&P 500, are particularly susceptible to this phenomenon.

And we’re not savants on this – people like James Grant made the call on bonds before we did; we just agree with him because his reasons are sound, and history backs him up.

What about commercial real estate, mentioned earlier? Like the Grinch, we wouldn’t touch small banks and commercial real estate with a 39-and-a-half-foot pole. There are tons of unrealized losses in those areas, just waiting to be dumped on hapless investors.

Along with commercial real estate broadly, the residential side is overbought in some geographical markets, so REITs heavily invested in those areas are also a no-go.

Not for the faint of heart, there are riskier plays that involve timing but present opportunity in the years ahead.

Lots of green energy stocks have gotten crushed because they’re promising technologies they can’t deliver, but every infusion of subsidies from the infrastructure bill, the IRA, etc. gives these things a boost.

That’s prime real estate for investors to do their research into these companies and see which ones are likely to get approved for more taxpayer dollars, or even ones that are already approved but haven’t received the funds yet.

If you have sufficient risk appetite for these “green” equivalents of penny stocks, and don’t mind doing your homework, more power to you.

We’ll reiterate one more time that we can’t give financial advice. Even if we could, we’d still have to point out that past performance is not a guarantee of future success.

What we’re doing here is giving you a little inside baseball on how we’re trying to protect ourselves – you and your financial planners can decide what’s right for you.

Remember, good investors know how to make money in any market, even lost decades. Bulls make money, bears make money, pigs get slaughtered. Be smart, not greedy – not just in the New Year, but every year.

So, cheers to the New Year. May it be better than the last, but only half as good as the one thereafter.

In the 1970s USA was still a major manufacturer. That allowed it to export manufactured goods to the rest of the world to accrue capital. Not so today. It may rhyme but results may be different.

sound thinking here. very much on board with these thoughts