In the End, It'll Be Inflation

Why "all roads lead to inflation" and how to protect yourself

The very clear lesson from the last several months is that inflation isn’t going anywhere. Although we’re not likely to return to double-digit annual inflation rates like we saw in the producer price index in 2022, we’re still in for sustained levels above 2 percent.

The simple reason is that we’ve entered a fiscal dominance regime, a kind of positive feedback loop. In short, here’s how it works.

Massive federal deficits necessitate equally massive borrowing. That pushes up the demand for loanable funds, which in turn puts upwards pressure on the price of loanable funds: the interest rate.

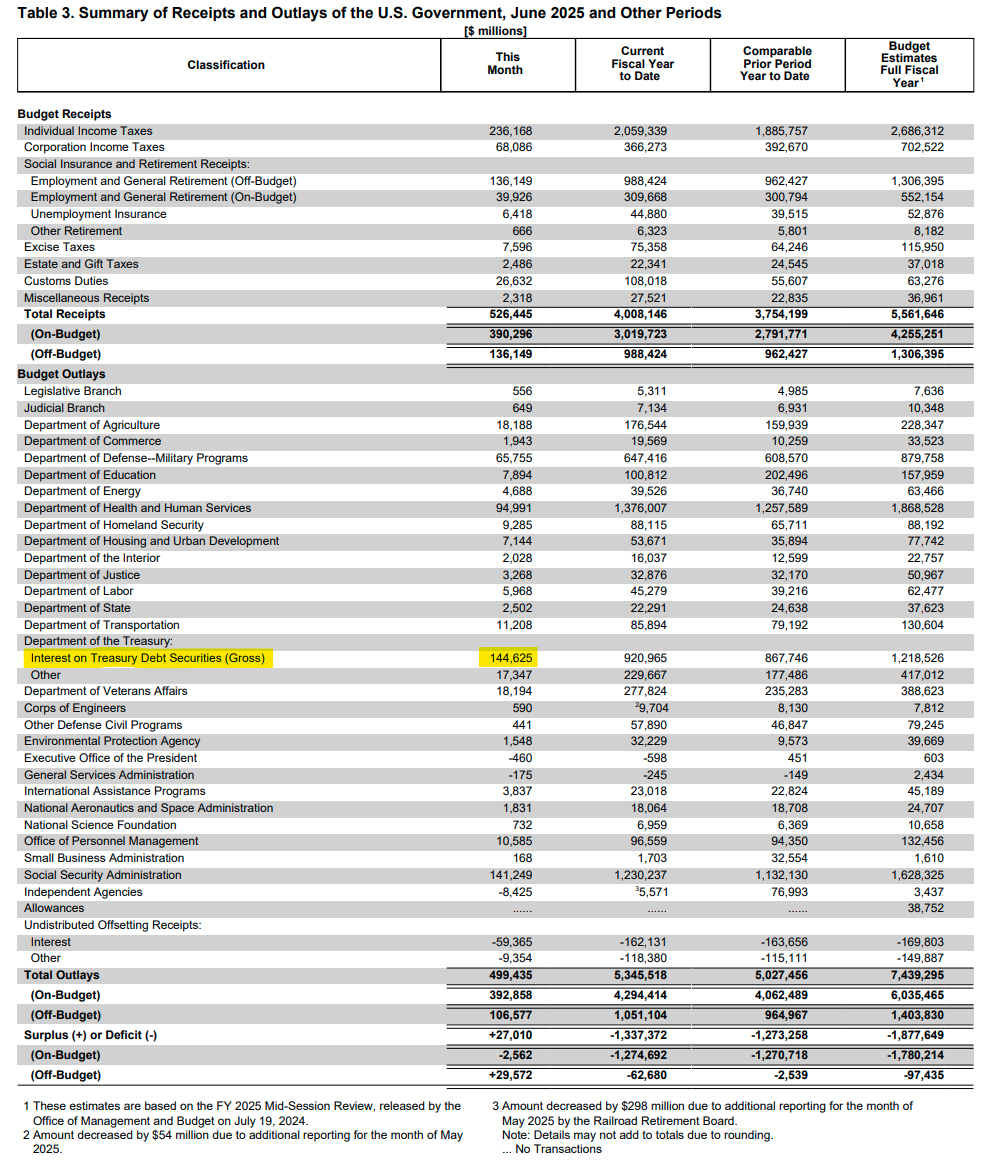

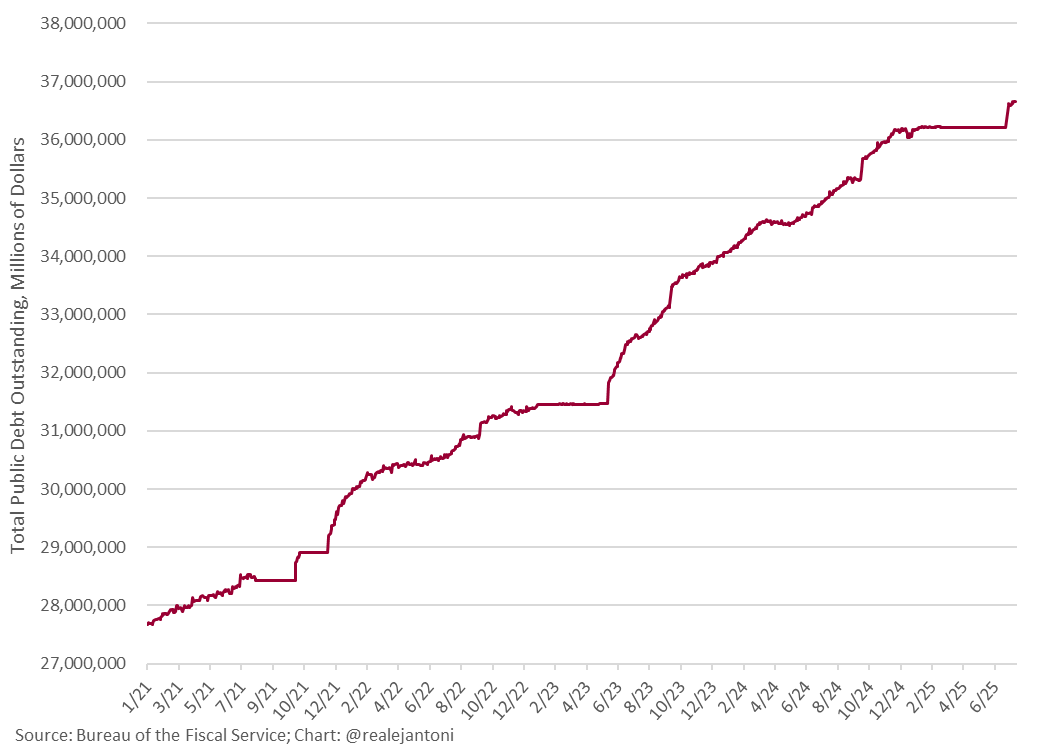

And that’s where things get tricky because, as noted in a previous post, the interest rate plays an increasingly large role in determining the size of the deficit. One of the Treasury’s expenses—in fact, the biggest line item in the June monthly Treasury statement—is the interest paid on the $36.7-trillion federal debt.

For the first time in modern American history, the cost of financing the debt is more than the Department of Defense, more than the Department of Health and Human Services, and more than the Social Security Administration. At $144 billion in June, it was equal to a quarter of all federal revenues that month.

The interest expense is a function of both this monstrous outstanding debt balance and the average interest rate. As the interest rate climbs, so does the financing cost on the debt.

Because the deficit is so large, any marginal spending is, by definition, borrowed. The larger interest expense directly increases deficit spending, which mean even more demand for loanable funds and even more upward pressure on interest rates.

Now you can see how this is a downward spiral. Once you’re in a fiscal dominance regime, it’s just lather, rinse, repeat. In short, we’re in serious trouble and it’s the kind of trouble that yields oodles more inflation—because politicians won’t take their medicine.

There’s just no good way out of the mess that is today’s federal finance situation. We say that as folks who have the utmost respect for and confidence in Treasury Secretary Scott Bessent. We also give President Trump more credit than most for wanting to cut spending.

But we’re also political realists who recognize that Congress is not willing to play ball, and they’re the ones who ultimately decide how much to spend.

It was very telling that the clowns in Congress could barely pass a rescissions package put together by Russ Vought (Director of Office of Management and Budget). The package was less than $10 billion—not even 0.2% of annual federal spending.

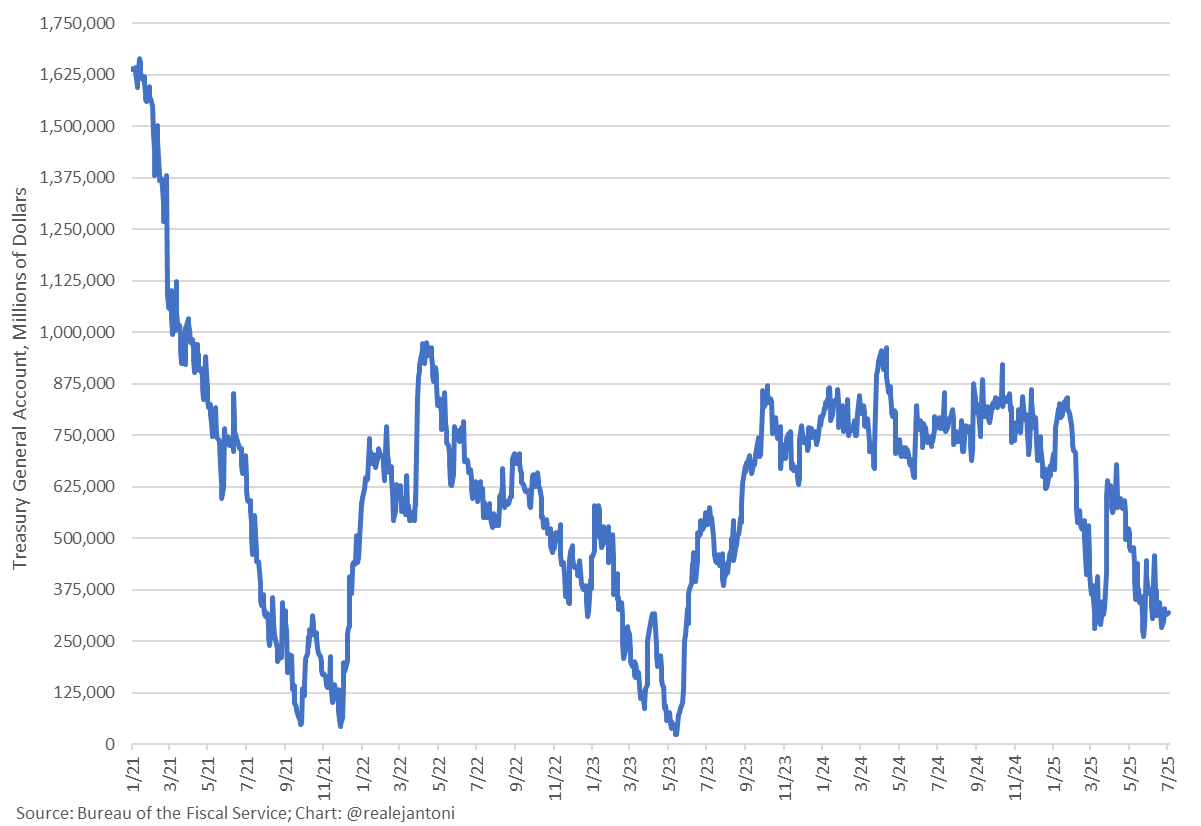

With the debt ceiling lifted, Bessent is slow walking the refill of the Treasury General Account so as to not upset sovereign debt markets when yields are already at about 5 percent. That’s much smarter than what former Secretary Janet Yellen did. Still, it doesn’t solve the problem of inordinately large federal deficits.

With Congress unwilling to cut the spending and reduce deficits, interest rates should steadily climb. But we don’t have free-floating interest rates like we have free-floating prices in most markets. Instead, we have a cartel called the Federal Reserve.

And if the Fed wants to continue its existence, it has to keep Congress happy. Afterall, Congress made the Fed and can unmake it. The hard truth is that even when Powell gets replaced in May, his successor is not going to be an inflation hawk.

Even if Trump nominated an inflation hawk, like Judy Shelton, that person would never get approved by Congress because those clowns want to keep spending like drunken sailors and they want us to pay for it through the hidden tax of inflation.

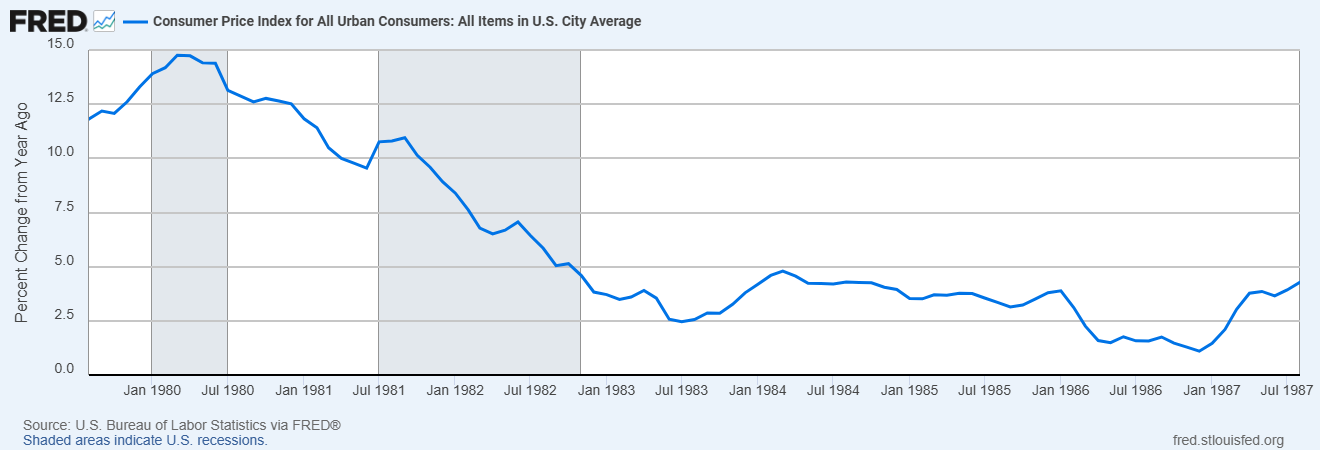

Recall that the vaunted Paul Volker, who many remember as the great inflation slayer, managed to get the annual inflation rate below 2.5 percent for only 12 months during his entire 8-year tenure as Fed Chairman. When he left the Fed in August 1987, the inflation rate was back up to 4.3 percent.

The point is that there was only so much he and Reagan could do when Congress refused to cut spending in any meaningful way. That’s what we’re facing today. The best we can hope for is to grow faster than the inflation and get some small real gains.

Reagan’s formula of tax cuts and deregulation succeeded in delivering blockbuster, double-digit growth, but only for a limited time. After 18 months, growth remained robust but never ventured back to 10%+ territory.

Of course, because the situation in federal finance is much worse today, growth alone won’t get us out of this mess, which is why there’ll be inflation. America would need sustained growth of 7 percent per annum to outrun the debt monster that’s chasing us. That’s not going to happen.

Inflation is a way to shrink that monster, so it doesn’t look quite so scary. It reduces the real value of what we owe, transferring wealth away from wage earners, savers, creditors, etc.—and giving it to the politicians and well-connected donor class.

In short, it’s evil.

But morality aside, the math here is very clear. The debt is on its way to $38 trillion. Yields are converging around 5 percent. That’s $1.9 trillion in annual interest. Even if a future dovish Fed cuts rates like they did in the Fall of 2024, that doesn’t mean yields will decline.

As the Fed cut 100 basis points last year, Treasury yields rose 100 basis points because everyone smelled a rat and knew it was monetary malfeasance. The only way for the Fed to be sure it’ll get yields down (which is what the president and Treasury secretary want), will be to buy all the Treasury bonds it can.

That’s straight-up monetization of the debt. And that’s good for those holding assets like equities, commodities, and general anyone who is a debtor. Good in the nominal sense at least, since those things appreciate faster during inflationary periods and debt denominated in dollars declines in real value.

How much faster asset prices rise helps determine how valuable those asset classes are for inflation protection.

Our loyal readers will remember when we correctly forecasted gold would hit $2,500 an ounce. And then $2,750. And then $3,000. And now the yellow metal still has room to run. How much more? And what else offers protection?