How to Thaw America's Frozen Housing Market

Politicians won't like the answer

Despite four months of very low inflation numbers, reduction of government waste, and strong real wage growth, the Biden-era homeownership affordability crisis still dogs America’s middle class. To fix the broken housing market and make homes affordable again, lawmakers and the public need to understand what caused this cost-of-living crisis.

When President Biden took office, homeownership was not only affordable, but more affordable than the long-run average. But as the government spent the nation into oblivion, that quickly changed.

To accommodate the profligate spending of Biden and the radical liberals in Congress, the Federal Reserve created trillions of dollars out of nothing and purchased debt issued by the Treasury. Simultaneously, the Fed kept interest rates artificially low to reduce borrowing costs for the federal government.

These monetary manipulations sparked the worst inflation in over 40 years. Prices everywhere exploded, but housing costs were particularly hard hit. That’s because the same artificially low interest rates that made it cheap for the Treasury to borrow also made it cheap for potential homebuyers to borrow—and borrow they did!

What people really care about when it comes to buying a home is not so much the home price as the monthly payment, since that’s what must fit in their budget. Record low interest rates allowed potential homebuyers to get ever-larger mortgages and thereby bid up the price of homes for sale, on top of the rising prices from inflation.

The party was not to last, and the worst inflation in four decades was predictably followed by the fastest rise in interest rates in just as long. Suddenly, mortgages interest rates below 3 percent were replaced by nearly 8 percent rates. When monthly mortgage payments quickly doubled, demand dried up, and the housing market began to seize.

The situation also rapidly deteriorated for homeowners, whose below-3-percent mortgage interest rates became golden handcuffs. Selling a home almost always means losing the old interest rate and getting a new mortgage at today’s rates. Therefore, sellers faced the same prospect of their monthly payment skyrocketing if they borrowed the same amount for a new home.

The only way to make the math work in this situation is to sell an existing home for such a large premium that the owner has a very large down payment for the next home, reducing the amount borrowed and the size of the next mortgage. That offsets most of the pain from the tripling of interest rates.

It also means that the price of the median existing home is so stratospheric that it has eclipsed the price of the median new home—a rarity. It’s especially shocking since new home prices have never been higher.

Inflation has pushed up the cost of new home construction by a third in less than five years. Homebuilders today can’t lower their prices, despite high interest rates, because they need to cover their record-high costs on materials and labor. Since many homebuilders finance their projects with credit, high interest rates are another cost increase.

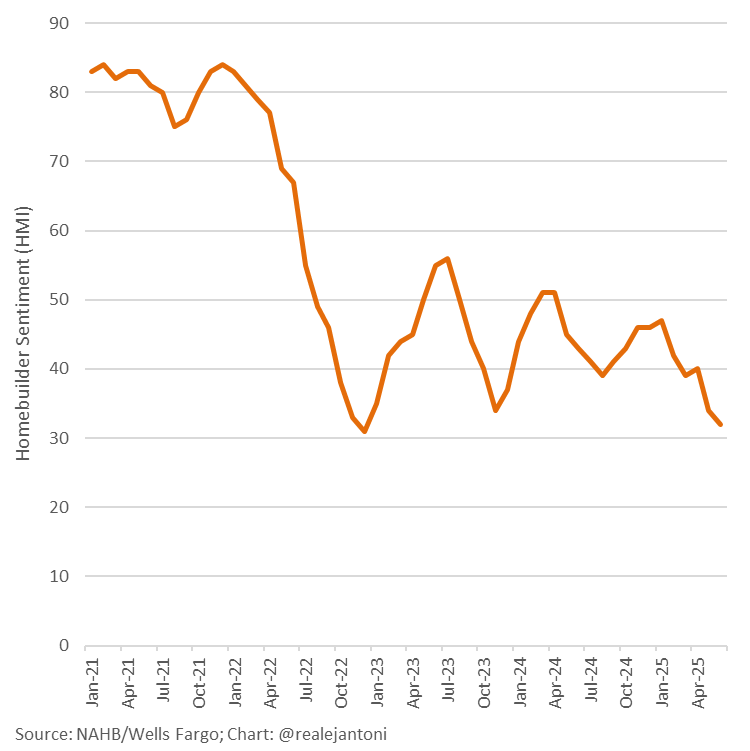

It’s no wonder homebuilder sentiment has collapsed to the lowest level in years while pending home sales are near a record low and a full two-thirds of Americans think homeownership is out of reach for those under 40. The deadly one-two punch of high home prices and high interest rates has essentially killed the starter home.

It’s tempting to blame this problem just on high interest rates and then call upon the Fed to lower rates as an easy fix. But that would merely treat a symptom, not a cause, and any relief to the housing market would be temporary.

Artificially reducing interest rates by one or two percentage points again would simply allow potential homebuyers to borrow more, restarting the bidding war while also sparking more inflation. Pushing interest rates below 3 percent again would eliminate the premium on existing mortgages, but would cause even worse inflation and necessitate even higher interest rates thereafter.

The only way to really thaw this frozen housing market is to allow interest rates to fall naturally. The interest rate is just the price to borrow money, and the biggest borrower is the federal government. Excessive borrowing in Washington DC is the real reason everything from mortgage interest rates to Treasury yields to credit-card interest rates are sky-high today.

Reducing government borrowing will reduce the demand for borrowed money, and that will bring down the price, which is the interest rate—it’s Econ 101. Therefore, if Congress wants to help the housing market, they must spend—and borrow—less money.

This article originally appeared in Townhall and has been reprinted here with the author’s permission.

You forgot one very important aspect of the rise in housing prices; corporate purchases. Outfits like Blackstone, Black Rock, Vanguard, State Street and Invitation Homes, among others, are responsible for 25% of all home purchases. That's 25% more demand than was normal before the Tax Reform Act of 2017. Why?

Corporate homebuyers, or corporate slumlords if you will, are permitted to depreciate homes over 27 1/2 years, or 3.6% per year. In addition, they can depreciate flooring, appliances, window treatments and a host of other things on an accelerated basis over three years. They can also write off maintenance costs, inspections, and repairs. Basically, in addition to rent, corporate homeowners get a built in IRS subsidized profit of at least 4% every year that individual homeowners do not benefit from. (It should be noted that the home depreciation reduces the amount of the capital gain when the property is eventually sold.) Corporate homeowners also routinely use the properties as collateral to borrow against and buy more homes for rental. Of course, as interest rates increase, this tactic becomes more expensive.

You can read more about it @ https://rennerc.substack.com/p/bring-back-the-american-dream.

The TCJA passed in 2017 also allowed individuals to create S-Corps that would capture these depreciation expenses on homes that they rent so while corporate homeowners benefit in a much bigger way, the TCJA also added demand to the home market from wealthier asset holders. Median home prices jumped 39% between Q2 2020 and Q4 2022 because of low interest rates and corporate homeownership. Invitation Homes stock price doubled but has come back with the rise of interest rates. (It is still higher by 60% since 2020.)

FXHedge has rightfully cited the benefits of lower interest rates to spur home demand but unfortunately, the tax laws in place will also increase demand from corporations so that any benefit realized from a lower interest rates will be lost in the amplified price of homes. Of course, as FXHedge stated in another article, higher long term interest rates are probably the norm for the foreseeable future as it appears that the Fed only has control over short term rates. For young couples and first time home buyers just starting out, the American Dream is vanishing.

Since houses rarely depreciate, Congress should increase the depreciation period to 100 years (or make corporate homeownership solely subject to capital gains), eliminate accelerated depreciation on tenant improvements, and bring back the American Dream!

"Reducing government borrowing will reduce the demand for borrowed money, and that will bring down the price, which is the interest rate—it’s Econ 101. Therefore, if Congress wants to help the housing market, they must spend—and borrow—less money."

We know this is never going to happen as both parties are wed to the kick the can down the road until the economy collapses under the weight of their spend, spend, spend insanity.

Furthermore, let the market set the interest rates. We act as though the Fed has some magic wand to determine what interest rate is the best for the very complex American economy. The Fed never has a clue. With that said, it is time for interest rates to be higher anyway. Zombie companies kept alive with cheap interest rates will die and allow that capital to be used for better uses. Higher interest rates rewards savers versus the usual, backward view of rewarding debtors. Remember when passbook savings used to pay 5.25% and the economy didn't collapse?