Housing Inflation Is 4X "Official" Metrics

How the government purposely undercounts increased cost of homeownership

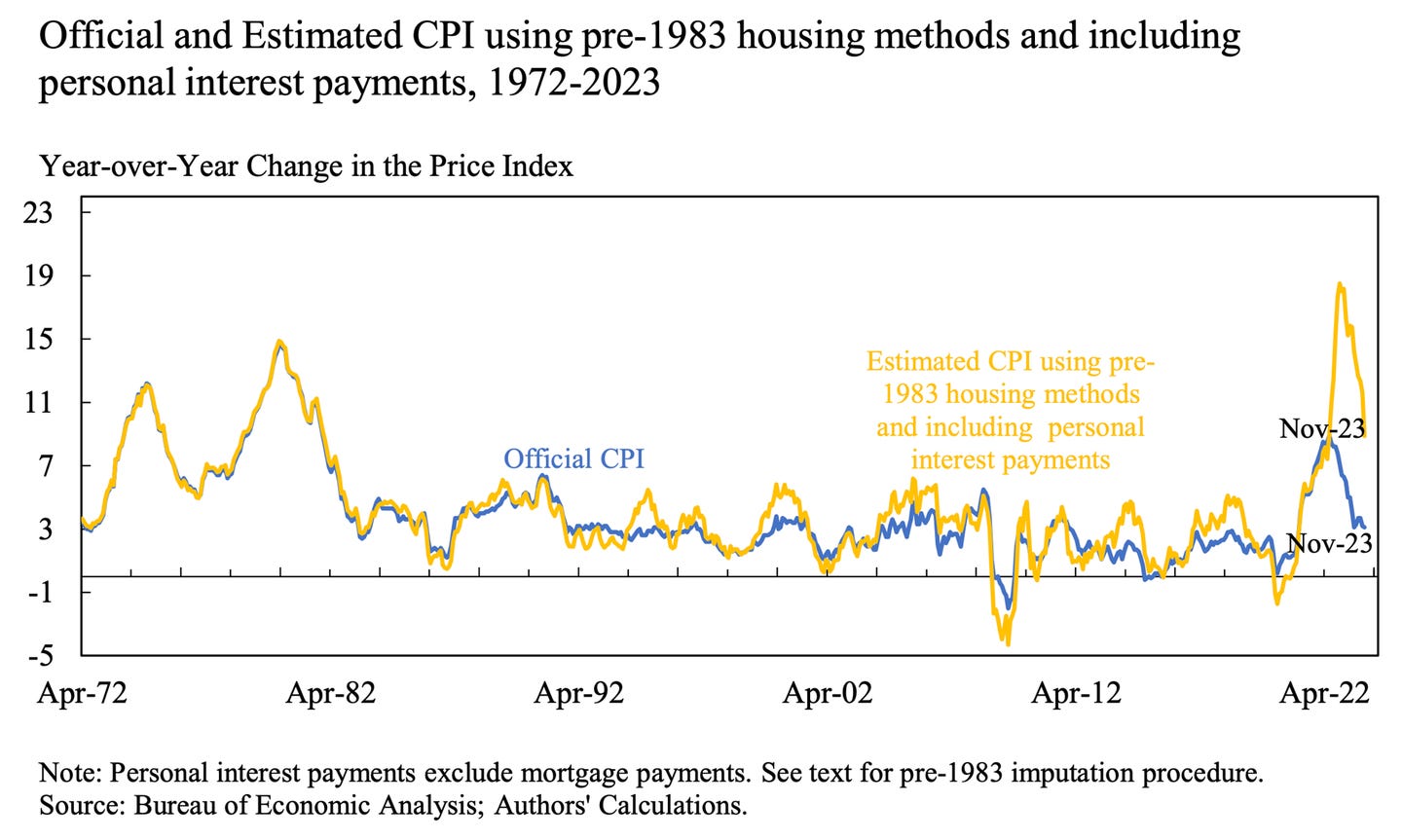

Word has been circulating over the interwebs that inflation is way worse than the government says. Several prominent figures, including a former Obama economist, have said that this is due in part to the 1983 change in how housing inflation is measured.

Since some of our paid subscribers had questions on this topic, we’re taking the time to provide answers.

First up: what changed? In short, the government stopped using real-world data and started using proxies to estimate the real-world data.

The reason for this was to artificially bring down inflation numbers, providing political cover for the politicians that created the rising prices in the first place.

No longer would applicable factors like interest rates and home prices be used to calculate a monthly mortgage payment. Instead, vague survey questions with a downward bias became the new statistical foundation for housing inflation.

If you own a home, how can you tell what your home would rent for? The only way to answer that is to actually put the home up for rent and see what price the market will bear. Otherwise, you’re just guessing, and most people will underprice the rent of their home when making such a guess.

But if you don’t guess, if you actually put your house up for rent and get an offer, you’re ineligible to respond to the survey question.

So, the group of people who are best able to answer the question (arguably the only people able to answer the question) are excluded from doing so.

But it gets better. The question of how much you think your home could rent for is only used for calculating weights which are then used to compute the average increase in the price level. It is not used for determining the month-to-month increase in the cost of homeownership.

Instead, that’s imputed from data on rent prices. Why? Because, reasons, of course.

If rents and the cost of homeownership were to increase at the exact same rate, then this bizarre methodology would actually work. Of course, the two never move in lockstep, so the methodology is garbage.

This is especially true during periods of high inflation, which always see housing inflation accelerate more than the overall inflation rate.

We can get a sense of the true housing inflation rate by looking at different indexes of the cost of homeownership, or by doing things the old-fashioned way and using real-world data—like home prices and interest rates—to calculate the change.

There’s plenty of source data to choose from here: Redfin, Zillow, NAR, FreddieMac, HUD, Optimal Blue, etc. There’s also the choice of whether to include things like property taxes and the size of the downpayment.