GDP=Grossly Distorted Picture

An honest review of the latest GDP print and where the next is headed

The final estimate of Q1 gross domestic product was recently released, and it moved much closer to our previous estimates of how the economy looked in the first three months of this year.

The overall figure didn’t change that much—rather, the composition is what deteriorated, and badly. These changes have significant implications for the future.

As a refresher, GDP tries to measure the economy by looking at the expense side of the equation, with the earning side being gross domestic income.

The advance (first) GDP estimate had growth pegged at 1.6 percent, which fell to 1.3 in the revised (second) print, and settled at 1.4 for the final (third). Both headline and core inflation rates were unchanged between the advance and final estimates at 3.4 and 3.7 percent, respectively.

Again, the topline figures seem relatively innocuous as far as changes go.

But recall that GDP is made up of 4 spending categories: personal consumption, government consumption, investment, and net exports. It turns out the government portion is growing like gangbusters.

That’s the opposite of what we want to see because government purchases don’t increase a nation’s wealth or increase the standard of living. At best, they’re a wash, but in all realistic cases, they’re a net drag.

That’s why the “multiplier” on government spending is less than one. For each dollar you take from a private citizen so that the government can spend it, it adds less than $1 to the economy because it’s spent inefficiently.

The advance estimate for Q1 GDP showed personal consumption (consumer spending) grew 2.5 percent at a seasonally adjusted annualized rate in Q1 while government consumption grew less than half as fast at 1.2 percent.

Fastforward to the final estimate and personal consumption was revised down to a mere 1.5 percent growth rate while government consumption grew 1.8 percent—or 50 percent faster than the advance estimate of 1.2 percent.

So, now the relationship has flipped - instead of private consumption growing faster, the government is now growing faster than private consumption. And no, think this isn’t anything new - it’s now a seven-quarter trend.

Government is Q1 grew so fast relative to the private economy that government consumption expanded faster than either the private goods or private services sectors.

Put simply, the private economy—which is all that matters since it’s the only part that’s productive—is stalling out.

That’s especially evident when you look at the actual driver of economy growth: real fixed private investment.

This is where you get factories, tools, computers, machinery, AI, and all other forms of technology and productivity-enhancing devices, software, etc. It’s the source of real wage growth, medical advancements, better quality of life, higher standards of living, and so one.

Real fixed private investment is, in a word, awesome—but it’s stagnating. This category of investment has only increased a cumulative 2.7 percent over the last 2 years—nowhere near the rate of increase in GDP. That means the recent increases in GDP are unsustainable.

Furthermore, it’s clearly lagging way below the pre-pandemic trend, even more so than GDI:

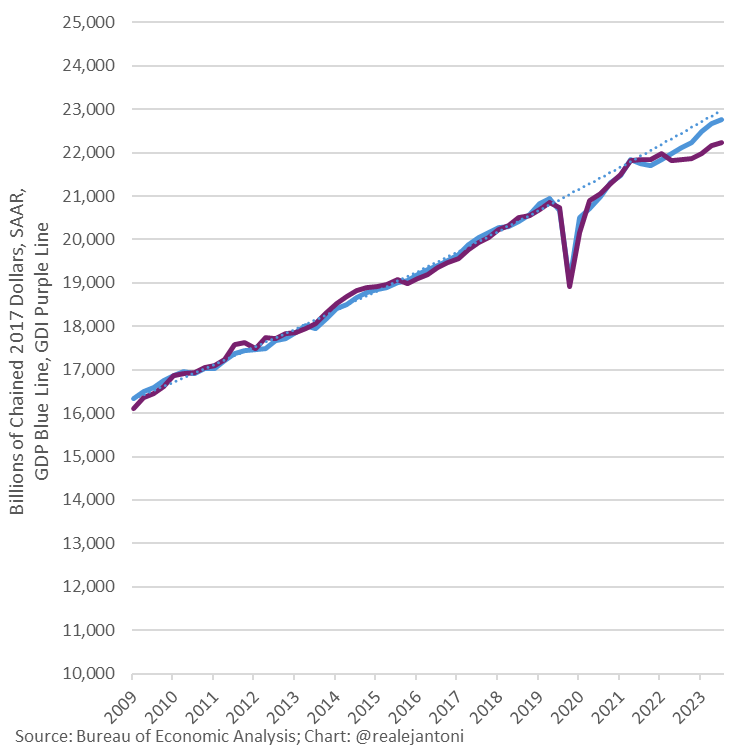

Speaking of, there’s the continued discrepancy between GDP and GDI, which has reached unprecedented proportions by some metrics. It seems pretty clear that GDP is overstating real growth in the economy while GDI has been a closer approximation.

Some of the discrepancy can be traced back to the gargantuan debt issuances over the last three years, which cannot go on forever. Since these two metrics have to eventually converge (they’re measuring the same thing, after all), either GDI has to catch up or GDP will catch down.

Our money is on the latter.

Government borrowing is basically the only thing keeping the charade going at this point. The federal debt increased almost $600 billion in Q1, in exchange for GDP increasing about $300 billion.

In other words, the federal government is “buying” only 53 cents of “growth” for every dollar it goes into debt—what a great deal…

This is all very important context for interpreting market conditions today and predicting conditions in the future—and when you consider the long-term cost of today’s debt, that future looks… unpleasant.