Forget What You Know About Saving

Why you need to reconsider some basic retirement saving moves

The past week was a flurry of economic data releases, several of which had significant impacts on inflation and economic growth forecasts. Here are the highlights of the week along with a surprising connection to retirement planning that most overlook today.

Grab a coffee – there’s a lot here!

The biggest business news stories over the past week were the wholesale and consumer inflation numbers, both of which show price increases still running hot.

That’s true even if you strip out the more volatile food and energy categories to get “core” inflation rates.

Two other ways to remove outliers are trimmed-mean CPI and median CPI, both of which show that not only is inflation running hot, but today’s price increases are broad based, throughout the economy. Inflation is not being caused by merely one or two items shooting up in price.

Everything is getting more expensive, little by little. Across these 6 inflation measures, all are above the 2.0% target, and none are trending towards that target either.

And no one’s buying the 2.0% target anymore either. (3%+ is the new normal.) Data from the federal reserve banks of Atlanta, Cleveland, and New York all show inflation expectations anchored well above 2.0%.

Additionally, the sticky CPI shows those items which change price less frequently are also rising at a steady, but nonetheless fast, rate. Inflation is structural at this point, hence the expectations data.

Further indication of the falling value of the dollar was seen this past week in import prices which skyrocketed higher as foreigners demanded more currency for the same products and services to make up for dollar depreciation.

To be fair, other currencies are losing value too, many at faster rates than the dollar. Still, there’s no denying that things are getting more expensive, whether they were made here or abroad.

As our readers know, the dollar’s decline stems from the government spending freshly printed money, and that trend is continuing.

The Treasury wiped out the last of its April 15th windfall during the past week, and even spent another $50 billion on top of that. With the cash cushion gone, Yellen is now set to resume borrowing.

The federal debt is on track to expand by almost $1 trillion in the next 100 days. Bank reserves will expand as all that government spending works its way through the banking system and multiples.

There’s your continued inflationary impulse.

For the Fed’s part, they haven’t yet begun the taper, so that’ll add to inflation next month.

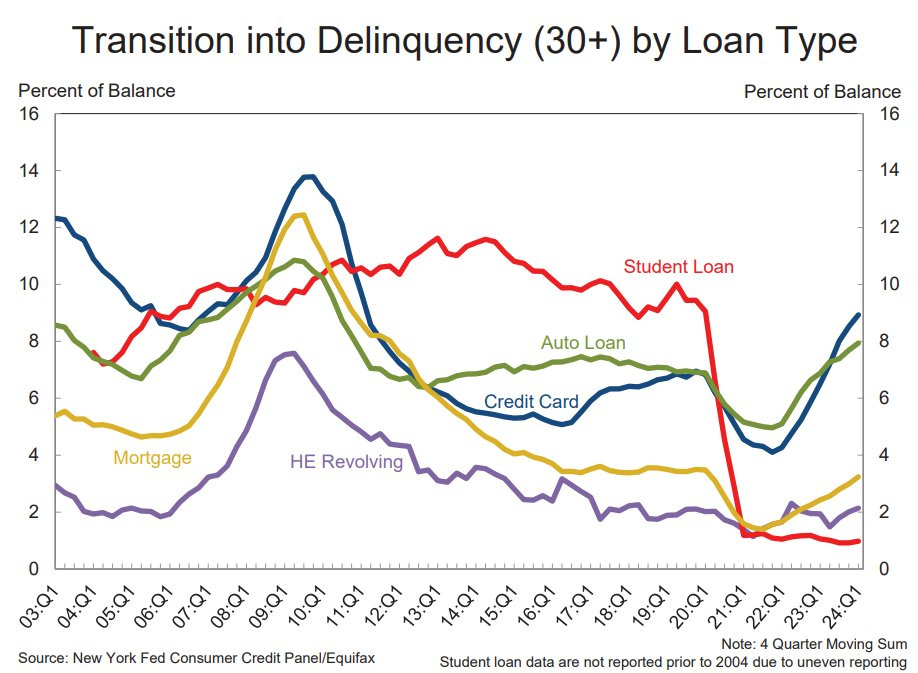

In the face of rising prices, households are falling deeper into debt. Although credit card balances stabilized in the first quarter, this week’s NY Fed report showed accounts transitioning into severe delinquency at an accelerating rate.

Finance charges on credit cards alone are over $240 billion, and that’s just interest – not a penny towards paying down balances.

And that brings us to the federal reserve bank of Dallas, whose banking survey shows further deterioration in that sector. As higher interest rates work their magic, more and more loans just aren’t penciling out.

That’s especially true for commercial real estate, an area that’s really in trouble this year, but even more so next year.

And the broader banking data from the federal reserve board of governors confirms how screwy the banking system still is, even if none of the board members will say the truth out loud.

The balance sheets of many banks remain a total and complete mess. In normal circumstances, getting on the wrong side of the interest rates trade isn’t that big of a deal, and it can be remedied in a relatively short period of time.

The bottom line gets dinged briefly, but the whole thing doesn’t go up in flames.

Well, normally, anyway.

But these aren’t normal times. The flood of new money pushed out by the Fed beginning in 2020 was the basis for a massive increase in loans – all of which were at rock bottom interest rates.

So, instead of a small increase in low-interest rate assets, banks acquired unprecedented volumes.

That’s why the data combine to paint such an ugly picture for many banks. It’s going to take many years for their low-interest-rate assets to mature while they continue to pay out on high-interest-rate liabilities.

At the same time, loan volume growth has dried up as credit standards tighten and loan pricing rises. That means the very loans which banks need to be making more of are happening less and less as consumers hit the wall.

QED: the banking system is in trouble (as we’ve noted before here).

The bank term funding program was merely a Band Aid and didn’t solve this underlying problem. At best, it bought time - which has been squandered.

Today’s tighter credit conditions are a product of the Treasury sucking up so much of the loanable funds market, and the Fed redirecting capital away from the private sector. (More on that here.) That’s putting the squeeze on capital-intensive industries.

Cue the melodramatic organ music as manufacturing takes center stage.

Additional data this week from the regional federal reserve banks show the sector is still doing badly. Most data sources actually show manufacturing is contracting and has been for many months.

Even the Fed’s industrial production and manufacturing capacity report shows anemia in the sector.

So, we’re looking at more inflation and less growth. In a word, stagflation.

Of course, St. Jerome recently said he didn’t see the “stag” or the “flation” in the current American economy, presumably because he’s only looking at the economy of Carlyle, his old employer. The wealthy are doing well and that’s all that matters.

As inflation-adjusted paychecks decline, consumers have relied on debt to get by, but that’s starting to end. Consumers are hitting a wall as debt service consumes so much of their income. Credit cards alone now have interest charges of over $240 billion per year.

Likewise, lenders are slamming on the brakes as they realize many of their existing loans probably won’t be good debt much longer. That’s evidenced by loan nonperformance (defaults and delinquencies) steadily rising.

What’s really scary here is that those upward trends are typically reserved for recessions as unemployment spikes, causing folks to lose their incomes and fall behind on bills.

The fact that this is happening at a time of supposed full employment means that as soon as unemployment hits, loan nonperformance will skyrocket.

For context, if we go back to the mortgage meltdown, global financial crisis, and Great Recession, consumers debt was not this overstressed until the economy was well into contraction and layoffs were widespread.

Maybe it has something to do with the fact that this week’s data also show the consumer is even more leveraged than in 2007. Which means the fallout is likely to be worse.

There are serious implications here for investing and retirement planning in particular.

A common question among investors is whether to use a retirement savings vehicle like a traditional 401(k) or a Roth IRA, and the calculus behind that choice is changing.