Politicians Broke the Housing Market ... Again

How the political establishment broke America's housing market, maybe forever

It’s no secret that the American dream of homeownership is dead, and lots of people say Biden killed it. While he put the last nail in the coffin, there’s plenty of blame to go around both sides of the political aisle going back decades.

This has been a long time coming and we have to go back to Lord Lyndon Johnson to see where the seeds of this noxious weed were planted.

Before LBJ, Americans understood that homeownership was something you had to work towards - a point of pride and sign of hard work, delayed gratification, and class mobility. As American as apple pie.

But the Great Society ushered in talk of homeownership as a right and even bestowed that “right” (at taxpayer expense) on certain groups of people.

Notice the sleight of hand - the people LBJ got stuck in this new cycle of welfare dependency (the welfare trap) were “housed” but were not “homeowners.” The Great Society propaganda used these terms interchangeably, muddying the waters.

(Welfare Trap graph curtesy of Daniel Mitchell)

It also diverted residential investment from homes to apartments at the government’s behest. Since the scale was relatively small, it didn’t have much of an impact on the price of homes initially, but it was the thin end of the wedge.

Subsequent administrations slowly ratcheted up how much government was subsidizing housing, and those subsidies even expanded into single-family home construction.

At first blush, you’d think this would push down the cost of homes because it should increase the supply, and you’d be right - if it were actually a competitive market. But these additional welfare programs applied only to certain people and increased housing costs for everyone else.

When the government would declare a neighborhood, let’s say, as housing designated for the poor, it removes that housing from the private market where most people are trying to buy. The largest effect on home prices in this instance comes not from the homes themselves, but from the land.

Since single-family homes can house significantly fewer people on a given amount of land than apartments, using the former to house welfare recipients that previous had apartments greatly reduces land available to house private market participants.

This drove land values up relatively quickly in areas with high concentrations of low-income earners who were more likely to be eligible for welfare. Increasingly scarce land created a chasm between private market home values and what welfare recipients could ever hope to afford.

The inability to escape poverty encouraged crime. For the first time, ghettos became synonymous with crime in America.

Ironically, the more welfare expanded, the more of a trap it became regarding housing. Still, these programs were small compared to today and didn’t affect many Americans. The effect was geographically isolated, almost always in the inner cities.

Then came the inflation.

Someone had to pay for the welfare programs, the war in Vietnam, and all the other government boondoggles. Unwilling to rein in spending nor raise taxes (and unshackled from the gold reserve standard), the chosen mechanism of financing was inflation.

With runaway devaluation of the dollar in the 1970s, it became nearly impossible to save for a downpayment. Every time you had squirreled away enough money, the price of homes had increased and now you needed more. Get back on the treadmill, peasant!

As interest rates zoomed in the late 70s and early 80s, having a 20% downpayment didn’t matter because you couldn’t afford the monthly payment.

Americans in some cases were forced to delay home purchases for years, saving enough to put down about half the cost of a home to get their monthly payments back to affordable levels.

While Ronald Reagan made limited progress in scaling back the negative effects of housing welfare programs, the effect was minimal. It was the booming economy and the defeat of inflation in the 80s that caused real wages to explode and made homeownership affordable again for millions of Americans.

His successor set about reversing that progress. King Bush the First rolled back Reagan’s limited progress on housing welfare and oversaw an increase in taxes, inflation, and interest rates. The effect wasn’t massive, but it certainly didn’t help Americans afford homes.

It was his son, King Bush II, who did far more damage. In the name of “compassionate conservatism” (a nomenclature from Hell if there ever was one), W greatly expanded housing welfare. He also doubled down on regulation from his predecessor, Slick Willy.

While Clinton signed welfare reform, including for some housing programs, he also added regulation that effectively forced banks to lend to certain groups with disproportionately bad credit. Like in Johnson’s day, these changes had little impact at first because they were initially small.

But the noxious seeds had been sown and W fertilized them diligently.

In a time of lower-than-normal interest rates, banks were pressured by regulators like the FDIC and SEC to make loans to increasingly risky borrowers. Ratings agencies were incentivized to look the other way. Homebuilders were flush with cash from government subsidies.

The greatest housing bull market in history was on. Millions of Americans left welfare housing and became homeowners, but only in the nominal sense, since they were in homes they couldn’t afford.

Fancy sounding financial vehicles like “reverse-amortization-partial-interest-only mortgages” were a bill of goods that met regulatory requirements but doomed the homeowner and the entire industry to disaster. The whole thing was dependent on home prices rising stratospherically forever.

And then Lord Greenspan remembered that running the printing press causes inflation, and interest rates went back to normal. When the music stopped, a shocking number of people were without seats.

Many Americans found themselves so underwater on their mortgages that it felt like Ted Kennedy drove them home.

The epic collapse that followed sunk so many financial derivatives that it set off the first truly global financial crisis since the Great Depression.

In the years that followed (called the Great Recession), the Fed swooped in and tried everything possible to buoy falling home prices, thinking that would fix the problem. They bought mortgage bonds, did multiple rounds of QE, initiated operation twist, and more.

It didn’t work. What the market needed was to burn off all the deadwood and liquidate all the bad assets quickly. Instead, the process was spread out over a decade and hamstrung economic growth. In fact, the process was never able to completely play itself out.

Real earnings role markedly during the “Orange Man Bad” years and homeownership affordability improved. But then came the horribilis annus of 2020 where the government threw the kitchen sink at the economy - enough liquidity to float a battleship.

With rates at record lows, suddenly almost anyone could afford a jumbo mortgage with almost no money down. And anyone who wanted to refinance their old, higher rate mortgage, did so, often repeating the cash-out refi’s that were so infamous from the previous housing boom.

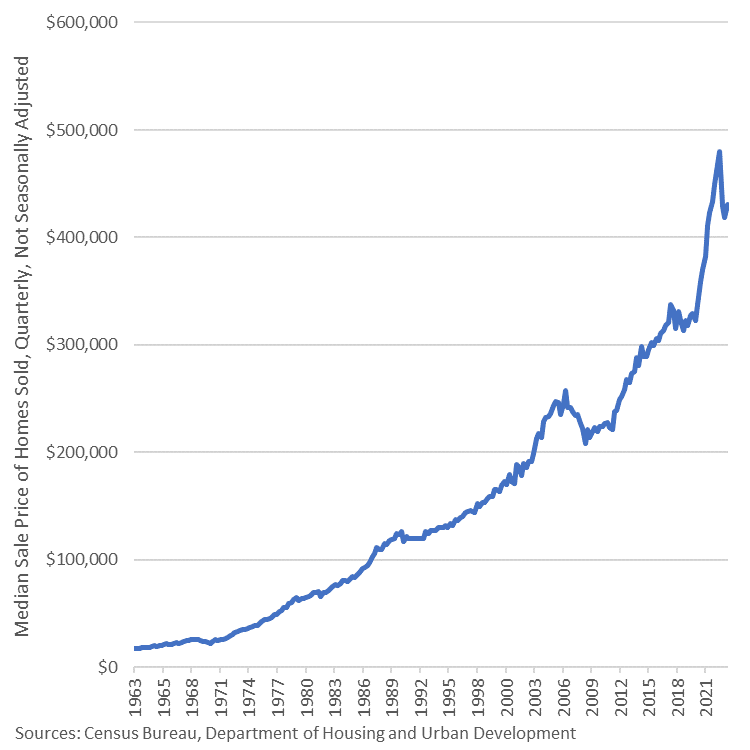

The frenzy quickly bid up home prices even worse than last time. That was bad enough, but then the elderly King Biden turned the one-time covid emergency spending into institutionalized multi-trillion-dollar deficits.

Then came the inflation. Again, we mean.

That prompted the court jester, Powell, to belatedly raise rates. Hard.

And that threw the golden handcuffs on countless homeowners. We’ve outlined previously how the Fed broke the bond market and got the banking sector into trouble, and the effect has been similar with housing.

Many Americans have mortgages between 2 and 3%. If they sell their homes today, they’ll lose those mortgages because the bank’s lien on that asset means it still has claim to the first dollar from the sale of a home. To buy a new home, those folks must get a new mortgage at today’s market rates.

Going from a 2.5% rate to a 7.5% rate is enough to double the monthly mortgage payment for many borrowers. You either have to drastically downsize and buy half as much house, or drastically increase the price at which you sell your own home.

And that inflation we mentioned? It’s driven wholesale inflation for homebuilders to record highs, so builders can’t drop their prices appreciably and still be profitable.

Normally, there’s a very tight inverse relationship between home prices and interest rates and monthly mortgage payments stay relatively stable over time. But the meddling by the elderly King Biden and the violent changes in monetary policy have short-circuited that mechanism.

What we’re left with are sticky home prices, higher interest rates, and record low affordability because of the drop in real wages over the last two and a half years. With median home prices well over $400,000, starter homes don’t really exist anymore.

You may think lower interest rates next year will solve the problem, but don’t get your hopes up. Unless the court jester, Powell, cuts rates back to near zero so that mortgages are near their pandemic-era level, the golden-handcuffs effect will still be in play, keeping a lid on existing home sales.

Likewise, unless prices for construction come down (hint: they won’t), homebuilders are going to jack up prices as rates come down because they’re still trying to make up for previous lost profits.

In short, monthly mortgage payments are stuck at these painful levels and it may take a decade (or longer) before real wages catch up to the point where homes are affordable again.

What has this done to America? It’s created a two-tiered society of have’s and have not’s. If you were lucky enough to buy a home in 2020 or earlier, you may be stuck where you are, but at least you have a home.

To be sure, millions of Americans’ homes have appreciated so much in nominal value that they couldn’t afford to buy their own homes today. For everyone else, you’re hosed for the time being.

While it’s never been more expensive to own a home and owning a home has never been so much more expensive than renting, rents are also at a record high. Consequently, most renters can’t afford to save for a down payment.

This is modern day serfdom, orchestrated over decades by American’s ruling elites. There are owners of property, and then there’s everyone else.

The nation’s current trajectory is the truly tragic chapter in this tale. The political establishment, from both sides of the aisle, only want to continue down this road because it enriches themselves and their donors.

Fortunately, the next chapter of this book isn’t written yet. If the mountains and the oceans can be overcome, then anything made by man can be overcome. In the meantime, there are investment opportunities to make money, or at least limit your losses.

While the elites have made it harder for the common man to get ahead, it’s not impossible. Not yet anyway. You can still beat the market and your competition and snatch victory from the jaws of defeat, despite the establishment’s best efforts.

We’ll chat again before the New Year and that’ll be the perfect opportunity to consider what worked in years past when we faced similar obstacles. We’ll look at what types of investment allowed people to get ahead and be able to afford homes, and which investments were losers.

We’re determined to turn this tragedy into a comedy - with the elites as the punchline.

1930: Medians, % of income housing purchase 300% rent 16% car (purchase) 46%

2023: Medians, % of income housing purchase 800% rent 42% car (purchase) 85%

The GFC was never fixed. I was at a company supplying engineered products to manufacturers. Lehman was a big hit but we and partners were prepared. Manufacturing came back second half of 2009. In 2010, the Fed should have stopped QE. Instead it doubled down to save big banks at the expense of main street. It’s all been paper money covering up distorted activity since then as local bank disappears. Main Street paid for the bailout over some ten years as banks put money at Fed and made five percent interest while grandma’s savings account was less then 0.05%. Something bad lurks under the waves of fake money. 2024 should be interesting for CRE. The smart ones got out last year and it wasn’t easy.