Biden’s Appointed Inmates Running the Fed Asylum

The economic inmates are running the monetary asylum. That has become painfully evident over the last two and a half years with the return of 40-year-high inflation, the start of a banking crisis (which isn’t over yet), a frozen housing market, and de-dollarization abroad. Political cheerleaders—from both sides of the aisle—have no busy being at the controls of a currency, but that’s exactly where we’re at today. Exhibit A: Chicago Fed President Austan Goolsbee.

Aside from being a professional sycophant awarded for his groveling with a high appointment, Goolsbee is a voting member of the Federal Open Market Committee which sets interest rate targets. His constant advocacy for low rates and easing of monetary conditions while a Democrat is in office has even earned him the nickname “Easebee.”

But his record on economics, monetary policy specifically, leaves much to be desired. That’s a nice way of saying he’s been wrong about literally everything and persists in his delusions to this day. Goolsbee was firmly on the side of excessive fiscal and monetary stimulus throughout 2020. As a good Keynesian (or Neo-Keynesian, take your pick—maybe even Modern Monetary Theorist), no amount of spending, borrowing, and printing of money was too big for him while the economy was shutdown.

January 28, 2021 should’ve been his wake up call. That’s when the Bureau of Economic Analysis released the advance estimate for GDP in 2020. According to the “conventional” theories to which Goolsbee subscribes, we should’ve had deflation to go with the 3.5% GDP contraction in 2020. Instead, we had 1.2% inflation. The pump was primed for runaway inflation in the coming years. All the government had to do was keep its foot on the gas. Goolsbee advocated for exactly that.

But as inflation marched steadily higher, Goolsbee joined the chorus of Orwellian voices telling us inflation was “transitory” and the perception of higher prices was just the “base effect” and “supply chain problems.”

Transitory was clearly wrong. The base effect was nonsense. And with the latest data from S&P Global showing supply chain logistics are back to the same level they were before the pandemic, that excuse is now debunked too. Furthermore, if supply chain problems really had been the cause of inflation, then prices should’ve come back down after the kinks were worked out. Instead, prices are still going higher.

So, what’s Goolsbee’s latest advocacy effort? Inflation has been trending to 2% and we’ll be there shortly. Wrong again.

This one is particularly damning of a Ph.D. economist because it can be refuted with simple algebra – there’s no differential geometry or multivariate calculus. We can just look at the consumer price index (CPI) and do similar math to what a banker does when calculating your mortgage payment. Here goes…

During the last economic expansion and through 2020, inflation was relatively low, at an annualized rate of 1.8%. That means the cumulative inflation over the entire period was equivalent to prices rising steadily at a rate of 1.8% per year. That all changed in 2021 as the government kept its foot on the stimulus gas. There’s a clear inflection point in the chart below:

From the beginning of 2021 through June 2022, inflation soared higher and higher, but the price index was climbing at a remarkably steady rate, matching the steady expansion of government expenditures and the Fed’s balance sheet. Those steady monthly increases in prices can be annualized just like the preceding period was, and we find inflation was a stratospheric 8.5% annualized rate over those 18 months.

Of course, that’s not to say prices went up 8.5% during that time—they went up much more. Rather, if the average monthly rate of change during this period were to persist for an entire year, then inflation would be 8.5% over that year. But since we’re talking about 18 months, not 12, prices were up even more than that.

Things slowed down in June 2022 (especially at the Fed, which finally admitted they got the whole “transitory” thing wrong). From then on, as the months with larger price increases dropped out of the annual inflation calculation and more months with smaller price increases were included, inflation came down, meaning prices still rose but at a slower rate. Once again, the monthly changes in prices were surprisingly consistent, and from that we can easily see where inflation is trending.

If inflation were actually trending to 2% as Goolsbee has been asserting, then the monthly increases after June 2022 would be consistent with a 2% annual inflation rate. In other words, if we annualized the price increases since June 2022, we would get a 2% rate. But we don’t. Not even close.

Instead, the annualized rate is 3.4%. To borrow a line from the miniseries Chernobyl, “that’s not great, not terrible.” But it is consistent with elevated levels of government spending compared to the average from before 2021. Even if Goolsbee doesn’t understand what’s causing the inflation, just basic algebra tells him that it’s not trending towards 2%.

And he clearly doesn’t understand what’s causing the inflation, just as he doesn’t understand what’s causing interest rates to rise. They’re both the result of the Treasury’s multi-trillion-dollar spending and borrowing spree, curtesy of the debt ceiling suspension and never-ending blowout budgets from the last three years. Once again, it’s disturbing for an economics Ph.D. (Piled High and Deep?) to not understand the basics of supply and demand. Strap yourselves in for Econ 101.

Many people—including Mr. Goolsbee, apparently—don’t think of interest rates as a price, but that’s what they are: the price of loanable funds. Savers and borrowers come together and agree on a price that the borrower will pay the saver in exchange for the temporary use of the saver’s money.

Like any price, this one is determined by the basic interactions of supply and demand. The sheer volume of borrowing by the Treasury has increased demand for loanable funds to such an extent that long-term interest rates have risen to the highest level in 15 years and are poised to go even higher. Rates will continue to rise as long as the Treasury maintains its unsustainable trajectory of borrowing. How is Goolsbee puzzled by such a basic concept?

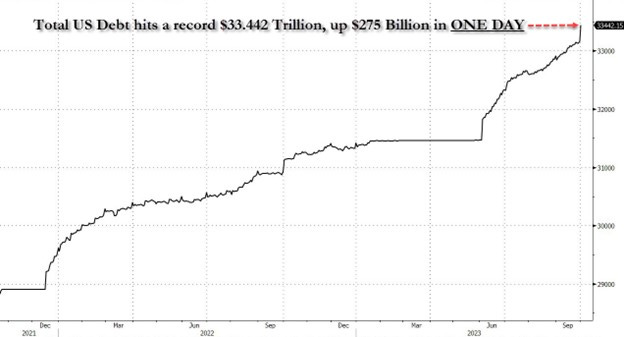

Apparently, he’s blind to the fact that, just last month, the Treasury had to borrow $275 billion—in just one day. That single-day surge was more than all the borrowing from the previous month and 13 percent of all borrowing in the last fiscal year. The Treasury has borrowed well over $2 trillion just since the debt ceiling was suspended in June.

Given Goolsbee’s atrocious but predictable track record, we can expect that by the time he acknowledges these facts about government spending, deficits, and debt, he will have come up with an excuse for why they don’t matter and haven’t caused our problems. Such is the luxury of an unelected, unaccountable bureaucrat – or an inmate running an asylum.