Biden Economic Advisors Are Economically Illiterate

Biden administration spin doctor Jared Berstein is at it again, demonstrating his complete ignorance of both economic theory and fact — an alarming trait for the chairman of the Council of Economic Advisers. Yet, we shouldn’t be surprised since Berstein isn’t even an economist; his degrees are in music, philosophy, and social work.

Don’t be shocked – when has this administration ever hired any competent people?

Berstein’s role seems to be less an advisor to the president than an advisor to the press, handing out talking points which the willing sycophants can spout each day about how great the economy is. “Don’t believe your lying eyes or your empty wallets, folks – come on, man!” Things are going swimmingly, and inflation is just a conspiracy, as AOC now says.

So, we’re left with a radical disconnect: an administration that touts isolated economic numbers and conspicuously narrow measurements, versus a two-thirds disapproval of the economy and horrific survey data, including consumer sentiment, confidence, and expectations.

It’s very simple to reconcile the disconnect: Berstein and other Biden administration officials are manipulating data and often flat-out lying.

A prime example is Mr. Bernstein’s whitewashing of our nation’s burgeoning credit card debt, which has surpassed $1 trillion for the first time. Even as interest rates soar, Americans are increasingly relying on credit cards to make ends meet. Ordinarily, higher interest rates discourage credit utilization and people pay more (or all) of their credit charges each month fall because it’s too expensive to carry a balance

The fact that we’ve seen the opposite today speaks to the desperate situation of the consumer. Because real earnings have fallen so precipitously, people are relying on credit cards to maintain their standard of living. And it’s not yachts and caviar driving the spending for most Americans, but necessities. In fact, multiple financing companies have popped up in the last year that only make loans for groceries – people literally can’t afford to eat.

So, now we have a situation where people are spending more than they earn, and therefore can’t afford to pay their credit card balances each month. That causes their balance to steadily grow. But with rising interest rates, their balances are skyrocketing because the financing charges are exploding. If people couldn’t pay off their entire balance, they certainly can’t pay the interest too.

For example, most Americans don’t have enough savings to cover a $400 emergency, so let’s start there and put it on the credit card. The typical American family’s weekly paycheck has ballooned $230 under the Biden administration, but it buys $100 less, leaving a monthly deficit of $430. Let’s assume the family cuts back $230 per month, which means we’re running a monthly deficit of $200.

That deficit is the amount on the credit card we can’t afford to pay off, so it’s added to the balance each month. All we can afford is the minimum payment, but at least we avoid penalties. If the credit card still had a low rate, the balance would be just under $2,900 after one year.

But rates aren’t low anymore – they’re at record highs. Now, the card’s balance is $3,400 after 12 months, $500 more in interest compared to when rates were low. We’re already running a $200 monthly deficit, so there’s no hope of paying an additional $500 on top of it.

But when confronted with these facts, Mr. Bernstein brushes them off, claiming that the financing costs for consumers have declined relative to disposable personal income, which is not true.

To facilitate his lie, Berstein performs two sleights of hand. First, he compares today to pre-pandemic levels, because if he compared today to when Biden took office, the data would show we’re worse off. But, by including the last year of the Trump administration, Berstein can take credit for his predecessor’s success.

Second, Berstein switches from his original claim to comparing disposable personal income with credit card debt levels, but not credit card financing costs. While $1 trillion in credit card debt is alarming, it’s apples and oranges to compare a stock (credit card debt) to a flow (income).

To illustrate, imagine if instead of paying your mortgage off in 30 years, you had to do it in just one. The former is probably affordable, and the latter almost certainly isn’t. That’s because the flow of mortgage payments is less than the flow of your income in the former case, but more than your income in the latter case. But in both instances, the stock of your mortgage debt was identical.

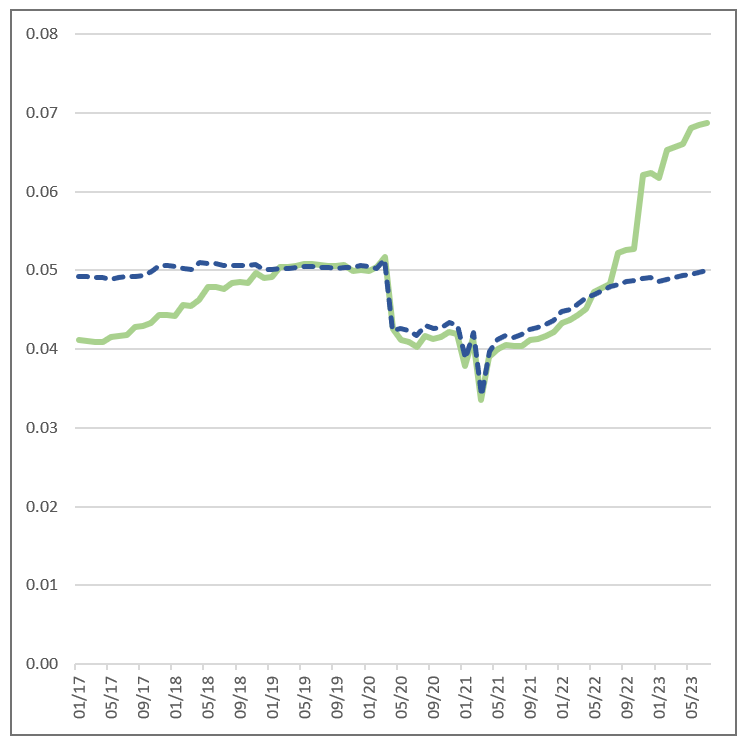

The graph below shows Berstein’s silly comparison of credit card debt as a portion of disposal personal income via the dashed blue line. Today, it is a fraction of 1% less than the pre-pandemic ratio, demonstrating that Berstein is technically correct about his nonsensical comparison. But the solid green line adjusts credit card balances for the interest rate, transforming the stock into a flow, and making the comparison to income actually meaningful.

Two things immediately just out because of this transformation. Going from left to right, the first two years of the Trump administration had lower financing costs on credit card debt relative to incomes because interest rates were low. As rates rose, the same proportion of debt to income caused financing costs to rise 25% relative to the rise in incomes.

In other words, credit card financing charges ballooned not because credit card debt rose relative to incomes, but because interest rates rose. But that jump is nothing compared to what’s happened under Biden. The faster rate hikes to combat 40-year-high inflation have sent credit card interest rates to record highs. In about the last year, financing costs on credit cards have exploded 40% relative to incomes.

When you compare apples to apples, you get a better sense of what’s truly going on. People are genuinely hurting because they are getting trapped into financial death spirals of burgeoning credit card debt. The speed at which this is escalating is clear from the graph and that helps explain the very rapid rise in nonperforming credit card debt, meaning delinquencies and defaults.

Like the stock vs. flow discussion, credit card nonperformance hasn’t gotten a lot of attention because the level is still very low, having been artificially depressed for three years but all kinds of fiscal and monetary stimulus as well as various debt repayment moratoria, all of which left consumers flush with cash. But although the level is still low from a historical perspective, it is rising fast – very fast.

But that’s no concern for Berstein and the rest of the Biden administration since there’s no good way to spin rising rates of credit card default. We’ll just brush that under the rug and hope it “seasonally adjusts” out at a future date…

Click here to Follow FX Hedge on X (formerly Twitter) …