Are We in Recession Already?

Most people say yes, as do several indicators

Every textbook on economics says a recession is marked by two consecutive quarters of negative economic growth in real (inflation-adjusted) terms. That was the definition for over half a century, until politics got in the way.

The first half of 2022 saw GDP fall twice, but no recession was declared by the nonprofit National Bureau of Economic Research (NBER) - a bunch of eggheads in Cambridge, Massachusetts that are allegedly nonpartisan. Allegedly.

Anyway, they said there was no recession, so it never happened, and apparently every Econ book on the subject was declared null and void overnight.

The justification went something like this: because nonfarm payrolls kept rising, it couldn’t have been a recession. That’s silly for two reasons.

First, there are a slew of problems with the BLS’ nonfarm payroll statistic, something we have delved into deeply multiple times and won’t rehash everything here. Second, even if the nonfarm payroll numbers were accurate, the increase can be chalked up to the economy reopening after government-imposed lockdowns.

Businesses were still struggling to find workers and get back to normal employment levels at that time. The federal and state governments still had covid measures in place that provided all kinds of handouts, whether cash or in kind.

There were also debt moratoria, including student loans and mortgages, that caused many people to stay home and not work since their major bills were no longer coming due. In fact, the last local rent and eviction moratorium didn’t end until early this year.

Between the handouts that were still in effect and the various moratoria, businesses were helplessly understaffed before 2022 started. Conversely, most recessions start when businesses are fully staffed. Any decrease in customer demand at a business will typically result in layoffs.

That didn’t happen in 2022 because there were so many unfilled positions. Instead of firing employees, businesses were still hiring. It just meant that instead of being short 10 workers, maybe a business was short 8 or 9.

Likewise, consumer spending kept rising in the first half of 2022 - a function of people having over $1 trillion in extra savings that they acquired in the pandemic, mostly from government handouts.

Even though income growth didn’t keep up with inflation during those six months, people kept spending more because they were so flush with cash.

Fast forward to now and GDP keeps going up because government spending is marching relentlessly higher. Not only are “government purchases” rising but so are government handouts to consumers and businesses alike.

That’s why total government spending is increasing so much faster than government purchases. This makes it look like private spending is rising in the GDP report, but it’s really all fueled by government transfers.

But who cares about GDP and whether it’s negative or positive? The NBER threw that definition of recession out the window, remember?

Ok, then - let’s look at a few other data points and see if things are growing or shrinking.

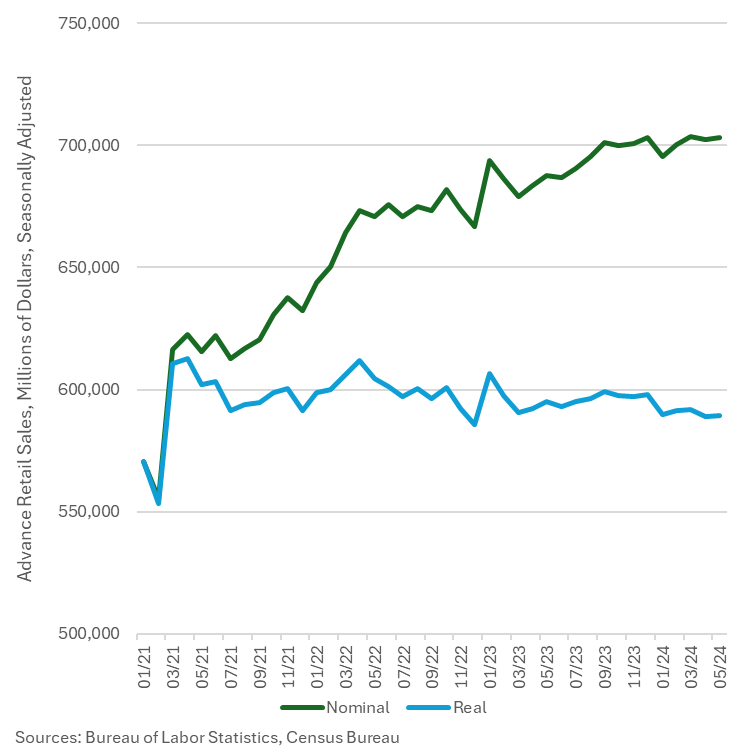

On the consumer side, we have retail sales which have moved sideways recently after considerable growth. But that growth has been entirely growth in prices, not more physical stuff actually being sold. In fact, real retail sales have arguably been on a slight and somewhat erratic downward trend since early 2021.

And retailers’ inventories aren’t much better. While the total price of those inventories keeps climbing, the amount of stuff they contain is essentially flat since the summer of 2022.

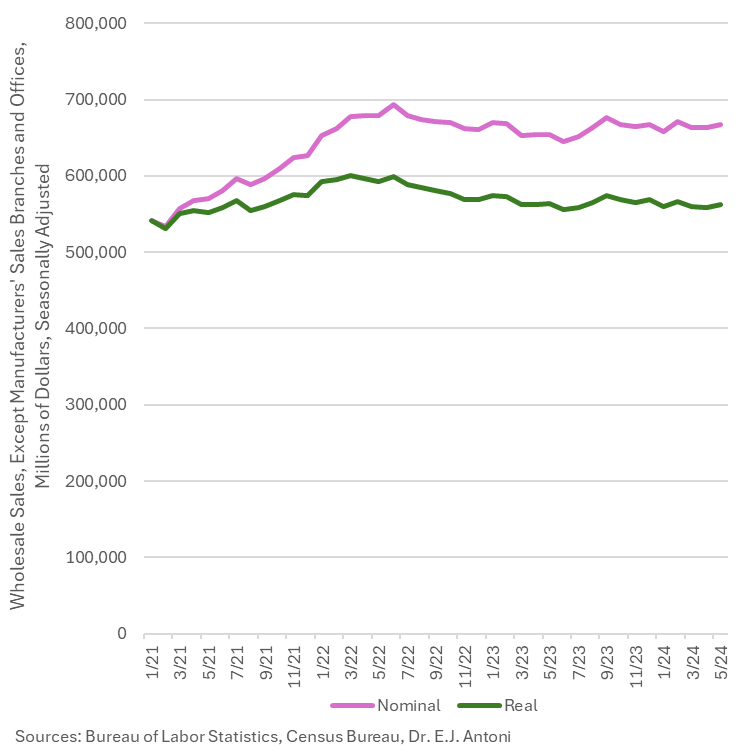

Wholesalers seem to have taken it on the chin even harder. Their nominal sales are up 23.0% since January 2021 but real sales have increased a measly 3.6% according to E.J. Antoni, a public finance economist.

We also think it’s interesting that March 2022 was a turning point for a lot of corporate data, just like it was for many labor market metrics. Just as the household survey for employment had a sharp change, so did sales at the nation’s wholesalers.

Since that month, nominal sales have fared poorly, but real sales growth has been terrible at -6.4%.

Wholesalers’ inventories tell the same story: up 33.5% since the start of 2021, but that’s not how much additional physical stuff is in their warehouses. That real amount is up just 12.5% and is down 4.4% since the end of 2022, when many businesses realized they overbought, and the consumer wasn’t keeping up since Covid cash couldn’t last forever.

Other businesses have similar patterns. Manufacturers saw their inventories quickly appreciate in price through the summer of 2022, but they’ve flatlined since then. Adjusting for inflation shows the increase was never that much and sums to about 3% over 2 and a half years. Once again, we’re seeing a slight (and erratic) downward trend, this one being about a year old.

And what of profits? Well, let’s take a look at both the manufacturing and service sectors.

Manufacturing has been in recession for a while, as our readers know, even if you only look at nominal figures. In real terms, it’s worse. The industry’s profits are almost back down to where they were 5 years ago.

Service sector profits have done much better, but there’s still a gargantuan gap between nominal and real figures — about $890 billion worth. While nominal profits are up 29.6% since the start of 2021, the real increase in just a third of that: 9.9%.

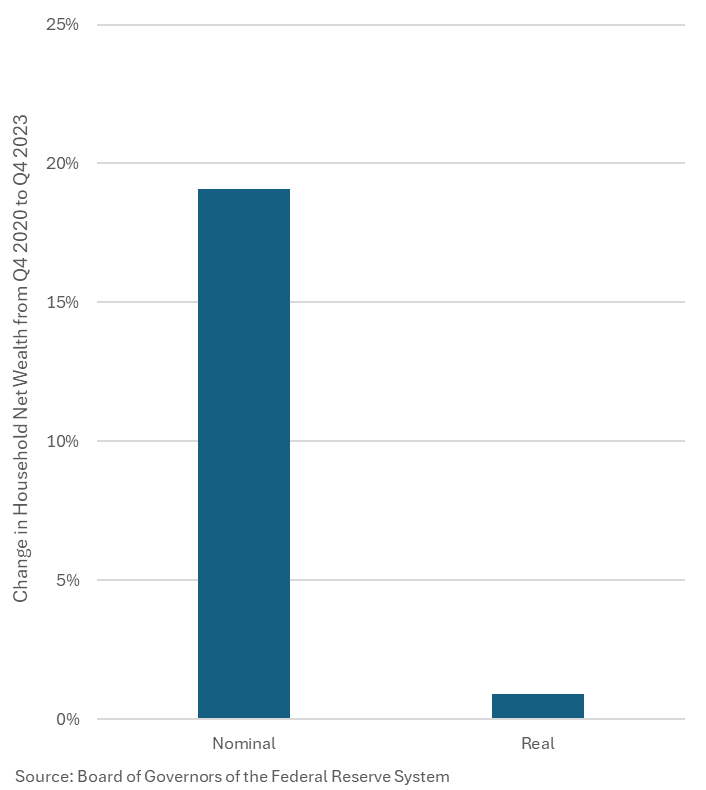

This is all on the business side of the ledger. But what about households? The story is very similar, with any reader of this post likely able to write the following paragraph.

The massive 19.1% increase in household wealth over the last 3 years has been almost entirely due to inflation. In real terms, household wealth has risen less than 1%. That’s almost no progress at all in 3 whole years, despite tens of millions more people working, trillions of government “stimulus” spending and “investment,” and the Federal Reserve pushing interest rates to record lows so that everyone could borrow at unprecedently low rates.

Suddenly, it starts making sense that more than half of Americans think we’re already in recession. When the business news channels tell you that corporate profits are at record levels, remember that weekly paychecks are too. But what those paychecks can actually buy has gone down — and the same is true for corporate profits.

There’s a very good chance that the productive (private) economy is shrinking and has been for some time. The lagged effects following the extreme interventions in 2020 and today’s continued runaway government spending are all still impacting many macro-level indicators like GDP and nonfarm payrolls, but there are still tons of other warning signs.

Like the indicator lights on a car dashboard, these warning signs are not to be ignored because they indicate a problem has already arisen — and it might be engine failure.

If there were a hard ceiling of age that no one could circumvent it would put the careers of those in love with power to have another perspective. Loving power that blinds us to the consequences to win at any cost. Life is not a zero sum game of time we all will live through versus the murderous competition that nations are in. Through generation after generation of unending war. The fact that at 75 and you're done. The office holder, judge, district attorney, president of the U.S. of Ass holes, 75. and you are done at this position. Execute plan for the ancient race to death with however much time is left. Power absolutely corrupts the powerful. They become monsters with a pocketbook.

Rather than gambling on how long a judge would live we would all know that after the cutoff age then this person must stop whatever they're doing to play god.